Veeva Systems (VEEV) Beats on Q3 Earnings, Revises FY23 View

Veeva Systems, Inc. VEEV reported adjusted earnings per share (EPS) of $1.13 in the third quarter of fiscal 2023, reflecting an improvement of 16.5% from the year-ago EPS of 97 cents. Adjusted EPS surpassed the Zacks Consensus Estimate by 5.6%.

GAAP EPS in the fiscal third quarter was 67 cents, up by 3.1% from the year-ago EPS of 65 cents.

Revenues

For the quarter, the company’s revenues totaled $552.4 million, outpacing the Zacks Consensus Estimate by 1.2%. On a year-over-year basis, the top line improved by 16%.

The fiscal third quarter top line was driven by Veeva Systems’ robust segmental performances.

Segmental Details

Veeva Systems derives revenues from two operating segments — Subscription services; and Professional services and other.

In the fiscal third quarter, Subscription services revenues improved 15.9% from the year-ago quarter to $441.6 million. This was driven by Veeva Systems’ most established products in Research and Development (R&D) Solutions and increased growth contribution from Veeva Vault CTMS and Veeva Vault QMS.

Professional services and other revenues were up 16.2% year over year to $110.8 million, primarily resulting from strong demand associated with R&D Solutions and Veeva Business Consulting.

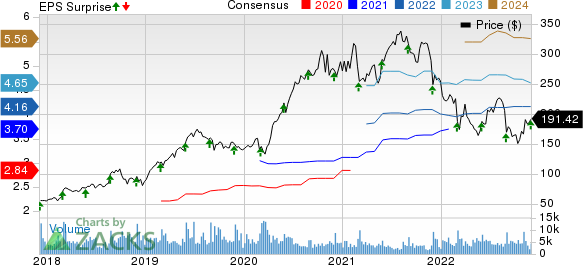

Veeva Systems Inc. Price, Consensus and EPS Surprise

Veeva Systems Inc. price-consensus-eps-surprise-chart | Veeva Systems Inc. Quote

Margin Details

In the quarter under review, Veeva Systems’ gross profit rose 14.9% to $398.4 million. Gross margin contracted 65 basis points (bps) to 72.1%.

Meanwhile, sales and marketing expenses rose 29.7% to $93.9 million. R&D expenses went up 32.1% year over year to $130.3 million, while general and administrative expenses climbed 23.6% year over year to $52.9 million. Total operating expenses of $277 million increased 29.6% year over year.

Operating profit totaled $121.4 million, which declined 8.5% from the prior-year quarter. The operating margin in the fiscal third quarter contracted a huge 589 bps to 21.9%.

Financial Position

The company exited third-quarter fiscal 2023 with cash and cash equivalents, and short-term investments of $3.02 billion compared with $2.92 billion at the end of the fiscal second quarter.

Cumulative net cash provided by operating activities at the end of third-quarter fiscal 2023 was $717.1 million compared with $710.4 million in the year-ago period.

Guidance

Veeva Systems has provided its financial outlook for the fiscal 2023 fourth quarter and revised its estimates for the full fiscal year.

For the fourth quarter of fiscal 2023, the company expects total revenues to be $551 million-$553 million. The Zacks Consensus Estimate for the same is currently pegged at $557.1 million.

Subscription revenues are estimated to be approximately $452 million in the fiscal fourth quarter, while Services revenues are estimated to be within $99 million-$101 million.

Adjusted EPS is projected to be $1.05. The Zacks Consensus Estimate for the metric is pegged at $1.08.

Veeva Systems now expects its revenues for the fiscal year 2023 to be within $2,143-$2,145 million, narrowed from its earlier-provided outlook range of $2,140-$2,145 million. The Zacks Consensus Estimate for the same is currently pegged at $2.14 billion.

Subscription revenues are continued to be expected to be $1,725 million. This consists of Commercial Solutions’ subscription revenues of around $942 million (up from $938 million) and R&D Solutions’ subscription revenues of approximately $783 million (down from $787 million).

Services revenues are now expected to be within $418 million-$420 million, narrowed from the earlier projections of $415 million-$420 million.

Adjusted EPS for the year is expected to be $4.19, up from its earlier projection of $4.17. The Zacks Consensus Estimate for the metric is pegged at $4.16.

Our Take

Veeva Systems exited the third quarter of fiscal 2023 with better-than-expected results. The uptick in the overall top and bottom lines and robust performances by both segments during the quarter are impressive. The company continues to benefit from its flagship Vault platform, which is encouraging. Veeva Systems’ continued strength in its Commercial Solutions, with new SMB customer additions and enterprise seat expansions in Asia Pacific and North America, looks promising.

The robust adoption of Veeva Systems’ products like Veeva Vault PromoMats and Veeva Vault MedComms looks promising. The continued strength in Veeva Link Key People and positive feedback for its Veeva Compass auger well for the company. The continued adoption of Veeva Vault eTMF and increased adoption and record bookings for Veeva Vault CTMS are also encouraging.

On the flip side, rising operating costs putting pressure on the margins during the quarter is a headwind. Per management, a decrease in U.S. TV and digital marketing spend in life sciences in the current fiscal year is creating a headwind for Crossix, which raises apprehensions.

Zacks Rank and Stocks to Consider

Veeva Systems currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are AMN Healthcare Services, Inc. AMN, Medpace Holdings, Inc. MEDP and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy), reported third-quarter 2022 adjusted EPS of $2.57, which beat the Zacks Consensus Estimate by 10.3%. Revenues of $1.14 billion outpaced the consensus mark by 3.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed estimates in all the trailing four quarters, the average being 10.9%.

Medpace Holdings, sporting a Zacks Rank #1, reported third-quarter 2022 EPS of $2.05, which beat the Zacks Consensus Estimate by 39.5%. Revenues of $383.7 million outpaced the consensus mark by 8.1%.

Medpace Holdings has an estimated growth rate of 44.9% for the full-year 2022. MEDP’s earnings surpassed estimates in all the trailing four quarters, the average being 22%.

Merit Medical, carrying a Zacks Rank #2, reported third-quarter 2022 adjusted EPS of 64 cents, which beat the Zacks Consensus Estimate by 20.8%. Revenues of $287.2 million outpaced the consensus mark by 5.2%.

Merit Medical has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average being 25.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance