Wealthiest Americans raking in billions from coronavirus pandemic: report

As 30 million Americans have lost their jobs over the last six weeks amid the coronavirus pandemic, America’s billionaires are becoming even richer.

According to a new report from the Institute for Policy Studies, a left-leaning think tank, over the past 6 weeks, American billionaires have seen their wealth increase by $406 billion — a boost of just under 14% to their net worth.

An initial decline

The global pandemic has impacted everyone’s pockets, regardless of income. As the markets have been roiled by the coronavirus and broad economic shutdown, hundreds of billionaires saw their net worth decline. In total, 267 of the world’s 2,153 billionaires saw their worth decline below $1 billion, dropping off the billionaire list. But as some billionaires struggled, others, particularly in the United States, profited.

“U.S. billionaires have seen ups and downs over the same period. Their ranks increased from 607 to 614 people, but their total wealth declined from $3.111 trillion in 2019 to $2.947 trillion in 2020,” the report noted.

But unlike most Americans, the country’s wealthiest have managed to recover their losses, and in many cases increase their net worth.

After an initial decline, by April 5, billionaire collective wealth rose to $3.017 trillion from $2.9 trillion a few weeks prior. “The U.S. billionaires, the last couple of weeks seem to be ‘delinking’ from the U.S. economy,” said Chuck Collins, one of the authors of the report. “There are some huge winners.”

Just 5 days later, according to the report, their wealth surged to $3.229 trillion — surpassing their 2019 levels.

“Between March 18 — the near bottom point of the pandemic financial swoon — and April 10, 2020, U.S. billionaire wealth rebounded by $282 billion,” the report states.

‘Pandemic profiteers’

Roughly half of the world’s billionaires have seen their wealth increase since the beginning of the year. According to the report, eight billionaires in particular saw their wealth increase by over $1 billion each.

“There’s a subgroup of people you can call ‘profiteers’ that are economically reaping enormous benefits,” Collins said.

Most billionaires derive their net worth from business holdings and investments.

By April 15, Amazon’s (AMZN) founder and CEO Jeff Bezos had increased his net worth by a staggering $25 billion, padding an already full bank account of roughly $140 billion, according to Forbes. This increase totals roughly the combined increase of the following top 7 billionaires on the list.

Following Bezos on the list is Elon Musk, the CEO of electric-car company Tesla (TSLA). He saw his net worth surge by $5 billion since the beginning of the year. He is worth just under $37 billion. Others on the list include former Microsoft (MSFT) CEO Steve Ballmer and Eric Yuan, CEO of the popular video conferencing platform Zoom (ZM). They both boosted their wealth by roughly $2.5 billion each.

How they did it

Despite the volatility of the markets, Collins said that rising stock prices and market caps of companies in tech, delivery services, and video conferencing are partly the reason behind these wealth surges.

But, he said, the “larger trend” is that Wall Street “typically” rebounds faster than the rest of the economy.

“It’s still volatile,” Collins said. “The markets may still go down substantially but in the short term, it’s odd that so much bad news would be accompanied by a surge and an updraft at the top.”

Additionally, Collins says, going into the pandemic, the scales were tipped in favor of the billionaire class. “The reward funnel,” Collins explained, moves upwards. “The tax policies were favorable to that class,” he added.

What’s more, stimulus packages passed by Congress have also benefited some of the country’s wealthiest.

While some Americans are still waiting for stimulus checks, over 30,000 Americans who earn $1 million or more a year have received over $1.5 million in coronavirus relief. The CARES Act changed tax law to allow for the relief in the form of a tax benefit.

‘Unseemly’ and ‘unethical’

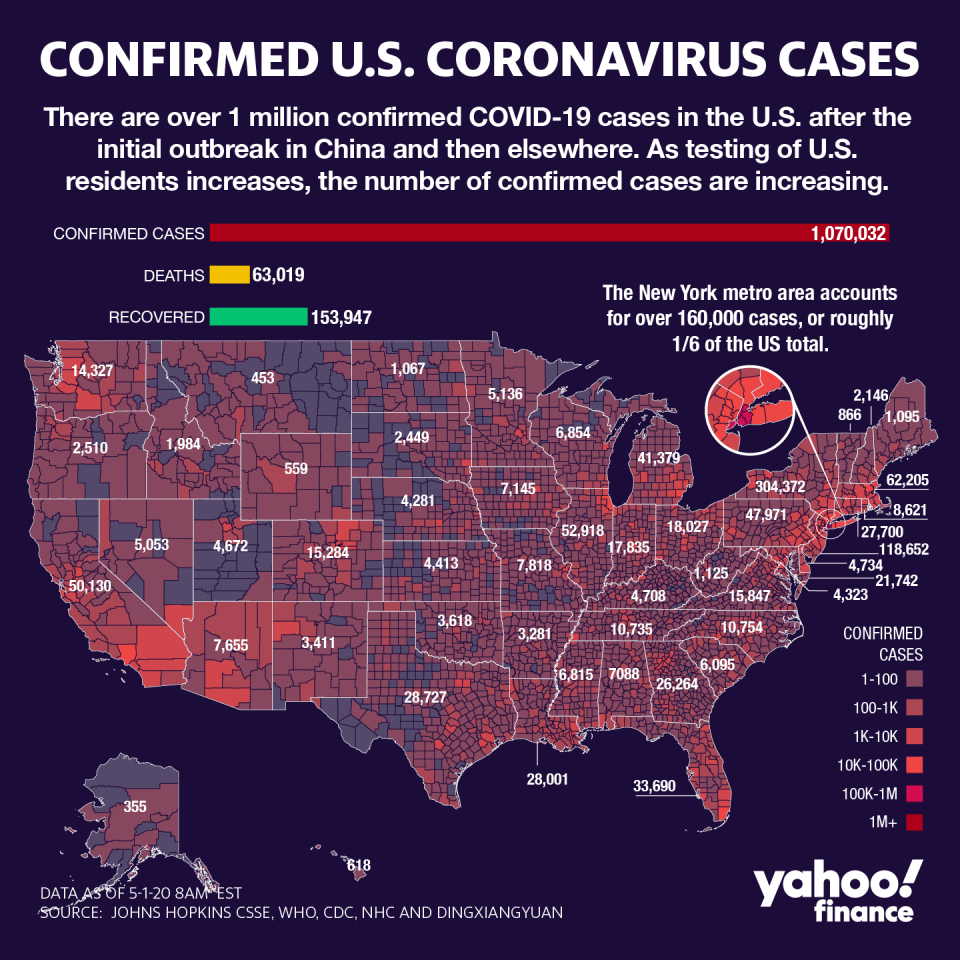

The report calls for transparency, oversight, and greater taxation to prevent billionaires from making even more money off a crisis that has now killed nearly 60,000 Americans, according to the Johns Hopkins University tracker. There are over 1 million confirmed cases of the virus in the United States.

Collins said that in exchange for coronavirus stimulus packages, companies should give greater transparency, especially about where they make their profits.

He has also called for an excess profits tax so that “companies that are making so many windfalls of this moment” are taxed at “steeply progressive levels.” The funds gained from this tax, he said, could be reinvested into public health.

Excess profits tax is a tax on profits made from events not in the company’s making. It has been used in the United States during both World War II and the Korean War. The rate of the tax has been different throughout the years, but rose as high as 95%.

“You need the government to step in and say ‘this is not the moment to grab and hoard wealth, and extract from other people’s misfortune’,” Collins said. “It’s unseemly and unethical.”

It’s particularly so, he said, at a time when the most vulnerable and lowest-income workers are being hit the hardest.

“We are… creating a ‘we are all in this together moment’,” Collins said. “And some are using that moment to extract wealth from the economy.”

Kristin Myers is a reporter at Yahoo Finance. Follow her on Twitter.

Read more:

Georgia business owners split on Kemp’s decision to reopen economy amid coronavirus

AOC to oppose stimulus bill for being too 'small,' blasts Republicans

Coronavirus delivers a ‘highly predictable 1-2 punch’ to black Americans: McKinsey study

Will you get a ‘coronavirus check’? $2 trillion stimulus package explained

Coronavirus recession to hit over 24 million workers hardest: study

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance