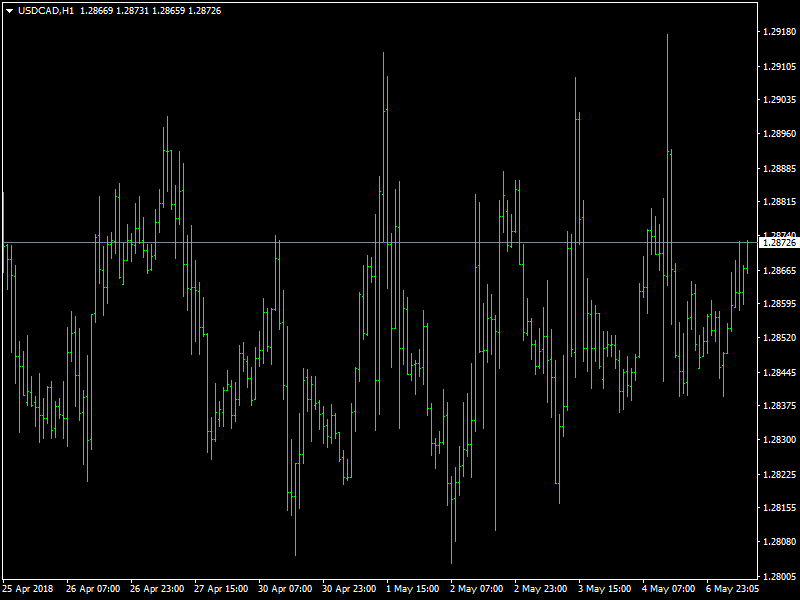

USDCAD Range-Play Remains Intact Ahead of US inflation Data

The USD/CAD pair caught some fresh bids at the start of a new trading week and has now moved back above mid-1.2800s. Dovish US Non-Farm Payroll data and Hawkish IVEY PMI data from Canada resulted in the pair seeing range bound momentum during Friday’s trading session, the pair caught some fresh bids at the start of a new trading week and has now moved back above mid-1.2800s. The latest leg of up-move could further be attributed to some renewed US Dollar buying interest, supported by a goodish pickup in the US Treasury bond yields.

USDCAD In Range

Further gains, however, are likely to remain capped amid the ongoing bullish run in crude oil prices, which tends to underpin demand for the commodity-linked currency – Loonie. Even looking at the broader picture, the pair has been struggling to build/sustain its up-move beyond the 1.2900 handle and remains within a two-week-old broader trading band. In absence of any major market moving economic releases, either from the US or from Canada, the USD/oil price-dynamics might continue to act as key determinants of the pair’s momentum.

Investors are on look out for the release of latest US inflation figures later this week, which might be looked upon for the required momentum to assist the pair to move out of its recent trading range, in Canadian market traders await employment report. Both these data are expected to have impact on the pair in the short term. The dollar is expected to remain strong as long as the incoming data meets expectation. Investors expect two more rate hikes in US as long as inflation remains high or meets target. The loony’s immediate future looks bearish with the current support at 1.2800 / 1.2700 and resistance at 1.2900 /1.300 respectively. We will have to wait and see which way the pair would want to move considering the fact that there is a lot of news lined up on either side of the border during the course of the week.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance