Wall St. has raked in over $1.5 billion in fees from AT&T and Time Warner in the past decade

AT&T (T) on Saturday agreed to buy media and entertainment giant Time Warner (TWX) in a cash-and-stock deal valued at $85.4 billion, making it the biggest deal of the year if it’s approved by regulators.

It would also mean a nice payday for the investment bankers working on the deal. Perella Weinberg, JPMorgan (JPM) and Bank of America (BAC) are advising AT&T, according to Reuters. JPMorgan and Bank of America are also working on the bridge financing. Allen & Co., Citigroup (C) and Morgan Stanley (MS) are advising Time Warner.

If the Time Warner deal goes through, Freeman estimates that AT&T will pay an additional $90 million to $120 million in advisory fees, plus $110 million to $130 million for the bridge loan, according to estimates from boutique M&A advisory firm Freeman & Co.

Time Warner and AT&T have been fee whales for Wall Street

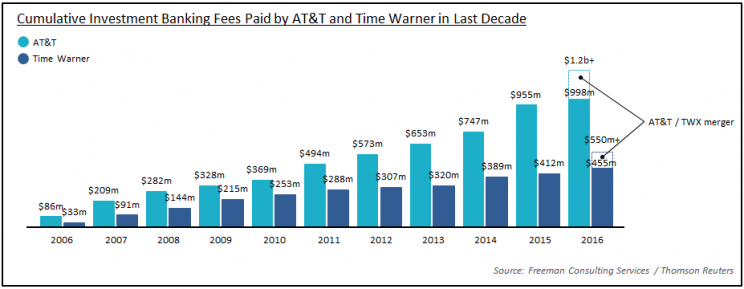

Freeman & Co.’s records show that AT&T and Time Warner have paid close to $1.5 billion in investment banking fees in the past decade prior to the the AT&T-Time Warner deal announcement.

AT&T alone has paid close to $1 billion in investment banking fees for M&A, bonds and loans in the last decade. Notable deals include AT&T’s acquisitions of Leap Wireless in 2013 and DirecTV in 2015.

Time Warner has paid about $455 million in that time. Notable deals in recent years include the spinoffs of Time Warner Cable in 2009 and Time Inc. in 2014. Time Warner should pay an additional $110-140 million for their sale to AT&T, Freeman estimates.

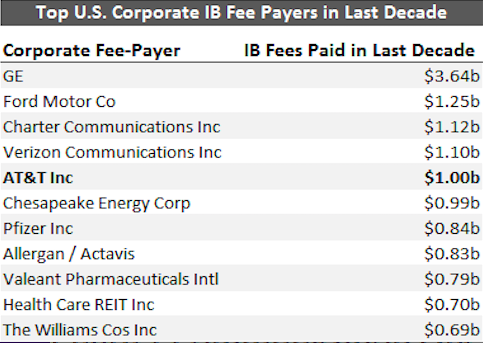

AT&T certainly looks like a prized client for investment banks just based on its deal activity over the years. The telecom giant currently ranked No. 5 among US companies (excluding financial institutions and funds) for investment banking fees paid in the last decade, according to Freeman & Co.

GE (GE) is currently ranked No. 1 with $3.64 billion in investment banking fees, followed by Ford Motor (F) Charter Communications (CHTR), Verizon Communications (VZ), and AT&T. If the Time Warner deal closes, AT&T could move up to the No. 2 or No. 3 spot.

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

Yahoo Finance

Yahoo Finance