Waste Management (WM) Benefits From Acquisitions, Debt Ails

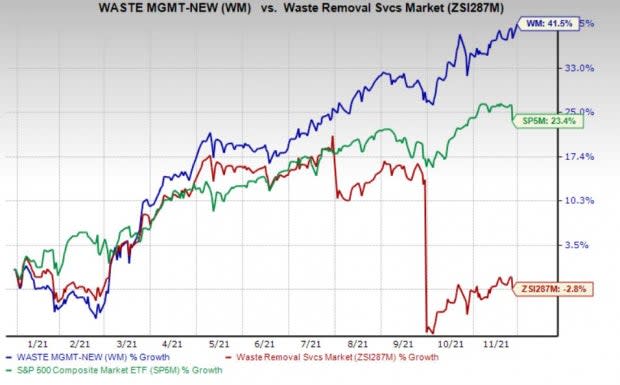

Waste Management, Inc. WM shares have had an impressive run on the bourses so far this year. The stock has appreciated 41.5% over the past year, outperforming the 2.8% decline of the industry it belongs to and 23.4% rise of the Zacks S&P 500 composite.

Image Source: Zacks Investment Research

The company recently reported third-quarter 2021 adjusted earnings per share of $1.26, which missed the Zacks Consensus Estimate by 5.3% but improved 15.6% year over year. Total revenues of $4.67 billion beat the consensus estimate by 2.6% and increased 20.8% year over year.

How is Waste Management Doing?

Waste Management’s revenue growth is backed by the favorable impact of acquisition revenues, volume increases and growth from yield. In third-quarter 2021, the company witnessed $295 million of revenues from the acquisition of Advanced Disposal, $137 million in volume increases and $123 million of growth from yield.

The company continues to execute its core operating initiatives of focused differentiation and continuous improvement, while instilling price and cost discipline to achieve better margins. Strength across the traditional solid waste business boost the company's cash and earnings. Successful cost-reduction initiatives have helped it achieve better margins.

The company has a dominant market capitalization and a steady dividend as well as share repurchase policy. In 2020, 2019 and 2018, the company had repurchased shares worth $402 million, $248 million and $1.004 billion, respectively. It paid $927 million, $876 million and $802 million in dividends during 2020, 2019 and 2018, respectively. Waste Management plans to return significant cash to shareholders through healthy dividends and share repurchases in the future as well.

Waste Management's cash and cash equivalent balance of $116 million at the end of third-quarter 2021 was well below the long-term debt level of $12.4 billion, underscoring that the company does not have enough cash to meet this debt burden. Further, the cash level cannot meet the short-term debt of $601 million.

Zacks Rank and Stocks to Consider

Waste Management currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other top-ranked stocks in the broader Business Services sector are Avis Budget CAR and Cross Country Healthcare (CCRN), both sporting a Zacks Rank #1, and Charles River Associates (CRAI), carrying a Zacks Rank #2 (Buy).

Avis Budget has an expected earnings growth rate of 420.6% for the current year. The company has a trailing four-quarter earnings surprise of 76.9%, on average.

Avis Budget’s shares have surged 744.3% in the past year. The company has a long-term earnings growth of 18.8%.

Cross Country Healthcare has an expected earnings growth rate of 447.8% for the current year. The company has a trailing four-quarter earnings surprise of 75%, on average.

Cross Country Healthcare’s shares have surged 201% in the past year. The company has a long-term earnings growth of 21.5%.

Charles River Associates has an expected earnings growth rate of 61.2% for the current year. The company has a trailing four-quarter earnings surprise of 51%, on average.

Charles River’s shares have surged 119.3% in the past year. The company has a long-term earnings growth of 15.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance