VIVUS (VVUS) Q2 Loss Wider Than Expected, Revenues Up Y/Y

VIVUS Inc. VVUS reported a loss of 12 cents per share for the second quarter of 2018, narrower than a loss of 13 cents in the year-ago period but wider than the Zacks Consensus Estimate of 11 cents. Quarterly revenues increased 33.3% from the year-ago period to $14.7 million mainly due to higher Qsymia sales and additional sales of recently acquired drug, Pancreaze.

So far this year, VIVUS shares have increased 32.5%, while the industry witnessed a decrease of 3.5%.

Quarter in Detail

The company’s weight management drug Qsymia generated net product sales of $11.1 million, up 30.7% from the year-ago period due to increase in shipments of the drug.

However, supply and royalty revenues from Stendra/Spedra were down 36.9% to $1.7 million in this quarter.

Pancreaze brought in sales of $2.1 million during the quarter. The exocrine pancreatic insufficiency drug was acquired on Jun 8 from Janssen, a subsidiary of Johnson & Johnson JNJ.

Selling, general and administrative (SG&A) expense was $11.7 million, almost flat year over year. The increase in expense related to acquisition of Pancreaze, debt restructuring and addition of new members to senior leadership team were almost offset by the cost control initiatives for Qsymia.

Research and development expense more than doubled to $2 million in the reported quarter on continued development cost of tacrolimus.

New President

On Aug 6, the company announced the appointment of Ken Suh as its new president. Previously, he served as president and chief executive officer of Willow Biopharma, a wholly-owned subsidiary of VIVUS.

Our Take

VIVUS’ obesity drug, Qsymia, showed strong performance during the quarter as sales grew year over year as well as sequentially. The company’s efforts, including realigning its sales force and refining its marketing and promotional programs, had a positive impact on Qsymia sales and also lowered marketing expense. The company’s efforts to lower its debt are likely to bring down interest expense. These factors will boost the bottom line, going forward. The company’s initiative to acquire cash-flow positive drugs was also a positive. We expect the growth trend to continue through the year.

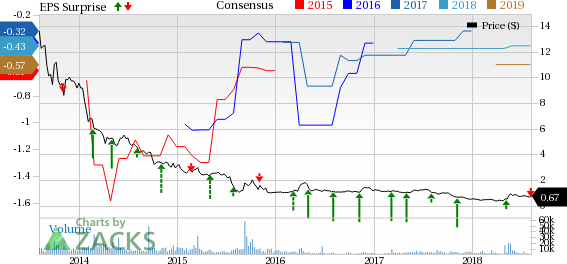

VIVUS, Inc. Price, Consensus and EPS Surprise

VIVUS, Inc. Price, Consensus and EPS Surprise | VIVUS, Inc. Quote

Zacks Rank & Stocks to Consider

VIVUS currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the biotech sector are Gilead Sciences, Inc. GILD and Seattle Genetics SGEN. While Gilead sports a Zacks Rank #1 (Strong Buy), Seattle Genetics carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gilead’ earnings estimates increased from $6.12 to $6.57 for 2018 and from $6.36 to $6.48 for 2019 over the last 30 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with an average beat of 6.43%. The company’s shares have increased 9.4% so far this year.

Seattle Genetics’ 2018 loss per share estimates narrowed from $1.81 to 83 cents and from 81 cents to 39 cents in the last 30 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with an average beat of 12.93%. The company’s shares have rallied 36.3% year to date

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

VIVUS, Inc. (VVUS) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Seattle Genetics, Inc. (SGEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance