Vale (VALE) Beats on Q2 Earnings, Misses Revenue Estimates

VALE S.A. VALE reported second-quarter 2018 earnings of 40 cents per share, which surged around 150% year over year. The bottom line also surpassed the Zacks Consensus Estimate of 14 cents, by a wide margin of around 186%.

Net operating revenues increased 19% year over year to $8,616 million in the quarter, primarily on the back of higher Base Metal’s sales prices, and increased sales volume of Ferrous Minerals and Base Metals. However, the top line missed the Zacks Consensus Estimate of $8,747 million by 1.5%.

Of the total net operating revenues, sales of ferrous minerals accounted for 73.4%, coal contributed 4.1%, base metals comprised 21.7%, and the remaining 0.8% was sourced miscellaneously.

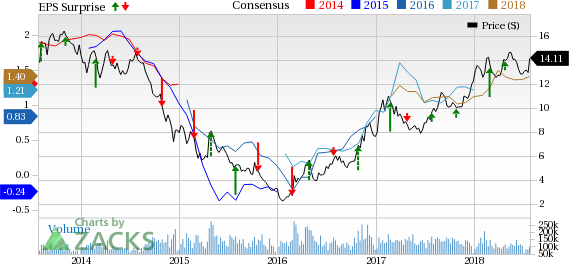

VALE S.A. Price, Consensus and EPS Surprise

VALE S.A. Price, Consensus and EPS Surprise | VALE S.A. Quote

Geographically, 10.6% of revenues were generated from South America, 58.5% from Asia, 6.7% from North America, 18% from Europe, 2.9% from the Middle East, and 3.3% from Rest of the World.

Costs & Margins

Cost of goods sold was $5,377 million in the reported quarter, up 5.4% year over year. This upswing resulted from elevated oil costs, higher freight rates, impact of the truck drivers’ strike and higher maintenance costs.

Gross margin was 37.6%, up 810 basis points year over year. Selling, general and administrative expenditure dropped 7.6% to $122 million, while research and development expenses flared up 15% to $92 million, both on a year-over-year basis.

Balance Sheet and Cash Flow

Vale exited the second quarter with cash and cash equivalents of $6,369 million, higher than the $5,720 million recorded in the year-ago quarter. During the quarter, Vale’s loans and borrowings came in at $16,084 million, down from $25,789 million recorded in the year-ago quarter.

In the June-end quarter, the company generated $3,544 million cash from operating activities, as against $3,443 million recorded in the year-ago quarter. Notably, the company's loans and financing repayment totaled $2,599 million in the quarter, up from $1,852 recorded in the prior-year quarter.

Vale announced a share-buyback program of $1 billion to be executed within a year. Per Vale’s new dividend policy, the company has announced to pay $2.05 billion to be paid in September 2018.

Capital spending summed $705 million in the second quarter, as against $890 million recorded in the previous-year quarter.

Share Price Performance

Shares of the company have outperformed the industry, over the past year. The stock has gained around 46% compared with 45% growth recorded by the industry during the same time period.

Zacks Rank & Key Picks

Vale currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector include BHP Billiton Limited BHP, Celanese Corporation CE and KMG Chemicals, Inc. KMG. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BHP Billiton has a long-term earnings growth rate of 5.3%. Its shares have rallied around 22%, over the past year.

Celanese has a long-term earnings growth rate of 9.3%. The company’s shares have gained around 23% in the past year.

KMG Chemicals has a long-term earnings growth rate of 28.5%. The company’s shares have surged around 45% in a year’s time.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Celanese Corporation (CE) : Free Stock Analysis Report

KMG Chemicals, Inc. (KMG) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

BHP Billiton Limited (BHP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance