Stock Market 2020: Most experts predict gains, some expect losses

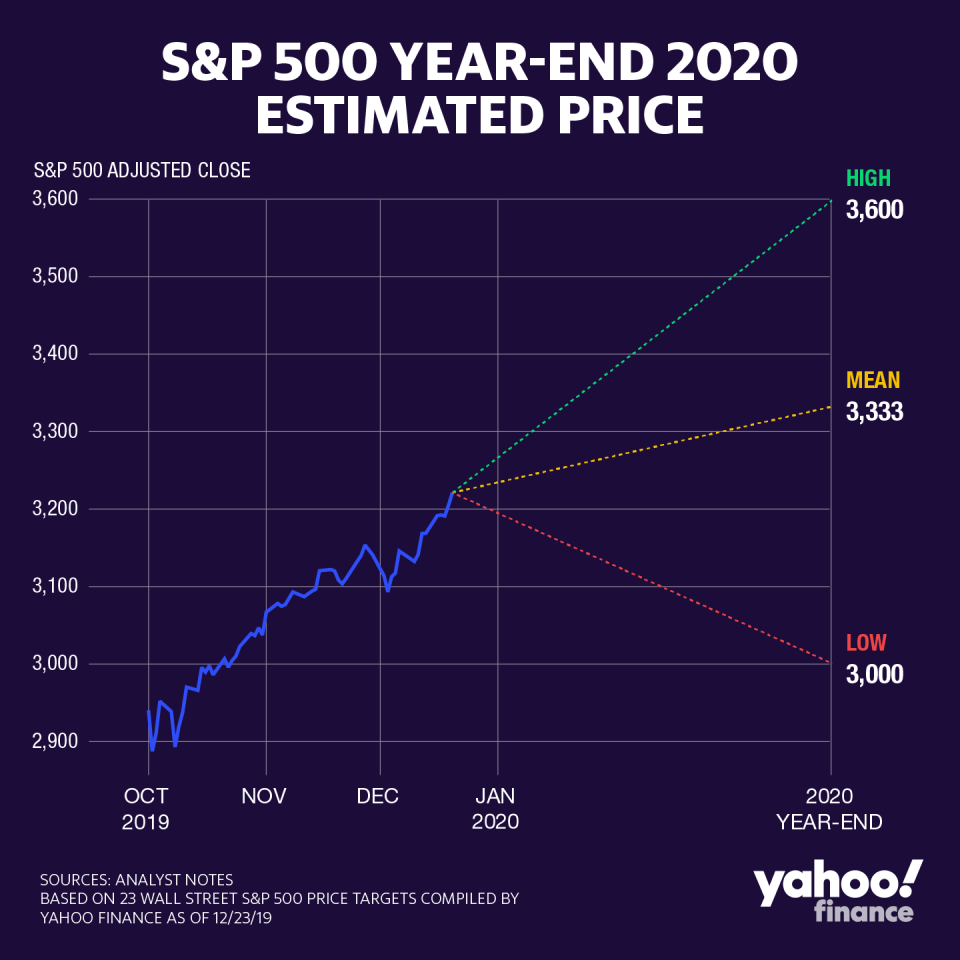

As the end of the year and the decade approaches, Wall Street strategists have been delivering their expectations about where the stock market will close out 2020.

The next year will bring with it myriad market-moving events, including the 2020 presidential elections and next phases in U.S.-China trade relations. Market pundits across Wall Street have each delivered their ideas for how these and other catalysts will shape equity markets in 2020.

Their theses come as stocks have flirted with fresh record highs time and again in the fourth quarter of 2019, as global growth concerns receded from a fever pitch earlier this year. As of mid-November, the S&P 500 was up more than 23% for the year-to-date.

Here’s a summary of what some of Wall Street’s top strategists are telling their clients for next year, updated as new 2020 views become available.

Wells Fargo (Target: 3,388; EPS: $166) – Recession risks in the rearview mirror, but a correction could be coming

Over the past couple months, strategists’ expectations for a market “melt-up” early next year have far outpaced fears of a recession from earlier this year. The swift about-face in sentiment, however, could pose a risk to markets in 2020, according to Wells Fargo.

Since the stock market sell-off this past August, “the frequency of Bloomberg ‘r-word’ mentions are down nearly 70% and the VIX Index has retreated to 40% below its long-term average,” Chris Harvey, Wells Fargo Chief Equity Strategist, wrote in a note. “The last time sentiment felt this positive (4Q17, on the heels of tax reform) stocks initially rallied in 1Q18 before running head-first into a 10% correction.”

For 2020, investors should brace for a more volatile equity market, Harvey said. With the VIX (^VIX) volatility gauge back down around 12 and investment-grade credit spreads shrunken down to about 100 basis points, “we see material scope for an upward move,” he added.

“A 10% stock market correction in 1H20 is possible; we can envision one in late March/early April when the Fed’s balance sheet possibly stops growing,” Harvey said, with emphasis his. “If we do see a healthy equity sell-off in 1H20, we would buy weakness, all else equal. Until that time, we recommend reducing portfolio risk slowly and opportunistically.”

With this in mind, Harvey downgraded semiconductors to Neutral from Outperform, noting that “this high-risk, early-cyclical group has outperformed expectations and many of the reasons for the upgrade have already played out.” On the other hand, the value group of REITs has underperformed the market since June “and is approaching technically oversold levels,” Harvey added.

Wells Fargo’s price target of 3,388 suggests stocks will ultimately end slightly higher next year, with gains mostly held back by still-sluggish increases in company profits.

As Harvey points out, most of the S&P 500’s 27% gain for the year-to-date was driven by a price-to-earnings multiple expansion, meaning stocks have gotten more expensive in absence of major earnings growth. This, in turn, was driven by declines in both Treasury yields and credit spreads this year – neither of which will likely continue next year, Harvey said.

“We take a more conservative stance on 2020 EPS growth,” Harvey said. “A number of economic factors that are positively correlated with EPS growth should improve: ISM [manufacturing purchasing managers’ indices], ISM Services, and capacity utilization.”

“However, other factors will likely be neutral-to-negative: credit spreads, volatility, and unemployment,” he added. “The net result is an SPX EPS estimate of $166, or 5% growth from the current estimate of $158.50.”

Wells Fargo price target introduced December 19, 2019

Fundstrat (Target: 3,450; EPS: $178) – ‘2009 was the best analog for 2019’

In Fundstrat’s view, 2018 was “a proper bear market and a reset of economic and fundamental expectations.” Taking this approach, 2020 will represent the second year of a bull market, analogous to 2010, when stocks limped out the gate but ultimately ended the year 12.8% higher.

“We stated, at the start of 2019, that ‘2009 was the best analog for 2019,’ and we believe this remains correct,” Fundstrat head of research Tom Lee said in a note.

Three major phenomena will take place in 2020 and help propel stocks higher, Lee said. Purchasing managers’ indices will rebound after hitting a bottom this year and corporate earnings per share will recover, Lee predicts. Each of these occurrences had also taken place in 2010 in the wake of a series of Federal Reserve interest rate cuts and easing of financial conditions.

And third, 2020 will have the added bonus of extra fiscal stimulus from Japan and Europe, as policymakers turn to fiscal rather than monetary policy to boost growth further amid already-negative interest rates.

Fundstrat’s 2020 target of 3,450 is based on predicted EPS growth of 10%. This implies, however, that P/E will remain roughly flat at 17.88x.

“The last 2 years have been about P/E (de-rate in 2018, re-rate in 2019) but in 2020, we see EPS being the key,” Lee said.

Fundstrat price target introduced December 19, 2019

Oppenheimer (Target: 3,500; EPS: $175) – ‘Significant focus will be placed on corporate earnings growth’

News of a “phase one” trade agreement pulled concerns of a U.S.-China trade war escalation mostly off the table and positioned stocks to vault even higher next year, according to Oppenheimer.

“The change in status of the trade war by virtue of a phase one agreement in principle presents an opportunity for markets to move higher near term and on further news of progress related to the phase one process (the final hammering out of details before it’s signed) and the further ‘phases’ that are likely to follow,” John Stoltzfus, chief investment strategist for Oppenheimer, wrote in a note.

“We see room for higher valuations in the new year but believe significant focus will be placed on corporate earnings growth as trade war uncertainty is reduced further over the next phases of negotiations,” he said.

Beyond improving sentiment around trade, a number of factors drove the S&P 500’s surging growth through the end of 2019 including stronger-than-expected corporate profit trends and oil prices, firming economic data and improving clarity and communication from Federal Reserve officials.

“Equity market gains since the September 20, 2018 peak through today do not suggest to us the presence of animal spirits or irrational exuberance but rather an ‘about face,’ and an acknowledgement (in hindsight) that it wasn’t so much a deterioration of economic or business fundamentals in Q4 of 2018 that dragged the S&P 500 down nearly 20%, but rather an overblown misinterpretation of economic slowing related to the trade war, monetary policy, and a ramp-up in oil production initiated by OPEC,” Stoltzfus said.

While risks remain – such as a negative reversal in trade talks, a misstep in monetary policy or rapid market melt-up and correction – stocks are likely to end next year higher, according to Oppenheimer.

The firm’s 2020 S&P 500 price target of 3,500 implies a 20x multiple of its 2020 earnings estimate of $175, and represents 9.7% appreciation from closing prices Monday.

“From current levels, a price target of 3,500 in our view appears attainable for the S&P 500 in 2020 considering the strengths and resilience of the U.S. economy, a potential improvement of the global economy tied to lessening of tensions that have impeded economic progress over the past 18 months, and the capability of the Federal Reserve to navigate uncertain waters,” he said.

Oppenheimer price target initiated December 17, 2019

Piper Jaffray (Target: 3,600; EPS: $180.50) – ‘Overall fundamentals appear supportive for a continuation of risk asset outperformance’

The stock market is poised for another year of double-digit returns, according to Piper Jaffray.

The firm’s price target of 3,600 represents upside of about 13.6% for the S&P 500, based on closing prices Dec. 13. That’s also the most bullish price target seen by Yahoo Finance to date.

“As we look ahead to 2020, overall fundamentals appear supportive for a continuation of risk asset outperformance, and based on current expectations, catalysts are in place for growth to come in better-than-feared,” a consortium of Piper Jaffray analysts wrote in a note.

“We suspect interest rates and curve spreads will gradually rise as a result and also help alleviate recession fears,” they added. “Trade policy remains a key risk; however, similar to ’19, we believe trade-related volatility will be temporary and represent a buying opportunity.”

By these analysts’ measures, the technical setup for U.S. equities “remains bullish” heading into 2020, driven by a rotation from safe havens like Treasuries and gold into risk assets like stocks.

“Large-caps and growth have held on to their leadership credentials, but participation has broadened out into cyclical sectors along with value and smaller-cap stocks,” the analysts said. “On the S&P 500, momentum has been reset from overbought levels with key resistance coming into play at the recent November high of 3,154. Support on the index sets up at 3,120, followed by 3,100, which we view as a key level for bulls to defend as a downside violation would imply an additional 2.0-2.5% pullback.”

Meanwhile, the domestic economic expansion is set to outperform against low expectations and help contribute to equity appreciation next year. The analysts view a “robust labor market, accommodative monetary policy, stable/improving housing market, and a resilient U.S. consumer” as key drivers of growth.

This better-than-anticipated economic growth and still-low inflationary pressures will likely keep the Federal Reserve on hold through next year, mirroring its mid-cycle adjustment in 1995 and 1996 when rates were left unchanged in the year following a 75-basis point rate reduction, the analysts said. And in a stronger economic growth environment, Treasury yields may move slightly, with the analysts expecting 10-year Treasury yields to finish 2020 in a range of between 2.15% to 2.35%.

Piper Jaffray price target initiated December 16, 2019

JPMorgan (Target: 3,400; EPS: $180) – ‘The profit cycle is at an inflection and should rebound’

Appreciation in the S&P 500 next year will be driven by easier monetary policy, trade deal progress and positive sentiment around the 2020 elections, according to JPMorgan strategist Dubravko Lakos-Bujas.

“Next year, we see the S&P 500 rising further to 3,400 on global cycle recovery, partial trade deal, pro-growth election-year rhetoric and neutral investor positioning,” he said.

Domestic stocks faced two main headwinds in 2019 – tighter monetary policy and higher tariffs – which in turn contributed to a slowdown in global business and profit growth, Lakos-Bujas said. He estimated the cumulative damage from tariffs alone slowed 2019 earnings per share growth down to just 1%, from an estimated rise of 8% in absence of import duties.

“Heading into 2020 these drags are expected to at least partially reverse,” Lakos-Bujas said. “Easier monetary and fiscal policies are in motion globally with [the] majority of benefits expected to flow through the economy in the coming quarters.”

And for trade, Lakos-Bujas expects an at least partial deal between the U.S. and China sometime ahead of the 2020 election. Upside for earnings growth and S&P 500 appreciation will “depend primarily on the magnitude and timing of the trade deal(s),” he said.

In the event of a full deal and reversal of all tariffs, EPS would rise to as much as $184, or an increase of 12% a year. On the flip side, an escalation of tensions and increase in tariffs would lead to EPS growth of just 4% to $171, JPMorgan estimates.

But the firm’s base case scenario of $180 in EPS implies a partial trade deal and roll-back of List 4A tariffs first applied in early September. By JPMorgan’s measure, earnings growth “likely bottomed in 3Q and should stabilize in 4Q [of 2019], followed by an earnings recovery in 1H20 (+5%) and stronger growth in 2H20 (+10%).

“The profit cycle is at an inflection and should rebound,” Lakos-Bujas said.

On positioning, Lakos-Bujas said the rotation out of momentum and into value stocks beginning in late August is less than halfway complete, based on historical trends of similar rotations.

“The second phase should be propelled by better macro-fundamental data and confirmation of cycle recovery,” he said. “Looking ahead to 1Q20, we recommend investors overweight Value, stay neutral Growth, and underweight Momentum, Low Vol and Quality.”

JPMorgan price target initiated December 9, 2019

Canaccord Genuity (Target: 3,440; EPS: $172) – ‘A move back toward the peak valuation of this cycle’

Canaccord Genuity cites the Federal Reserve’s suggested pause on interest rate adjustments as creating a tailwind for both economic and earnings growth, contributing to a higher S&P 500 in 2019. In an updated note, the firm raised its price target for the S&P 500 to 3,440, from its 3,350 price target initiated in May.

“The bullish story for 2019 was based on the economy experiencing a non-recession slowdown that was dramatic enough to cause the Fed to reverse the policy mistakes made in late 2018,” Canaccord Genuity analyst Tony Dwyer wrote in a note.

The Fed’s pivot to easing this year and bringing key rates down by a total of 75 basis points has driven a rebound in U.S. economic data and will likely contribute to a pick-up in earnings growth next year, Dwyer said. Canaccord expects EPS growth will be between 5-6% in 2020, but from a “lower base” of $162 a share in 2019, bringing their EPS estimate for 2020 down to $172 from the $176 seen previously.

“In addition to raising our growth rate assumption, we are also raising our multiple assumption from 19x to 20x,” Dwyer said. “This reflects the Fed literally telling us they will ease further on any weakness and will not raise rates until inflation is meaningfully above their target, which likely won’t happen for the foreseeable future.”

Dwyer outlined a series of interconnected factors that informed his bullish thesis for the S&P 500 next year. He expects monetary policy will remain accommodative due to persistently low core inflationary signals. This will in turn drive an abundance of available credit for companies and consumers to use to invest and grow.

“We expect a move back toward the peak valuation of this cycle as long as our core fundamental thesis driven by credit remains positive,” Dwyer said.

Canaccord Genuity price target raised to 3,440 from 3,350 December 9

CFRA (Target: 3,435; EPS: $176.35) – A number of ‘clues’ pointing to a good year

CFRA’s 2020 outlook implies 7.3% upside from the firm’s expected 2019 closing price of 3,200 for the S&P 500.

“Clue’s pointing to a good year include a below-average differential between the best and worst-performing S&P 500 sectors, the upcoming presidential election year, the continuation of the Fed’s easy monetary policy, EPS growth projections that will likely prove to be too conservative and the ongoing lack of attractive alternatives,” CFRA chief investment strategist Sam Stovall wrote in a note. “We see the signing of a Phase One trade accord to materialize, but we expect no additional agreements until after the election.”

“Finally, we have re-embraced a neutral allocation toward equities and fixed income,” he said. “We currently favor cyclical sectors and emphasize higher-quality equities that offer growth at a reasonable price.

CFRA price target included in note published December 9, 2019

Citi (Target: 3,375; EPS: $174.25) – Some upside, some risks

Earnings growth will help lead the S&P 500 higher in 2020, but there are still some risks to the outlook, according to Citi’s chief U.S. equity strategist Tobias Levkovich.

Citi’s “Panic/Euphoria Model” has moved back to a neutral level amid stocks’ recent rally after edging toward “panic” territory a few weeks prior, underscoring improving investor sentiment, Levkovich said in a slide deck report.

Next year will likely see low-single-digit EPS growth for S&P 500 companies, Levkovich said, with the Street having pared back high expectations after 2018’s initial earnings estimates for 2019 proved overly optimistic.

Risks to the 2020 outlook will include ongoing geopolitical and trade uncertainty and politics, given potential changes to tax and fiscal policies, he added.

In keeping with the trend seen among equity flows in late 2019, value stocks are largely expected to outperform their growth counterparts, Levkovich said. By groups, Citi recommended capital goods, energy, health care equipment and services, insurance, pharmaceuticals, biotechnology and life sciences, semiconductors and retailing as Overweight. It rated autos and components, consumer durables and apparel, household and personal products, telecom services, transportation and utilities as Underweight.

Citi price target raised to 3,375 from 3,300 December 9, 2019

BTIG (Target: 3,450; EPS: $175) – ‘The year the public falls in love with stocks again’

To contextualize his bull thesis for the S&P 500 in 2020, BTIG strategist Julian Emanuel turned back the clock two decades.

“2000 and 2020 have commonality – yield curve inversion, manufacturing slowdown, confident consumers, a cutting Fed, Presidential Impeachment,” Emanuel wrote in a note. “With the [September 2019] pop of bond bubble and zero fee online trading, 2020 could be the year the public ‘falls in love’ with stocks again,” Emanuel said.

Emanuel’s price target implied about 10% upside from closing prices Dec. 6. In the year following a 20% or more gain in the S&P 500 – as looks to be the case for 2019 – returns have averaged about 14.3%, Emanuel noted.

“2019’s record money market balances could help reverse bond inflow/equity outflow fueling modest multiple expansion amid a return to earnings growth,” he said. “Growth will be driven by emerging clarity on trade and Brexit as politicians realize that growth is a vital requisite to their staying in power and postponing a 2000-02 economic and market downturn.”

An onslaught of brokerages now offering zero fee trading could usher in greater public participation in the stock market and help drive the S&P 500 as high as 3,950, Emanuel said. At the same time, however, the S&P could fall as low as 2,560 in the event that “a reversion to the pre-1989 Cold War multiple regime happens as a result of geopolitical miscalculations.”

“Upside surprises for 2020 could be higher inflation, a quiet Fed, and a 2020 political outcome which heals partisan divisions,” Emanuel said. “Downsides are a U.S.-China ‘no deal,’ a post-election ‘civilizational confrontation’ with China, and a Fed which loses control of money markets or won’t act to prop an unexpected slowdown.”

BTIG price target initiated December 8, 2019

Jefferies (Target: 3,300; EPS: $176): ‘Focused on the traditional drivers for U.S. markets’

Stocks will stabilize and appreciate slightly in 2020 after more than a year’s worth of choppy equity trading, which had been driven by gyrating interest rates and an ongoing U.S.-China trade war, according to Jefferies.

“Just over twelve months ago, the equity markets were selling off as the U.S. fixed income markets choked on expectations of further rate hikes,” equity strategist Sean Darby said. But in the year since, the Fed cut rates three times and returned to making large-scale asset purchases, which in part helped to drive a more than 20% gain in the S&P 500 in 2019.

“If 2018 was a year of policy over-tightening then 2019 was a year of unwinding policy mistakes,” Darby said. “Hence, 2020 looks to be the year of normalization as a number of macro factors recede.”

Darby also noted that rhetoric around U.S.-China trade discussions has become more upbeat recently, alleviating a key overhang of trade policy uncertainty for major companies. Plus, 2020 earnings will have fully lapped impacts from the Trump administration’s 2018 corporate tax cuts, which had driven tough comparisons and lowered earnings expectations for companies throughout much of 2019.

“2020 ought to see some normalization as earnings growth moves back in tandem with GDP,” Darby said. “In summary, equity investors are likely to be focused on the traditional drivers for U.S. markets namely earnings growth.”

Darby conceded that the 2020 presidential elections could generate some idiosyncratic risks for sectors like Health Care, Financials and Technology, depending on the prevailing policies of newly elected officials. His base case, however, is that neither party will win both the House and the Senate, creating a hurdle for politicians trying to implement policies that could impact any of these companies’ operations.

Heading into 2020, sector leadership will likely be driven by cyclicals, assuming the recent upturn in global economic data carries through next year, Darby said.

“S&P 500 valuations don’t necessarily start off as inexpensive as other bourses but the cyclicals offer a lot of earnings upside if the global economy begins to resynchronize,” Darby said. “Moreover, 2019 saw unprecedented risk aversion and there is plenty of room for assets to move away from fixed income into equities given the potential inflation risks.”

“In turn, this leads us to the biggest risk for 2020 which is a switch from low volatility, bond proxies into the real economy, cyclical growth stocks,” he said.

“We expect earnings to accelerate back to trend of circa 10%, real interest rates to remain negative alongside a steep yield curve,” Darby said. “This ought to mean that the S&P 500 can advance to 3,300. We upgrade the S&P 500 to Modestly Bullish.”

Jefferies is bullish on the consumer discretionary, energy, financials, industrial and materials sectors heading into 2020. The firm is bearish on consumer staples, real estate and utilities.

Jefferies price target initiated December 6, 2019

Ned Davis Research (Target: 3,325; EPS: N/A) – ‘The cycles muddle through’

The macroeconomic outlook, earnings, Federal Reserve and 2020 elections will be the main determinants of equity returns next year, according to Ned Davis Research.

The firm sees the U.S. economy slowing but avoiding a recession and earnings growth hovering near unchanged from 2019’s levels. The Fed will likely maintain its dovish posturing at least through the first half of the year, and the election cycle will shift from a headwind into a tailwind by the end of the year, according to Ned Davis.

“Our base case is the cycles muddle through: real GDP growth slows to 1.8%, the 10-year rises toward 2%, the Fed holds rates steady, and oil trends higher,” Ned Davis chief U.S. strategist Ed Clissold said. “The base case yields an S&P 500 target of 3,325, 7% above current levels. Given the uncertainty, we stress the need for flexibility. That includes using macro and political dynamics to create opportunities in the Health Care, Financials and Energy sectors.”

These three aforementioned sectors could be particularly impacted by the outcome of the 2020 presidential elections, sector strategist Pat Tschosik said.

Companies within these sectors could be hit if policies introduced by Democratic candidates including Elizabeth Warren were put into play, “including her desire to end offshore drilling and drilling on federal land, reduce greenhouse gases, increase regulation on big banks, impose regulation on private equity, control drug prices, make the U.S. government the sole health care insurance payer, break up big tech companies, increase gun control, and reallocate/reduce defense spending,” Tschosik said.

“As election winners become clear, we expect some sectors to mean revert to more normal valuations as political risk is priced out,” Tschosik said. “Again, we suspect Health Care, Financials and Energy are likely to have the most political risk priced in, creating a potential buying opportunity.”

That said, Ned Davis’s base case scenario sees Republicans maintaining control of at least one of the Senate or White House, which could make implementation of some of these policies more difficult.

Ned Davis price target included in note published December 5, 2019

Evercore ISI (Target: 3,400; EPS: $178) – ‘The outlook for growth and risk assets has improved’

Stocks are poised to rise again in 2020 as the domestic growth picture improves, trade-related risks lift and monetary policy remains accommodative, according to Evercore ISI.

“Looking toward 2020, the outlook for growth and risk assets has improved. Global economic growth, though still stuck in low gear, has started to improve. Earnings growth is set to reaccelerate,” said Dennis DeBusschere, Evercore chief investment strategist. “Global central banks remain dedicated to reaching their still elusive inflation targets, in part by maintaining asset-friendly financial conditions.”

“The year ahead is not without risks – the ongoing trade war, the U.S. presidential election, China’s deleveraging – but we forecast another strong year for equities, led by a rebound in Cyclical sectors and risk-on factors,” he added.

DeBusschere sees the S&P 500 rising to 3,400 in 2020 and earnings per share ticking up to $178.

Several core themes underpin the firm’s assumptions for the stock market next year.

Evercore ISI expects economic volatility to remain low and U.S. GDP to average around 2%, “as long as savings rates remain high, labor markets strong and consumer confidence firm.” And with inflation still below the Fed’s 2% target, the central bank will likely retain a dovish posturing, and “easy financial conditions will bias PEs higher,” DeBusschere said.

By style, Evercore favored a cyclical stock allocation, given that these equities have still mostly been priced for a recession relative to defensives and thereby have more room to rise.

“A recession is unlikely, so Cyclicals will extend their 4Q rally into next year,” DeBusschere said.

Evercore ISI price target introduced December 4, 2019.

Scotiabank (Target: 3,350; EPS: $167) – ‘Continue the transition toward cyclical-value equities/sectors’

As with many of his peers on Wall Street, Scotiabank strategist Hugo Ste-Marie said he expects the rotation into value stocks that began at the end of summer 2019 to continue well through next year.

“Our 2020 game plan is to continue the transition toward cyclical-value equities/sectors,” Ste-Marie said. “The outsized value reversal seen last September was relatively rare and these tend to be followed by value outperformance over the next 12 to 18 months.”

Equity indicators are mostly flashing mixed signals, Ste-Marie said, and investors’ “distrust seems as high as ever” in equities as outflows surged for U.S. mutual funds and ETFs at the start of December. But stocks could nevertheless be poised for a boost in 2020 in an improving economic environment.

“Over the next two years, we expected the U.S. and Canadian job market to remain robust (no sustained spike in jobless claims), with high consumer confidence/consumption, and accommodative monetary policy (no hikes until mid-2021),” Ste-Marie said. “The steep fall in yields has already started to percolate in the economy, with North American housing activity building some momentum in recent months. The global easing should eventually lift ISM/PMIs in H1/2020.”

The firm’s price target of 3,350 for the S&P 500 implies an 18.5x multiple on its 2021 EPS estimate of $181.

Scotiabank price target introduced December 3, 2019

LPL Financial (Target: 3,250-3,300; EPS: $175): Trade progress could help stocks in 2020

Stocks could be heading marginally higher in 2020, but a still-tumultuous geopolitical environment has clouded visibility heading into next year, according to LPL Financial.

The firm’s base case estimate is for S&P 500 earnings per share to rise to $175 in 2020, up from an estimated $165 for 2019 EPS. The forecast assumes further progress on trade talks between the U.S. and China, including at least a modest de-escalation of tariffs.

“Further progress on the U.S.-China trade conflict in early 2020 could help keep U.S. economic growth at or above the trend for the current economic expansion and support corporate revenue growth,” LPL strategists led by John Lynch said in a report. “We believe any small steps forward on trade could increase business confidence and spark capital investment, lifting corporate profits.”

However, “until we have clarity on trade, we would not expect 2020 earnings to improve meaningfully from 2019 levels,” Lynch said.

LPL’s 2020 year-end fair value target range for the S&P 500 is between 3,250 and 3,300, implying a trailing price-to-earnings ratio of 18.75x. The firm believes this valuation will be supported as inflation remains muted and interest rates hold at relatively low levels.

The low end of LPL’s range implies appreciation of just about 4% for the S&P 500 from closing prices December 2, versus the more than 20% advance the index has posted so far in 2019. But domestic equities still remain more attractive than those from international developed markets, LPL said, given that the U.S. economic backdrop and prospects for corporate profitability still look stronger than those of many developed global peers.

“We recommend tactical investors consider focusing the majority of their equities allocations here at home as U.S. economic growth expectations have held up well compared with global trends,” Lynch said.

“We recommend a balance of growth and value styles, with an emphasis on large cap stocks over their small cap counterparts as the business cycle moves into its latter stages,” he added. “We continue to prefer cyclical sectors as the U.S. economic expansion continues, and technology still leads this bull market. We expect industrials to benefit from a potential pickup in capital spending if there is further progress on a U.S.-China trade agreement.”

LPL Research price target introduced December 3, 2019

Deutsche Bank (Target: 3,250; EPS: $175): Stretched valuations may lead to limited upside next year

Deutsche Bank sees a sideways market in 2020.

The firm’s chief strategist Binky Chadha, one of the more bullish prognosticators on Wall Street for the S&P 500 this year, is calling for the index to end 2020 at 3,250 – the same price target he had for the blue-chip index in 2019. That implies just 4% appreciation from closing prices on December 2.

Equity traders may have gotten ahead of themselves in pricing in a rebound in macroeconomic data and corporate earnings, Chadha said, which could keep the S&P 500 range-bound next year.

“What’s priced in? A strong rebound in macro growth with the ISMs [Institute for Supply Management’s purchasing managers’ indices] rising to around 57 and earnings growth to 15%,” Chadha said. “This year the S&P 500 has climbed to new all-time highs despite continued slowing in both, suggesting the markets are pricing in a rebound in fundamentals, supported by recent green shoots optimism.”

After appreciating 20% this year, the S&P 500 has seen its multiple expand 19.1x earnings. At this level, valuations are at the high of their historical range, “having been higher only 10% of the time over the last 85 years,” Chadha said.

However, while this multiple is relatively high on a historical basis, “it is not too far above fair value (18.7x) indicated by its fundamental historical drivers,” Chadha said. These include earnings relative to normalized levels, the payout ratio, interest rates and inflation volatility.

“Where the multiple goes over the course of the next year will depend on how these drivers evolve,” Chadha said.

Aside from typical fundamental drivers, next year’s elections will also provide a market-moving event for traders to eye. As Chadha sees it, the risks from the election will be to the downside for equities.

“The US presidential election will make it difficult for the fundamental uncertainty emanating from US trade policy, which has plagued corporates and been a key driver of the US and global growth slowdowns, to dissipate completely,” Chadha said. “This argues for a break in the downward trajectory of growth and some bounce, not a rebound to the peaks of this cycle as the markets are already pricing.”

Deutsche Bank price target introduced December 2, 2019.

RBC Capital Markets (Target: 3,350 ; EPS: $174) – ‘A year of moderation, turbulence, and transition in the U.S. equity markets’

RBC Capital Markets said U.S. equity returns will be closer to trend in 2020, after a surge in stocks in 2019 sent the S&P 500 up a thumping 25%.

“We expect 2020 to be a year of moderation, turbulence, and transition in the U.S. equity market,” said Lori Calvasina, head of U.S. equity strategy for RBC. “Down years are rare in the U.S. equity market, outside of periods associated with growth scares, recessions, or Financial market bubbles. With those scenarios unlikely in the year ahead, we expect 2020 to be another positive year for the U.S. equity market.”

However, Calvasina added that she remains “on guard for a pullback in the months ahead,” given recent equity positioning by institutional investors driven by what she believes is a fear of missing out.

“In late November positioning in U.S. equities in the futures market among asset managers has been slightly above its July 2019, September 2018, and 2007 highs, which all marked major peaks in the U.S. equity market, resulting in pullbacks that ranged from 7% to 20% over the past few years,” she said. “This keeps us on guard for a period of significant consolidation near-term, and will be an overhang on 2020 performance if not resolved before year end.”

As Calvasina puts It, the stock market may have gotten “a little too excited” about the economy recently, and especially as the Federal Reserve has telegraphed a near-term pause to interest rates. While the U.S. expansion is poised to continue in 2020, it may grow with less gusto than some market participants may be pricing in, she said.

“Realization by equity investors that the U.S. is likely to see moderate as opposed to rapid economic growth in the year ahead could be a catalyst for profit taking,” Calvasino said.

In terms of investing style, RBC is maintaining a slight preference for value over growth stocks, dove-tailing off the rotation that began late in the summer on the heels of improving economic data and a steepening of the Treasury yield curve. The firm also said it is tilting in favor of cyclicals, assigning Overweight ratings to Financials and Industrial sectors. And given RBC’s concerns of a near-term pullback, it also maintained an Overweight rating on Utilities to keep some defensive exposure

RBC is Underweight Materials, Consumer Discretionary and Communication Services. It is Marketweight Consumer Staples, Health-Care, REITS, Energy and Technology.

RBC Capital Markets price target initiated November 27, 2019

Societe Generale (Target: 3,050; EPS: $164) – ‘A tug of war currently exists between two scenarios for 2020’

Societe Generale sees mild downside for the S&P 500 next year as this year’s surging stock growth peters out.

“The next big event we expect to take place under our scenario is a mild recession in the U.S. in 2Q/3Q next year. We expect global equity indices to finish 2020 on a more positive note and at a higher level in 2021 and 2022 as growth returns,” Societe Generale analysts including Sophie Huynh wrote in a note.

The firm’s base case price target of 3,050 implies downside of about 3% from closing prices Nov. 25. The decline will be driven by an “intensifying corporate profit squeeze,” even as concerns of a no-deal Brexit and escalating U.S.-China trade dispute abate.

“A tug of war currently exists between two scenarios for 2020: a mild recession and a fourth mini-cycle since 2009,” the analysts said. “We are cautious against this backdrop but not blindly bearish. The S&P 500 is likely to remain range-bound from here, with limited downside if we factor in our central scenario of a mild recession: consensus earnings growth forecasts will likely be revised down for 2020, and we don’t see massive P/E [price-to-earnings] contraction in the search for yield environment.”

“In fact, we continue to stay away from U.S. tech and small caps,” the analysts added. “Under the mid-cycle mindset, however, we see an upside risk to 3,400 for the next few months, but that won’t likely last.”

A balance of support from monetary policy in the U.S. and fiscal stimulus abroad could help drive risk assets in 2020, the analysts said. In the U.S., there may be limited room for further fiscal loosening after President Donald Trump implemented his corporate tax reform 2018. But this phenomenon is less of a concern abroad, as countries in the euro area and Japan increasingly turn to fiscal policy to stimulate growth as their interest rates already hold in negative territory.

“With a global economic slowdown, limited room for further significant monetary easing but potentially rising fiscal stimulus in the backdrop, we favor a balanced portfolio (45% equity, 45% bonds, 5% commodities and 5% cash),” the analysts wrote.

Societe Generale price target included in note issued November 26, 2019

Barclays (Target: 3,300; EPS: $166): ‘The recovery from the current slowdown is unlikely to be V-shaped’

Barclays’ view for the S&P 500 and global economies this year is just lukewarm: Growth won’t get much more sluggish, but it won’t rocket higher, either.

“For both the U.S. and Europe, our estimates for modest EPS [earnings per share] growth are predicated on the view that the current global slowdown in manufacturing is unlike to morph into a full recession next year and will thus remain a soft patch,” equity strategist Maneesh Deshpande said.

“In particular, we expect EM growth to start rebounding, Japanese and U.S. growth to pick up after declining a bit further, and EU growth to remain at current low levels,” Deshpande added, citing a recent pick-up in global manufacturing purchasing managers’ indices.

“However, in our opinion, the recovery from the current slowdown is unlike to be V-shaped/symmetric. The main reason for this is that, contrary to popular belief, the U.S.-China trade war has not been the sole contributor to the economic slowdown, and the self-imposed deleveraging by China to slow credit growth has also played an important role,” Deshpande added. He said he believes non-U.S. economic growth “peaked in late 2017 much before the start of the U.S.-China trade war.”

With all this in mind, Deshpande considers the current market environment to be akin to historical “easy soft patches,” wherein the central bank steps in and cuts interest rates to spur growth even in absence of an official recession.

During the previous five “soft patches” since the 1950s – which took place in 1966, 1984, 1989, 1995 and 1998 – U.S. equities have risen by about 40%, on average, in the two years after the start of a Fed easing cycle, mostly driven by an expansion in valuation as opposed to growth in earnings.

Looking to next year, Deshpande also said European equities may outperform against U.S. stocks, particularly as political risks like Brexit wane across the pond but pick up in the U.S. amid the 2020 elections. He expects Europe’s Stoxx 600 index (^STOXX) will appreciate by 5.3% in 2020 to 430, representing about the same level of appreciation as anticipated for the S&P 500.

“While our price targets give about the same upside for the two regions in 2020, we believe that Europe offers a mildly more attractive risk-reward given its relatively more attractive valuation, higher leverage to global/EM activity and cautious investor positioning,” Deshpande said.

Barclays S&P 500 price target initiated November 26, 2019

Bank of America Merrill Lynch (Target: 3,300; EPS: $177): 5 key trends will drive stocks next year

A handful of rotations will take place in 2020 and ultimately lead to modest appreciation in the S&P 500, according to Bank of America Merrill Lynch.

Strategist Savita Subramanian sees the 2020 presidential elections as the marquee event for next year, with the policy implications of the winner of the White House serving as a key consideration for investors.

But elections aside, Subramanian outlined five key rotations that will punctuate the coming year, leading to a shift in leadership among sectors and asset classes.

First will be a rotation from bonds to stocks, she said.

“The allocation decision is a no-brainer: the S&P dividend yield beats the 10-year [Treasury yield],” Subramanian said. “This rarely happens, but 94% of the time that it has, stocks have beaten bonds (by ~20ppt avg.) over the next 12 months.”

Second, Subramanian said she sees emerging markets (EM) and European equities as potentially offering more upside than U.S. stocks, especially against a backdrop of low interest rates abroad and already packed positioning in domestic equities. But for those who remain parked in U.S. stocks, Subramanian suggested a preference for domestically focused sectors like Financials and Discretionary, given an increasing tilt toward protectionism from U.S. and global political leaders.

Third, Subramanian called out a shift from the trade war to a “tech war,” as tech companies increasingly become caught in the crosshairs of geopolitical tensions. Bank of America downgraded the Information Technology sector to Marketweight from Overweight in consideration of these risks.

Fourth will be a shift to value stocks from their growth and momentum counterparts. The former refers to stocks typically valued trading at low multiples of their net worth.

“Value has never been this cheap,” Subramanian said, adding that “Value’s market cap has shriveled to levels historically followed by recoveries.” Financials, the largest value sector, is Bank of America’s highest conviction Overweight sector call.

Fifth and finally, Subramanian highlighted an increasing emphasis among investors on environmental, social and governance considerations, indicating that companies outperforming next year may coincide with those most heavily focused on maximizing their social impact.

Bank of America Merrill Lynch price target initiated November 20, 2019

Goldman Sachs (Target: 3,400; EPS: $174): 2020 election outcome a risk to equities

A unified government after the 2020 elections represents a downside risk to stocks, according to Goldman Sachs.

In a revised equity outlook, Goldman Sachs strategist David Kostin lowered his earnings per share view for S&P 500 companies to $174, from the $177 seen previously. While he maintained his previous base case target for the blue-chip index to hit 3,400 in 2020, he noted that political factors could prevent stocks from appreciating to this level.

“A durable profit cycle and continued economic expansion will lift the S&P 500 index by 5% to 3,250 in early 2020,” Kostin said. “However, rising political and policy uncertainty will keep the index range-bound for most of next year.”

The outcome of the 2020 election remains a primary source of uncertainty – and not just over who’s sitting in the White House, but also over where control lies in Congress.

“In the United States, equity returns during periods of divided federal government have typically exceeded returns achieved when one political party controls the White House, Senate, and House of Representatives,” Kostin said. “Since 1928, excluding recessions, when the federal government was controlled by a single party, the S&P 500 median 12-month return equaled 9%.”

In contrast, the median annual return under a divided government was 12%, Kostin said.

“During the next 11 months, shifting electoral prospects of candidates will be reflected in real-time prediction markets and sector and stock performance,” he added. “During the subsequent two months, S&P 500 performance will depend on the actual election outcome.”

A united government would facilitate easier passage of policy touted by some early candidates, including a proposed roll-back to the 2017 corporate tax cut. Goldman Sachs estimated that every one percentage point change in the effective corporate tax rate would translate to an about 1% change in S&P 500 EPS.

“A unified federal government post-election could prompt investors to assume the tax cut is reversed and lower projected 2021 EPS to $162 (-7% year/year growth), compressing the P/E multiple to 16x consistent with an index level of 2,600,” Kostin said.

That said, prediction markets current suggest that the most likely 2020 election outcome is a divided government.

In this scenario, “Clarification of policy will expand the P/E multiple to 18.6x and push the index to 3,400 by year-end 2020,” Kostin said.

Goldman Sachs EPS projection revised November 25, 2019

BMO Capital Markets (Target: 3,400; EPS $176) – ‘Notorious Bull Market’ still has staying power

According to BMO Capital Markets, the Federal Reserve has been to equities what Notorious B.I.G., Tupac and Snoop Dogg were to hip hop: a catalyst for a new epoch.

“Many believe the height of 1990s hip hop was 1995 to 1997, an era that helped define popular music and culture for years to come,” BMO chief investment strategist Brian Belski wrote in a note. “We believe the same can be said to a large degree for equity markets.”

Namely, the Federal Reserve’s pivot to cutting interest rates beginning in 1995 “ushered in a goldilocks period defined by low rates, steady growth and U.S. large cap quality stock outperformance,” Belski explained. A quarter-century later, “a similar environment is currently under way,” he added.

As Belski sees it, the Fed’s shift to cutting interest rates three time this year, after hiking them four times in 2018, set the stage for U.S. large cap, high quality and brand name companies to outperform their global counterparts.

Heading into 2020, Belski’s “Notorious Bull Market” is poised to continue for U.S. equities, with a still-accommodative Fed and other factors at play.

BMO’s bullish base case for the S&P 500 to end next year at 3,400 is predicated on three main factors: the firm’s expectation that the Federal Reserve will hold rates at least through the 2020 presidential elections, that improving prospects of a phase one U.S.-China trade agreement will continue easing markets’ worries and that investors will continue seeking out firms with stable earnings, thereby favoring U.S. companies.

BMO acknowledged a bear case scenario of 2,775 for the S&P 500, in the event that trade negotiations lose momentum, tariffs cut into margins and multiples contract quickly as investors begin pricing in a downturn. But in BMO’s bull case scenario, the S&P 500 would surge to 3,675, likely in the event of a “substantial trade agreement between the U.S. and China, igniting corporate investment and propelling global growth.”

But regardless of where on the dart board the S&P 500 ultimately ends in 2020, BMO remained resolute in its conviction that this more than decades-long bull market is set to last.

“We made a prediction in 2010, that U.S. stocks were likely entering a 20-year secular bull market,” Belski said. “We are sticking with that call.”

“To be clear, we are not maintaining our longer-term bullish position to be stubborn,” he added. “Rather, many of the same core principles remain in place – namely, U.S. corporate superiority in terms of earnings stability, cash flow, innovation, product and services, and company management.”

BMO Capital Markets price target introduced November 21

Stifel (Target: 3,265; EPS: $169.63): Stocks may go down before they go up

Trade talks will be a key driver of the stock market’s appreciation – or lack thereof – heading into 2020, according to Stifel strategist Barry Bannister.

Bannister updated his target for the S&P 500 to end 2020 at 3,265, up from a previous target of 3,100. The new view also includes a recommendation for a revamped investment strategy: favoring a long cyclical/short defensive posturing, versus the defensives and bond proxies play the firm had leaned on for the past year through October.

“Although we see a return of +5% for the S&P 500 in 2020, we see twice that return or 10% for Long Cyclical / Short Defensive industries in 2020,” Bannister said.

Like many other strategists, Bannister highlighted the recent rotation to cyclical stocks as a reflection that the Fed’s recent campaign to unwind some of its interest rate hikes through 2018 had revitalized high growth companies. And by Bannister’s measure, only about one-third of the cyclical rotation his firm predicts will take place by December 2020 has so far occurred.

“The Fed has (belatedly) done its part to revive cyclical growth, so now it’s up to trade,” Bannister said, with emphasis his.

Stifel thinks cyclical stocks’ run-up, and the S&P 500 as a whole, will follow the direction of manufacturing activity growth, a sector that comprises a small portion of the overall domestic economy but is highly levered to U.S.-China trade talks.

By Bannister’s measure, activity in this sector is poised to trend higher: He anticipates that the Institute of Supply Management’s manufacturing purchasing managers’ index (PMI) will rise to 53 in 2020, indicating expansion at a faster rate, versus this past October’s contractionary reading of 48.3.

But the S&P 500 may already have gotten ahead of itself, running up before PMIs have actually staged their recovery. As a result, a market correction, or drop of around 10% in the S&P 500, could take place before an anticipated rebound next year.

“One wrinkle is that our S&P 500 price model also suggests a brief late-2019 S&P 500 correction, perhaps with trade policy as a fundamental catalyst,” Bannister said.

Stifel price target raised to 3,265 from 3,100 November 20, 2019

Credit Suisse (Target: 3,425; EPS $173) – ‘Cyclical leadership’

Cyclical stocks will lead next year’s market rally, according to Credit Suisse.

The firm’s S&P 500 price target of 3,425 implies an about 9.8% gain from closing prices Nov. 15. The upbeat outlook assumes that S&P 500 revenues will grow in-line with nominal gross domestic product, margin headwinds will recede and become “substantially less onerous,” and buybacks will remain robust.

And next year reacceleration in economic growth will drive a rotation to cyclical stocks, Golub added. This would reverse a trend from earlier this year when growth stocks outperformed and value stocks lagged.

“Economic data has decelerated over the past 1+ years, resulting in the outperformance of Low Vol and Growth stocks, at the expense of value,” Golub said. “This leadership shifted more recently, on aggressive Fed action (3 cuts) and improving economics.

“Our work indicates that this rotation will continue through the early part of 2020. Absent a ‘V’ shaped bounce in the data (similar to 2016-2017), we expect this rotation to fade as we move further into next year,” he added.

Credit Suisse upgraded “economically-sensitive groups” including Financials, Industrials and Materials to Overweight from Market Weight, and Energy to Market Weight from Underweight.

The firm downgraded defensive sectors including Staples, Utilities and REITS to Underweight from Market Weight, and Communications from Overweight to Market Weight.

Credit Suisse price target introduced November 18, 2019

Morgan Stanley (Target: 3,000; EPS $162) – ‘U.S. remains our least preferred region’

U.S. equities may underperform their global counterparts next year, according to Morgan Stanley.

The firm set its base case S&P 500 target at 3,000, implying an about 3.9% decline from closing prices on Nov. 15.

In a more optimistic bull case, the S&P 500 could reach as high as 3,250, strategists including Andrew Sheets and Michael Wilson wrote in a note. But their more pessimistic bear case sees the S&P 500 falling to as low as 2,750.

“In the U.S., we continue to expect earnings growth to remain under pressure as our earnings model projects another year of flat to modestly down earnings as margin pressures continue to mount,” the analysts said. “The forecasts from our economics team, which have slow growth and accelerating wage gains, are likely to amplify these margin pressures and weigh on the outlook for earnings further, which should translate into better earnings growth outside the U.S.”

U.S. stocks have been the leader in global equities so far in 2019, and European shares have also posted sizable gains. Stocks in both regions have benefited from easier monetary policy and lower interest rates as their respective central banks stepped in to help spur growth.

While acknowledging a likely rebound in global economic growth next year, the analysts said they expect any such pickup in growth will be mild by historical standards.

“The path for global growth may look better next year, but our economists project that the rebound is only to modest levels of economic growth that, in many cases, are still below trend,” the analysts said. “With many valuations across major equity markets already having rebounded to slightly above five-year averages, we don’t think it prudent to rely on more multiple expansion in what is still a fairly tepid growth environment. This means that forward returns at this point need to be driven by a realization of the earnings growth that is already in the price.”

“The U.S. remains our least preferred region, given limited scope for multiple rerating or incremental flows, and earnings expectations that look materially too high to us,” the analysts said.

“We see the biggest potential upside in markets with a clearer path to achievable earnings growth (Japan and EM) or scope for some multiple re-rating on falling political risks,” with Europe being one such example, they added.

Morgan Stanley note published November 17, 2019

UBS (Target: 3,000; EPS: $170) – ‘Equities have further to discount’

UBS also thinks stocks are going down in 2020.

As UBS equity strategist Francois Trahan sees it, “investor sentiment toward equities has turned overly optimistic.” In recent weeks, bets against renewed volatility (^VIX) have risen as the S&P 500 sailed to record levels.

“Volatility shorts have seen more intensity in recent weeks than at any point since the recovery of 2009, highlighting the consensus belief that financial markets are moving past the slowdown.”

Heading into the fourth quarter of 2019, stocks were led higher by cyclicals like transports and energy as economic data improved from the doldrums earlier this year. But these sectors may not continue to sustainably until leading economic indicators have “truly bottomed for the cycle,” Trahan said.

Starting around October, there’s been “a significant change in sentiment, and there is now a widespread perception among investors that equities have fully discounted the U.S. economic slowdown and begun to price in an eventual recovery,” Trahan said. “It is certainly true that the S&P 500 index is a leading indicator of the U.S. economy. What is not so clear is whether the S&P 500 has appropriately priced in the slowdown.”

“In the right context, it appears more likely that the slowdown is not behind us just yet. We believe the recovery WILL get priced in at some point in 2020, but the process has not begun at this stage,” he said.

Historically, it’s taken about two years for a change in U.S. interest rates to be fully reflected in U.S. GDP, Trahan said. With that logic, given that interest rates last hit their peak in late 2018 after the Fed’s fourth rate hike of that year, GDP should reach a bottom in late 2020. Most previous business cycles saw the S&P 500 hit a low and then start to recover 5-7 months before GDP bottomed, he added, based on a review of the seven “major Fed-induced slowdowns” of the last five decades.

“If history was a perfect guide, then the U.S. economy would bottom exactly as interest rates suggest in November of 2020 and equities would begin to discount that in Q2 '20 or thereabouts,” Trahan said. “Who knows if things will work out exactly that way but we expect this dynamic to play out in early 2020.”

“If instead we went with consensus and assumed that the S&P 500 is already pricing in a recovery, then the low point in the S&P 500's return was this past June, which would argue that the low point in GDP growth would be in Q4 of 2019, or about six months later. That would be a full year before what interest rates suggest and a first in the modern era,” Trahan said.

“Nothing is impossible, of course, but it seems more likely to us that U.S. equities have further to discount,” he said.

UBS note published November 13, 2019

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

FedEx CEO: ‘Whistling past the graveyard’ on the U.S. consumer belies a broader slowdown

There won’t be ‘billion-dollar beverage brands’ in the future: Iris Nova CEO

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance