Volatility 101: Should Farmer Bros (NASDAQ:FARM) Shares Have Dropped 47%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term Farmer Bros. Co. (NASDAQ:FARM) shareholders have had that experience, with the share price dropping 47% in three years, versus a market return of about 46%. And over the last year the share price fell 40%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

View our latest analysis for Farmer Bros

Farmer Bros isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

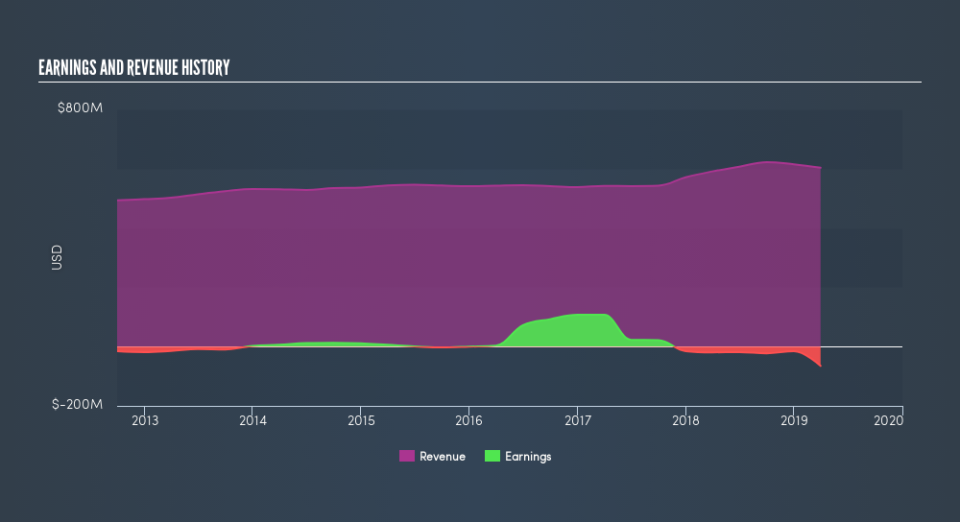

Over three years, Farmer Bros grew revenue at 5.3% per year. That's not a very high growth rate considering it doesn't make profits. The stock dropped 19% during that time. If revenue growth accelerates, we might see the share price bounce. But the real upside for shareholders will be if the company can start generating profits.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Farmer Bros in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 6.2% in the last year, Farmer Bros shareholders lost 40%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.1% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you would like to research Farmer Bros in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance