Virtu Financial (VIRT) Up 2.1% Despite Q2 Earnings Miss

Virtu Financial, Inc.’s VIRT shares rose 2.1% since it reported second-quarter results on Jul 28. Despite reporting weaker-than-expected results, investors might have been impressed by its growth opportunities. Increased net trading income in both segments might have played its part. While increased operating expenses affected the results in the second quarter, it was partially offset by a huge jump in interest and dividends income.

Virtu Financial reported second-quarter 2022 adjusted earnings per share (EPS) of 73 cents, which missed the Zacks Consensus Estimate by a penny. However, the EPS jumped from 63 cents a year ago.

VIRT’s adjusted net trading income of $357.4 million in the second quarter rose from $341.8 million a year ago. However, the metric missed the consensus mark by 2.4%.

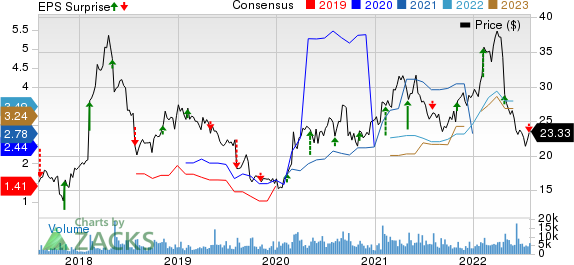

Virtu Financial, Inc. Price, Consensus and EPS Surprise

Virtu Financial, Inc. price-consensus-eps-surprise-chart | Virtu Financial, Inc. Quote

Q2 Performance

Revenues from commissions, net and technology services declined to $136.3 million from $143.1 million a year ago. However, it beat the Zacks Consensus Estimate of $135.9 million. Interest and dividends income rose to $30.8 million in the second quarter from $9.5 million a year ago, beating the consensus mark of $9.7 million.

Adjusted EBITDA amounted to $209.3 million, which jumped from $197.3 million in the prior-year quarter. Adjusted EBITDA margin increased to 58.6% from 57.7% a year ago.

Total operating expenses of $431 million increased from the year-ago level of $414 million. VIRT recorded increases in costs related to communication and data processing, interest and dividends expense, employee compensation and payroll taxes. This was partially offset by lower operations and administrative, brokerage, exchange and clearance fees, and payments for order flow and net expenses.

Segmental Update

Market Making:The segment reported a net trading income of $390.3 million, which improved from $380.6 million in the prior-year period. Segmental revenues rose to $432.6 million from $402.5 million in second-quarter 2021.

Execution Services:The net trading income of the segment increased to $5.7 million from $4.2 million a year ago. However, revenues fell 5.2% year over year to $131 million in the quarter under review due to lower revenues from commissions, net and technology services.

Financial Update (as of Jun 30, 2022)

Virtu Financial exited the second quarter with cash and cash equivalents of $810.6 million, which declined from the 2021-end level of $1,071.5 million. Total assets of $11,415.6 million increased from $10,320 million at 2021-end.

Long-term borrowings, net, amounted to $1,792.4 million, up from the 2021-end figure of $1,605.1 million. Short-term borrowings, net, at second quarter-end was at $157.1 million.

Total equity slipped from $1,863.6 million at 2021-end to $1,740.4 million.

Share Repurchase and Dividend Update

In the quarter under review, Virtu Financial (as part of its share repurchase program) bought back shares worth $47.5 million. It has around $432.2 million remaining under its share buyback authorization for future purchase of the shares of Class A Common Stock and Virtu Financial Units.

Concurrently, VIRT’s board of directors approved a quarterly cash dividend of 24 cents per share. The dividend will be paid out on Sep 15, 2022, to its shareholders of record as of Sep 1.

Zacks Rank & Key Picks

Virtu Financial currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader finance space are Encore Capital Group, Inc. ECPG, SmartFinancial, Inc. SMBK and Paramount Group, Inc. PGRE, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headquartered in San Diego, CA, Encore Capital is a global debt recovery solutions provider. The Zacks Consensus Estimate for ECPG’s 2022 bottom line indicates a 14.4% increase from the prior year’s reported number.

Based in Knoxville, TN, SmartFinancial is a leading financial services provider for individuals and corporate clients. The Zacks Consensus Estimate for SMBK’s 2022 earnings indicates 19.8% year-over-year growth.

New York-based Paramount Group works as a fully-integrated real estate investment trust. The Zacks Consensus Estimate for PGRE’s 2022 bottom line indicates 4.4% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Encore Capital Group Inc (ECPG) : Free Stock Analysis Report

Paramount Group, Inc. (PGRE) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

SmartFinancial, Inc. (SMBK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance