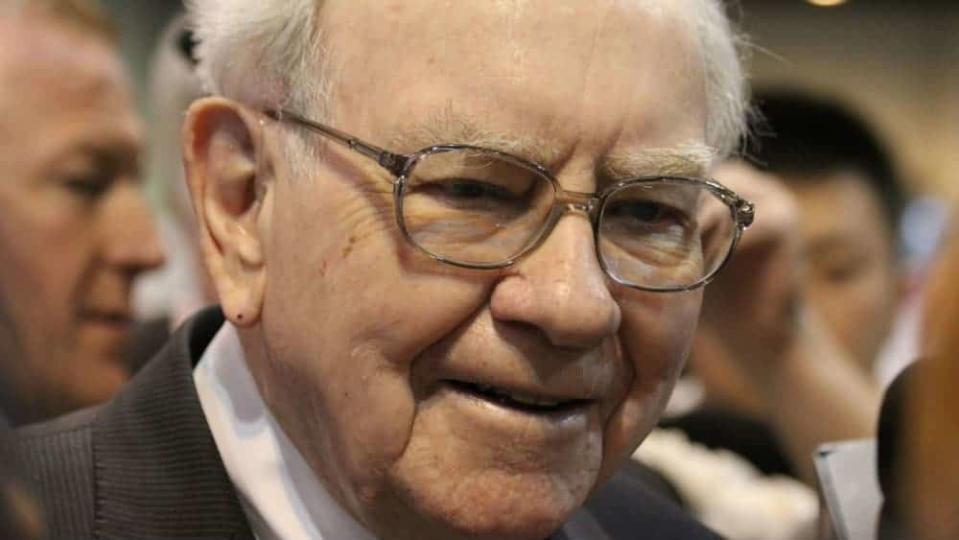

Warren Buffett: He Only Believes in This 1 TSX Stock

When it comes to investing, choosing companies you understand and believe in can be a beneficial long-term strategy. And it’s the one that Warren Buffett lives and invests by. He only buys profitable businesses with outstanding management teams and long-term growth potential. And when he thinks that a business is no longer profitable, he doesn’t waste much time divesting himself from that business.

That’s what Buffett did with his Canadian holdings. He let go of his Restaurants Brands International stake completely, and, more recently, he opened a position in a Canada-based gold mining company. But, as per his recent filing reports, he exited that position as well.

There is only one TSX stock he is still holding on to, and that’s Suncor (TSX:SU)(NYSE:SU).

The oil sands leader

Warren Buffett still believes in energy, even though a lot of investors are moving on to green stocks, thinking that a significant global shift might make energy companies and their behemoth infrastructures obsolete in a few years. But Buffett invested a significant amount in a gas line at an attractive price. He also bought a stake in some energy players like Chevron.

And even though he hasn’t completely let go of his Suncor stock, he did trim it down to size. As per Berkshire Hathaway’s recent filings, Buffett sold 5.3 million Suncor shares. Still, it’s one Canadian investment he hasn’t divested himself entirely from, and one probable reason behind is Suncor’s position as an oil sands leader.

If oil still has a healthy future, then Suncor’s dominion in the oil sands market will pay off sooner or later, because, unlike other oil reserves, which are expected to be depleted in a few decades, oil sands might last longer.

The stock

The Suncor stock started seeing the light of day about four months ago. From one of its lowest points in November 2020 till now, the stock has risen well over 70%. Since it had to cut down its dividend-growth streak and slash its dividends, Suncor is currently offering a modest 3.2% yield. The last two quarters weren’t as bad for Suncor’s revenue as the second quarter of 2020 was, so things might be turning a corner for Suncor.

The energy sector as a whole is recovering ever since global oil producers started to control production and are trying their best to get rid of the surplus before picking up the production pace. But another wave of COVID and lockdowns in a few major countries can tip the balance again.

Foolish takeaway

Despite its recent recovery bout, the company is still heavily discounted. It’s quite fairly valued right now, and if it continues on its upward momentum, it can be a decent recovery bet. Though if you follow Buffett’s actions, you might consider shedding your current Suncor position instead of buying shares of the company.

The post Warren Buffett: He Only Believes in This 1 TSX Stock appeared first on The Motley Fool Canada.

More reading

RRSP Investors: 2 Top Canadian Stocks I'd Buy Now and Hold for Decades

The Best Way to Make $1 Million During the 2021 Stock Market Rally

CRA Parental Guidance: Don’t Miss the $7,000 Child Care Benefit in 2021

Fool contributor Adam Othman has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares). The Motley Fool recommends RESTAURANT BRANDS INTERNATIONAL INC and recommends the following options: short January 2023 $200 puts on Berkshire Hathaway (B shares), short March 2021 $225 calls on Berkshire Hathaway (B shares), and long January 2023 $200 calls on Berkshire Hathaway (B shares).

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2021

Yahoo Finance

Yahoo Finance