Visa's (V) Q2 Earnings Beat Estimates, Revenues Increase Y/Y

Visa Inc. V reported second-quarter fiscal 2020 earnings of $1.39 per share, which beat the Zacks Consensus Estimate by 2.96% and also rose 9% year over year.

This outperformance was driven by expanded payments volume and processed transaction, partly offset by a decline in cross-border revenues that suffered due to spending cuts as a COVID-19 fallout.

Further, net operating revenues of $5.9 billion topped the Zacks Consensus Estimate by 1.78% and improved 8% year over year as well. This upside was primarily driven by higher business volumes, partly offset by lower cross-border revenues and increase in client incentives, which constitute a contra revenue item.

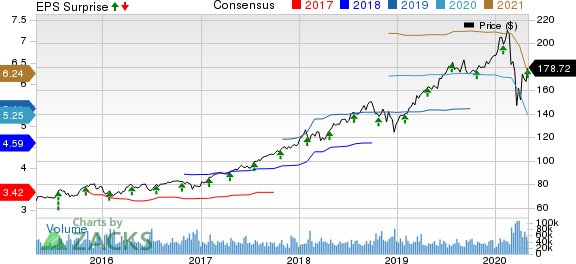

Visa Inc. Price, Consensus and EPS Surprise

Visa Inc. price-consensus-eps-surprise-chart | Visa Inc. Quote

Strong Financial Performance

On a constant-dollar basis, payments volume growth in the quarter was 5% year over year. Cross-border volume on a constant-dollar basis dipped 2%. Visa's processed transactions increased 7% from the prior-year quarter to 34.9 billion.

Service revenues increased 9% year over year to $2.6 billion on higher nominal payments volume. On a year-over-year basis, data processing revenues rose 11% to $2.7 billion and international transaction revenues grew 2% to $1.8 billion. Other revenues increased 20% year over year to $392 million.

Client incentives of $1.7 billion increased 15% year over year.

Adjusted operating expenses inched up 3.3% year over year to $1.9 billion, primarily due to higher personnel and depreciation and amortization.

Interest expense declined 15.7% year over year to $118 million.

Solid Balance Sheet

Cash and cash equivalents, and available-for-sale investment securities were $9.7 billion as of Mar 31, 2020, up 24.3% from the level as of Sep 30, 2019.

Total assets were $72.8 billion as of Mar 31, 2020, up 0.3% from the level as of Sep 30, 2019.

Share Buyback and Dividend Update

During the quarter, the company made share repurchases to the tune of $3.2 billion.

On Apr 21, 2020, the company declared a quarterly cash dividend of 30 cents per share, payable Jun 2, 2020 to its shareholders of record as of May 14, 2020.

Developments During the Quarter

On Jan 13, 2020, Visa signed a definitive agreement to acquire Plaid for $5.3 billion, a network that helps people easily and securely connect their financial accounts to the apps they use to manage their finances. The deal is expected to close by the end of 2020.

On Mar 31, 2020, the company issued senior notes worth $4 billion, the proceeds from which will be used for general corporate purposes.

2020 Guidance

Given the impact of COVID-19-led uncertainty on the company’s results, management has not provided any guidance for fiscal 2020.

Our Take

Despite the COVID-19-induced business disruption, which eroded the company’s cross-border revenues, overall earnings gained from a rise in processed transactions.

In reported quarter, the company renewed several key relationships and forged new partnerships to expand its reach in consumer payments, new flows and value added services.

The company’s policy to invest in organic and inorganic growth opportunities bodes well. Its strong brand name, vast business network, global presence, investment in technology, several alliances and acquisitions should help it overcome the current economic volatility.

Some other companies in the same space that already released respective March-quarter results are American Express Co. AXP and Mastercard Inc. MA, which beat on earnings by 17.2% and 6.4% each. However, Discover Financial Services’ DFS bottom line missed the mark by 118.4%.

Visa carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance