Is Visa Stock a Buy After Rising 34% in 2019?

Visa's (NYSE: V) stock price has risen 34% so far in 2019 and 56% since the beginning of 2018. The S&P 500 has risen only 14.5% year-to-date, which begs the question: Considering Visa's recent outperformance, how much further can its stock go?

The transition to digital transactions over cash maintains a strong tailwind, sparking the debate on how to fully capitalize on the opportunity and which company you should be holding. There are several companies in the credit card space including Visa, MasterCard (NYSE: MA), American Express, JCB, and Discover. Visa, however, is the leading issuer in transactions globally and is projected to maintain that lead in the foreseeable future.

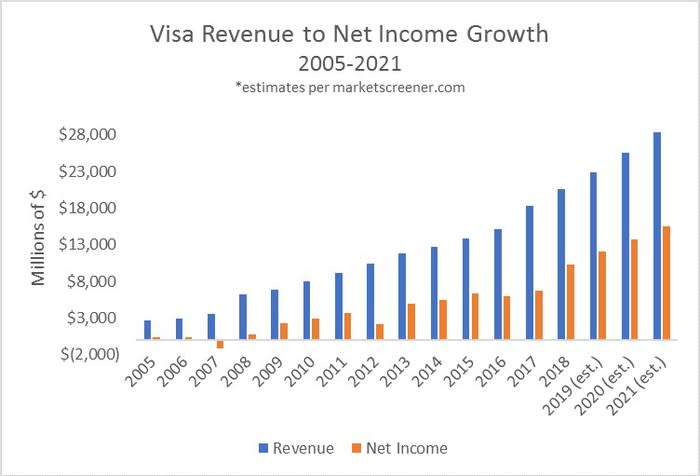

Data source: Company filings. Chart by author.

Contrary to popular belief, Visa does not lend borrowers money, meaning Visa doesn't profit from the interest charged to the borrower. Interest payments are paid to the card-issuing institution such as Capital One or Bank of America, which is great for Visa because the company is sheltered from borrower default risk.

Over 95% of Visa's revenue comes from three segments: services, data processing, and international transactions. During the third-quarter of 2019, the data processing segment drove 36% of revenue, followed by the services segment at 33%, and the international transaction segment at 27%. Each segment grew above 8% year over year -- data processing led the way with an impressive 12.8% growth rate.

Revenue growth is dependent on the geographic reach and transaction volume increasing from current customers. Going forward, growth will likely depend upon eWallets and mobile transactions, which according to a Worldpay Global Payments Report from 2018, made up 34% of preferred payment methods, while credit cards accounted for 23% and debit cards 12%.

Visa is focused on making transactions simple and fast through Visa Direct as the market demands payment convenience. A platform for business and person-to-person (P2P) payments allows individuals and businesses to transfer funds to a debit account in less than 30 minutes. Visa states there is a $10 trillion opportunity in the U.S., splitting $9 trillion in business disbursements and $1 trillion in P2P. In most cases, it takes a few days or weeks to receive a reimbursement from an insurance company in the form of a check, and an Automated Clearing House (ACH) direct deposit can be slow, requiring bank and routing account information. Visa Direct speeds this process up and allows consumers to move money fast, using direct transfer.

In 2018, Visa announced a partnership agreement with Western Union to implement Visa Direct's payment platform. Nearly $80 trillion is transferred annually, 85% in cash. Western Union reached 200 countries and 800 million transactions in 2018. As Visa builds partnerships with companies including Western Union, Square, and PayPal to expand the reach and convenience of transactions, the company can cement its place in the market and establish growth in market share.

In addition to its Western Union partnership, Visa recently announced the acquisition of Earthport, a company that specializes in cross-border payments and money transfer services. This acquisition, as stated by Visa, "will be able to reach the vast majority of the world's banked population and allow them to easily, quickly, and securely move money worldwide."

Regarding competition, the "apples-to-apples comparison" is MasterCard, as the business models are more alike than any other two companies and the two are overwhelmingly pitted against one another by analysts and investors.

Visa's trailing twelve-month operating margin is 65.87% while MasterCard maintains an operating margin of 51.77%. This shows that Visa is operating at a lower cost structure over MasterCard. Additionally, when comparing the value of each stock price, Visa is currently trading at a price-to-earnings ratio (P/E) of 35x while MasterCard is trading at 42x earnings. Price-to-earnings can be controversial, however, it provides a good snapshot of stock price value when considered with two alike business models in the same industry. These fundamental comparisons aren't conclusively in favor of Visa by any means. They do, however, demonstrate that Visa is leading in value when considering these two comparisons.

Visa analysts predict $22.92 billion of revenue in 2019 and $25.55 billion in 2020. These estimates, if correct, would provide 11.2% in sales growth in 2019 and 11.5% in 2020. Earnings per share estimates are $5.4 for 2019 -- 15.3% year-over-year growth -- and $6.26 for 2020 -- 16% growth over the previous year.

Data source: Company filings. Chart by author.

Establishing a strong foothold against competitors by aligning strategic partnerships is key in the race to the payment transition. The continued strength of Visa is reliant on total spending in volume, cross-border spending, and a subset of total transactions processed on the network. Visa has grown 11% in payments volume, 10% in cross-border volume, and 12% in processed transactions year over year from 2017 to 2018. 2019 growth is estimated to match or beat 2018 results.

If Visa can meet or exceed analysts' 2019 revenue estimate of $22.92 billion and an EPS estimate of $5.4, it would not be outlandish to assume the stock price will stay the course and rise alongside the growth of the company, maintaining the impressive YTD share price increase.

More From The Motley Fool

Justin Cardwell owns shares of Bank of America, Mastercard, and Visa. The Motley Fool owns shares of and recommends Mastercard, PayPal Holdings, Square, and Visa. The Motley Fool has the following options: short September 2019 $70 puts on Square and short October 2019 $97 calls on PayPal Holdings. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance