Walmart (WMT) Q1 Earnings Lag Estimates Due to Cost Inflation

Walmart Inc. WMT reported first-quarter fiscal 2023 results, wherein the top line advanced year over year and surpassed the Zacks Consensus Estimate. However, the bottom line declined and fell short of the consensus mark. The soft earnings results were a product of the unusual economic landscape, with U.S. inflation levels (especially food and fuel) creating greater-than-expected pressure on margins and operating expenses.

Quarter in Detail

Walmart’s adjusted earnings of $1.30 per share tumbled 23.1% from the year-ago period’s figure of $1.69 and missed the Zacks Consensus Estimate of $1.46. Total revenues of $141.6 billion grew 2.4% and beat the consensus mark of $138.3 billion. On a constant-currency (cc) basis, total revenues climbed 2.6% to $141.9 billion. Revenues were hurt to the tune of $5 billion due to divestitures and $0.4 billion due to currency movements.

Walmart Inc. Price and EPS Surprise

Walmart Inc. price-eps-surprise | Walmart Inc. Quote

The consolidated gross profit margin contracted by 87 basis points (bps), primarily due to Sam’s Club. The gross margin at Walmart U.S. fell 38 bps due to an adverse product mix, high supply-chain costs and increased markdowns, somewhat compensated by pricing.

The operating income at cc fell 22.7% to $5.3 billion. Consolidated operating expenses as a percentage of sales increased by 45 bps year over year, stemming mainly from elevated wage costs in Walmart U.S.

WMT’s global advertising business soared more than 30%.

Image Source: Zacks Investment Research

Segment Details

Walmart U.S.: The segment’s net sales grew 4% to $96.9 billion in the reported quarter. U.S. comp sales, excluding fuel, improved by 3% due to a 3% increase in the average ticket, with transactions remaining flat year over year. Comp sales were mainly driven by strength in food categories. Comp sales grew across the grocery and health & wellness categories. The segment continued to see an increased market share in grocery.

E-commerce negatively impacted comps by 30 bps. E-commerce sales in the segment rose 1%. On a two-year stack basis, e-commerce sales surged 38%. As of the first quarter, Walmart U.S. had 4,600 pickup locations and more than 3,600 same-day delivery stores. The company remodeled more than 75 stores during the reported quarter. The operating income of the Walmart U.S. segment declined by 18.2% to $4.5 billion.

Walmart International: The segment’s net sales fell 13% to $23.8 billion. Divestitures hurt the segment’s net sales by $5 billion and currency movements had a $0.4 billion adverse impact. On a cc basis, net sales dropped 11.6% to $24.1 billion. Management witnessed positive comp sales across all markets. The operating income, on a cc basis, slumped 33.7% to $0.8 billion.

Sam’s Club: The segment, which comprises membership warehouse clubs, witnessed a net sales increase of 17.5% to $19.6 billion. Sam’s Club comp sales, excluding fuel, grew 10.2%. While transactions grew 10%, the average ticket rose 0.2%. Comp sales saw broad-based strength across most categories, mainly led by food. However, tobacco hurt comp sales.

Membership income climbed 10.5% in the quarter, reflecting solid membership trends, with a record total member count. The plus penetration rate also ascended and reached another all-time high. E-commerce fueled comps by 150 bps. E-commerce net sales jumped 22% at Sam’s Club on a robust direct-to-home show and solid curbside performance. The segment’s operating income came in at $0.5 billion, down 20% year over year.

Other Financial Updates & Developments

Walmart ended the quarter with cash and cash equivalents of $11.8 billion, long-term debt of $32.2 billion and total equity of $85.6 billion. In the first quarter, WMT used operating cash flow of $3.8 billion and incurred capital expenditures of $3.5 billion, resulting in free cash flow of a negative $7.3 billion. The company allocated $1.5 billion for dividend payouts and $2.4 billion for share buybacks during the quarter.

Guidance

Walmart raised its net sales and comp sales view for fiscal 2023 while slashing its operating income and bottom-line guidance.

The company now expects consolidated net sales growth of about 4% at cc. Excluding divestitures, the metric is likely to grow 4.5-5%. Management earlier anticipated consolidated net sales growth of nearly 3% at cc. Excluding divestitures, the metric was expected to grow nearly 4%. U.S. comp sales, excluding fuel, are likely to be roughly $3.5% now, compared with the slightly more than 3% growth expected before.

Management now expects the consolidated operating income to decline around 1% at cc and remain flat excluding divestitures. The consolidated operating income was previously expected to grow nearly 3% at cc and at a greater rate than net sales on excluding divestitures. Management now envisions earnings per share (EPS) to decline nearly 1% in fiscal 2023 and remain flat year over year, excluding divestitures. Earlier, the EPS was likely to grow in the mid-single-digit range. Excluding divestitures, it was expected to rise 5-6%.

For the second quarter of fiscal 2023, Walmart expects consolidated net sales growth of more than 5%. Comp sales growth at Walmart U.S. (excluding fuel) is likely to increase 4-5%. The consolidated operating income and EPS growth are expected in the range of flat to a slight increase.

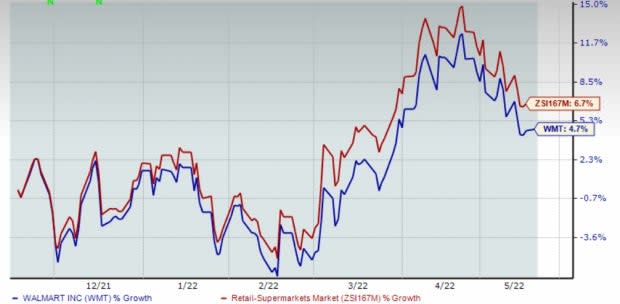

Walmart currently carries a Zacks Rank #4 (Sell). Shares of the company have risen 4.7% in the past six months compared with the industry’s growth of 6.7%.

3 Retail Stocks to Bet on

Here are three better-ranked stocks – The Kroger Co. KR, Target Corporation TGT and Costco Wholesale Corporation COST.

Kroger, a renowned supermarket company, carries a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 9.9% for three to five years. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kroger’s current financial-year sales suggests growth of 3.2% from the year-ago period. KR has a trailing four-quarter earnings surprise of 22.1%, on average.

Target, which operates as a general merchandise retailer, carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 21.3%, on average.

The Zacks Consensus Estimate for Target’s current financial-year sales suggests growth of 7.7% from the year-ago period. TGT has an expected EPS growth rate of 16.5% for three to five years.

Costco, the operator of membership warehouses, also holds a Zacks Rank #2. Costco has a trailing four-quarter earnings surprise of 13.3%, on average. The company has an expected EPS growth rate of 9.1% for three to five years.

The Zacks Consensus Estimate for COST’s current financial-year sales suggests growth of nearly 14% from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance