Wall Street Recommends Buying These 2 Falling Knives

- By Alberto Abaterusso

Wall Street recommends to buy shares of SenesTech Inc (NASDAQ:SNES) and Delcath Systems Inc (NASDAQ:DCTH), even though these two stocks have disappointed so much over the prior 52 weeks through Monday, Aug. 31. They have each lost more than 59% in terms of share price. Due to the sharp share price decline and positive recommendations, these two stocks have earned the name of "falling knives."

Those who invest in falling knives are aiming to catch them near their lowest prices as they expect to make impressive margin returns out of their investments after their holdings have rebounded. These investors should also be aware about the high risk they are running as falling knives could have permanent financial issues.

SenesTech Inc

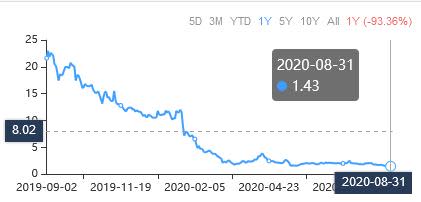

SenesTech Inc is a Phoenix, Arizona-based developer of pest control remedies in animal populations. The stock was trading at a price of $1.43 per share at close on Monday following a 93.4% decline in the share price over the past 52 weeks.

The stock has a market capitalization of $4.86 million, a 52-week range of $1.32 to $28.52 and a 14-day relative strength index of 33, which tells that the share price is trading close to oversold levels.

GuruFocus assigned a low rating of 2 out of 10 for the company's financial strength, as a Piotroski F-Score of 3 (out of 9) and Altman Z-score of -21.25 (less than 1.81) indicate possible insolvency possibility within two years. The debt-equity ratio is 0.29 (versus the industry median of 0.39).

The stock has an average price target of $4 per share on Wall Street, reflecting a 180% upside from Monday's closing price.

Delcath Systems Inc

Shares of the New York-based developer of treatments for primary and metastatic liver cancers were trading at a price of $11.90 per unit at close on Monday after decline of 85.8% over the past 52 weeks .

The stock has a market capitalization of $46.84 million, a 52-week range of $5.15 to $95.87 and a 14-day relative strength index of 52, which tells that the share price still stands far from oversold levels despite the significant slump.

GuruFocus assigned a low score of 3 out of 10 for the financial strength of the company, which is the result of a Piotroski F-Score of 2 out of 9, indicating poor business operation, and an Altman Z-Score of -24.35, suggesting the possibility of bankruptcy within two years. The debt-equity ratio is 0.33 (compared to the industry median of 0.24).

The stock has an average target price of $19.50 per share on Wall Street, which represents a 64% increase from Monday's closing price.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance