V.F. Corp (VFC) Slips on Fiscal 2023 View Cut, CEO Departure

V.F. Corporation VFC fell 11.17% on Dec 5, 2022 on management’s commentary on lowered expectations for fiscal 2023. Yesterday, the company trimmed its outlook for fiscal 2023, driven by lower-than-expected consumer demand across its business categories, mostly in North America. The reduced demand is likely to result in a heightened promotional environment and wholesale order cancellations to manage inventory levels.

V.F. Corp also notes that the reduced consumer discretionary spending in Europe due to inflationary pressures and ongoing pandemic-related disturbances in China is expected to affect its performance in fiscal 2023. Concurrent with the slashed view, the company also announced the departure of its chairman and chief executive officer (CEO), Steve Rendle.

V.F. Corp anticipates revenue growth in the second half of fiscal 2023 to be slightly below the previous view, expecting a 3-4% increase in constant dollars (excluding foreign currency translations). VFC earlier predicted 5-6% revenue growth for fiscal 2023.

Additionally, the company expects SG&A deleverage in fiscal 2023 due to lower volumes. This, along with the promotional environment in North America, is likely to weigh on profitability.

V.F. Corp anticipates fiscal 2023 adjusted earnings per share (EPS) to be $2.00-$2.20 per share compared with the $3.18 reported in fiscal 2022 and $2.40-$2.50 expected earlier.

However, the company stated that its long-term targets for fiscal 2027 and the capital allocation plan, as provided on Sep 28, 2022, remain intact. V.F. Corp has been on track with the execution of its strategy, vying to deliver on its long-term targets of strong shareholder value while improving near-term performance.

V.F. Corp’s five-year growth plan (for fiscal 2023-2027) targets revenue growth in the mid-to-high-single digits on a five-year CAGR basis. The bottom line is predicted to rise at a five-year CAGR of high single to low double digits.

The operating margin is envisioned to be 15% by fiscal 2027, driven by gross margin expansion and reduced SG&A. Management also noted that it would return roughly $7 billion via dividends and share repurchases by fiscal 2027. Free cash flow is forecast at $5.5 billion.

Following the departure of Steve Rendle, the company appointed Benno Dore as the interim president and CEO, effective immediately. Meanwhile, Richard Carucci has been selected to serve as the interim chairman of the board.

Things You Should Know

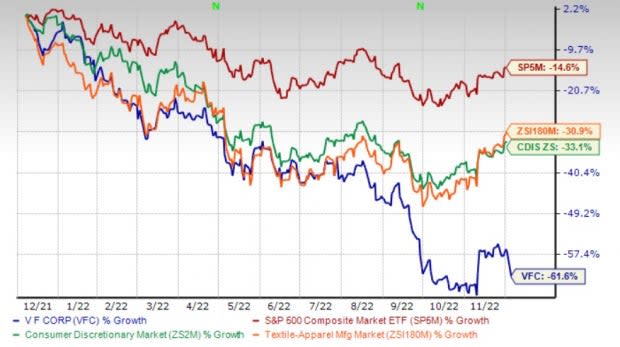

The V.F. Corp stock has declined 61.6% in the past year compared with the industry’s decline of 30.9%. This Zacks Rank #4 (Sell) stock also compared unfavorably with the Consumer Discretionary and the S&P 500’s declines of 33.1% and 14.6%, respectively.

Image Source: Zacks Investment Research

The stock’s dismal run on the bourses can be attributed to the continued bleak performance in the second quarter of fiscal 2023, wherein the top and bottom lines missed the Zacks Consensus Estimate and declined year over year. VFC has been struggling with a tough operating environment, including pandemic-related disruptions in China, macro-economic and geopolitical headwinds and near-term challenges at Vans.

V.F. Corp is also witnessing elevated SG&A costs and elevated freight expenses related to COVID-19 headwinds. SG&A expenses grew 7.8% to $1,251.3 million in the second quarter of fiscal 2023, following 11.5% in the fiscal first quarter.

However, VFC’s brand portfolio and strength in the outdoor, active, streetwear and workwear units remain tailwinds. Also, growth in the EMEA and Americas regions acted as major growth drivers.

Stocks to Consider

Here we have highlighted three better-ranked stocks, namely Crocs CROX, PVH Corp PVH and lululemon athletica LULU.

Crocs is one of the leading footwear brands, with its focus on comfort and style. CROX has a long-term earnings growth rate of 15%. The stock currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Crocs’ current financial-year revenues and EPS suggests growth of 51.5% and 23.7%, respectively, from the corresponding year-ago reported figures. CROX has a trailing four-quarter earnings surprise of 18.2%, on average.

PVH Corp specializes in designing and marketing branded dress shirts, neckwear, sportswear, jeans wear, intimate apparel, swim products, footwear, handbags and related products. It has a long-term earnings growth rate of 9.5%. PVH has a Zacks Rank #2 at present.

The Zacks Consensus Estimate for PVH Corp’s current financial-year sales and EPS suggests declines of 3.4% and 20.7%, respectively, from the year-ago corresponding figures. PVH has a trailing four-quarter earnings surprise of 22.9%, on average.

lululemon, a yoga-inspired athletic apparel company that creates lifestyle components, has a Zacks Rank of 2 at present. The company has a long-term earnings growth rate of 20%. LULU has a trailing four-quarter earnings surprise of 10.4%, on average.

The Zacks Consensus Estimate for lululemon’s current financial-year sales and EPS suggests growth of 26.8% and 27%, respectively, from the year-ago corresponding figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

V.F. Corporation (VFC) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance