Vistra Energy's (VST) 2020 Net Income & Revenues Fall Y/Y

Vistra Energy Corp. VST reported 2020 net income of $642 million, which declined 30.7% from the year-ago quarter’s $926 million.

Revenues

In 2020, operating revenues of $11,443 million dipped 3.1% from $11,809 million in the prior year.

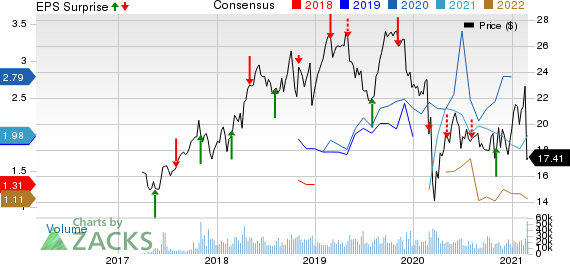

Vistra Corp. Price, Consensus and EPS Surprise

Vistra Corp. price-consensus-eps-surprise-chart | Vistra Corp. Quote

Highlights of the Release

Total operating expenses for 2020 amounted to $1,622 million, up 6% from the 2019 figure of $1,530 million.

Operating income came in at $1,519 million, decreasing 23.8% from the prior year’s $1,993 million.

At the end of the fourth quarter of 2020, the company was serving additional 2,736,000 residential customers. Retail electric volumes in the fourth quarter rose 20.8% year over year.

Financial Position

As of Dec 31, 2020, Vistra Energy had cash and cash equivalents of $406 million compared with $300 million as of Dec 31, 2019.

As of Dec 31, 2020, the company had long-term debt of $9,235 million, down from $10,102 million on Dec 31, 2019.

The company’s cash provided by operating activities in 2020 was $3,337 million compared with $2,736 million in 2019.

Capital expenditures including nuclear fuel purchases and LTSA prepayments in 2020 were $1,259 million compared with $713 million in 2019.

Project & Capital Details

The company advanced the development of 850 megawatt (MW) of renewable generation projects in Texas including one battery energy storage project and five solar facilities. It plans to retire additional 7,500 MW of coal-fueled assets and 350 MW of gas assets in the MISO, PJM and ERCOT markets.

The utility launched Vistra Zero, a generation portfolio consisting of 4,000 MW of zero-carbon generation resources including its existing nuclear, solar and energy storage facilities as well as the earlier announced emission-free projects under development. Also, in 2020, it acquired the Texas electric retail customers of Infinite Energy and Veteran Energy.

Guidance

The company expects 2021 adjusted capital expenditures to be $683 million.

Zacks Rank

Vistra Energy has a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc. NEE reported fourth-quarter 2020 adjusted earnings of 40 cents per share, which beat the Zacks Consensus Estimate of 39 cents by 2.6%.

Xcel Energy Inc. XEL posted fourth-quarter 2020 operating earnings of 54 cents per share, inline with the Zacks Consensus Estimate.

WEC Energy Group WEC delivered fourth-quarter 2020 earnings per share of 76 cents, which surpassed the Zacks Consensus Estimate of 74 cents by 2.7%

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

AccessZacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance