Valeant Down as FDA Refuses to Approve Duobrii For Psoriasis

Shares of Valeant Pharmaceuticals International, Inc. VRX plunged 12.3% after the company announced that its division, Ortho Dermatologics, has received a Complete Response Letter (CRL) from the FDA for its New Drug Application (NDA) for Duobrii.

The CRL was issued due to questions related to pharmacokinetic data. However, the CRL did not mention any deficiencies related to the clinical efficacy or safety of Duobrii.

Duobrii lotion ((halobetasol propionate and tazarotene) (IDP-118) is being evaluated for the treatment of plaque psoriasis.

Valeant will now work with the FDA and resolve the matter.

The news comes as a big disappointment for Valeant as it is now banking on new drug approvals to propel its top line. Duobrii is one of the key products in that pipeline and a delay in approval will dampen management projections.

While Ortho Dermatologics continue to be impacted by transition issues, Valeant had projected Duobrii as one of the key growth drivers going forward and a potential approval would have boosted the company’s struggling dermatology portfolio as well. The FDA had earlier approved its psoriasis treatment, Siliq, following which the drug was launched. Siliq is approved for the treatment of moderate-to-severe plaque psoriasis in adult patients, who are candidates for systemic therapy or phototherapy and have failed to respond or have lost response to other systemic therapies. Valeant entered into a collaboration agreement with AstraZeneca plc (AZN), granting the former an exclusive license to develop and commercialize Siliq globally, except in Japan and certain other Asian countries where the rights are held by Kyowa Hakko Kirin Co., Ltd. The agreement was amended in July 2016 to entitle Valeant the right to develop and commercialize Siliq in Europe.

Hence, a potential approval of Duobrii would have further boosted the dermatology portfolio as the market for plaque psoriasis holds great potential.

Once an acquisition giant, Valeant has been caught up in various controversies since October 2015. Of late, things were looking up for Valeant as the company started a rebuilding process with its CEO, Joseph C. Papa. Even though it is still early to comment on the rebuilding process, the company’s efforts to sell non-core assets and pay down huge levels of debt is commendable.

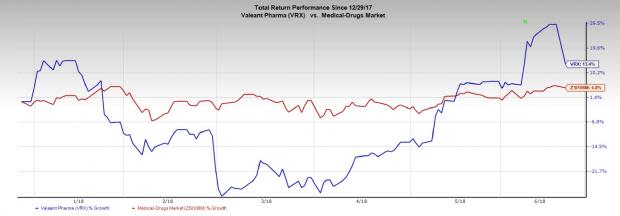

Valeant’s stock has gained 13.4% in the year so far compared to the gain of 4.8% for the industry.

Meanwhile, new drug approvals have boosted investor sentiment for the company. Valeant received clearance for the Thermage FLX System for non-invasively smooth skin on the face, eyes and body. Earlier, the company received the FDA filing acceptance for the NDA for Plenvu (NER1006), a novel, low volume polyethylene glycol-based bowel preparation for colonoscopies. The company also obtained FDA approval of Vyzulta, a treatment option for glaucoma. The FDA also approved Lumify, the over-the-counter eye drop with low-dose brimonidine for the treatment of eye redness. The FDA has also accepted New Drug Applications for Altreno (IDP-121), an acne treatment in lotion form; PDUFA action date of Aug 27, 2018 and Bryhali (IDP-122), a topical treatment for plaque psoriasis; PDUFA action date of Oct 5, 2018.

Zacks Rank & Key Picks

Valeant currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the pharma sector include Illumina, Inc. (ILMN) and Aeglea BioTherapeutics, Inc. (AGLE). While Illumina sports a Zacks Rank #1 (Strong Buy), Aeglea carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Illumina’s earnings per share estimates have moved up from $4.60 to $4.86 for 2018 and from $5.34 to $5.61 for 2019 over the past 60 days. The company delivered a positive earnings surprise in all the trailing four quarters with an average beat of 23.17%. The stock has rallied 32.2% so far this year.

Aeglea’s loss per share estimates have narrowed from $1.93 to $1.67 for 2018 and from $3.86 to $3.57 for 2019 over the past 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters with an average beat of 19.32%. The stock has rallied 101.3% so far this year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Aeglea BioTherapeutics, Inc. (AGLE) : Free Stock Analysis Report

Valeant Pharmaceuticals International, Inc. (VRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance