Ventas's (VTR) Q1 FFO Misses Estimates, Revenues Surpass

Ventas, Inc. VTR reported first-quarter 2018 funds from operations (FFO) as defined by the National Association of Real Estate Investment Trusts of 96 cents, missing the Zacks Consensus Estimate of $1.01. The figure came in lower than the year-ago quarter tally of $1.03.

Results reflected an increase in property-level operating expenses.

Ventas posted revenues of $943.7 million in the first quarter, comfortably beating the Zacks Consensus Estimate of $850.6 million. Further, it compared favorably with the year-ago number of $883.4 million.

For the first quarter, same-store cash net operating income (NOI) growth for the total portfolio (1,049 assets) climbed 2.6% year over year. Segment-wise, same-store cash NOI for the triple net leased portfolio grew 4.4%, seniors housing operating portfolio witnessed rise of 0.7% and medical office building portfolio rose 2.2%.

Quarter in Detail

During the reported quarter, Ventas signed a mutually-beneficial agreement with Brookdale Senior living which currently operates the company’s 128 wholly-owned senior housing communities. It combines all of the company’s leases with Brookdale into a single Master lease, with an initial term through Dec 2025. Brookdale has two 10-year extension options as well.

Brookdale and Ventas also plan to sell a few properties from the Brookdale portfolio, totaling $30 million in cash rent.

Liquidity

Ventas exited first-quarter 2018 with cash and cash equivalents of $92.5 million, up from $81.4 million as of Dec 31, 2017.

Updated 2018 Outlook

Ventas updated 2018 normalized FFO per share outlook to $3.99-$4.07 from the previous range of $3.95-$4.05.

The company updated same-store cash net operating income growth to 0.5-1.5% in 2018 from 0.5-2% issued earlier.

Our Take

Ventas is poised to grow on the back of its diversified portfolio, strategic acquisitions and strong balance sheet. Rising healthcare spending and aging population augur well for long-term growth. Moreover, the mutual agreement, which the company has signed with Brookdale, is likely to provide further support to Ventas.

However, an elevated supply of seniors’ housing assets in certain markets is likely to put pressure on rent and occupancy growth in the near-term. Further, the company is exposed to concentration risks since the majority of its revenues are generated from a few tenants. Hike in interest rate is also a concern.

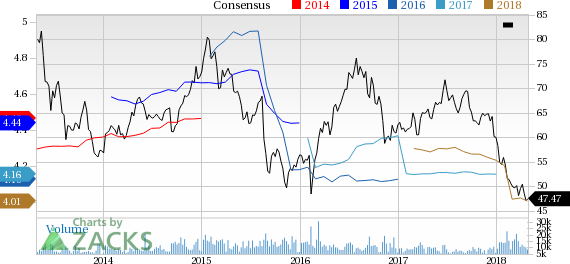

Ventas, Inc. Price and Consensus

Ventas, Inc. Price and Consensus | Ventas, Inc. Quote

Currently, Ventas carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of other REITs like Alexandria Real Estate Equities, Inc. ARE, Essex Property Trust Inc. ESS and Regency Centers Corp. REG. Alexandria and Regency Centers are scheduled to release results on Apr 30 while Essex Property is slated to report numbers on May 2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regency Centers Corporation (REG) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

Ventas, Inc. (VTR) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance