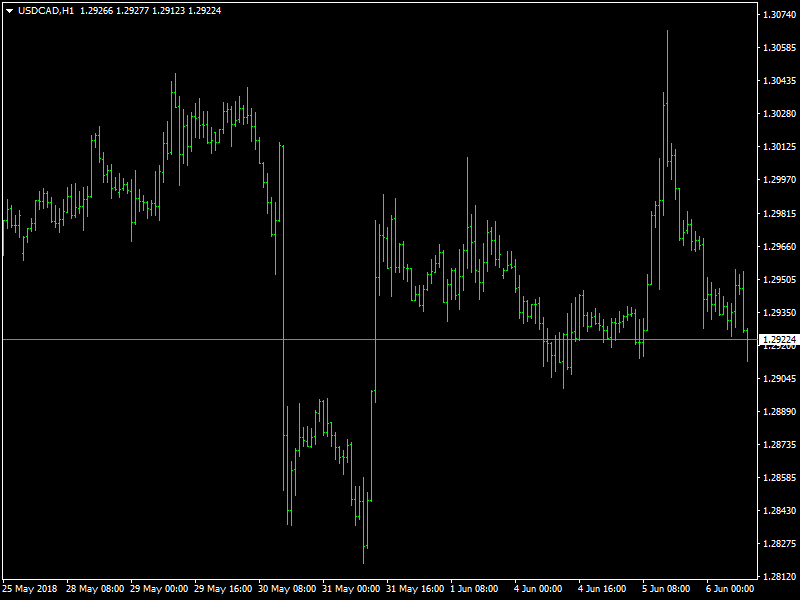

USDCAD Holds at 1.29 over Tariff Headlines

The USD/CAD is trading into 1.2935 in the early Asia session following headlines that key economic advisors to US President Trump attempted to convince the POTUS to exempt Canada from the steel and aluminum tariffs that recently hit some of the US’ closest allies. The Loonie was dovish for majority of Tuesday’s session as the pair hit 1.3066 before the Loonie staged a reversal moving into 1.29 price handle. Trump attempted to float the idea of the US taking part in bilateral talks with Mexico and Canada separately, a notion that both countries promptly rejected, and the CAD has regained its composure, chalking out Tuesday’s gains for the USD. US Greenback gained over Canadian dollar yesterday as PMI & JOLTs Job Opening data were positive. However US Greenback failed to sustain above the 1.30 mark in the US last session and from there embarked upon a downward spiral over news on Tariff related proceedings. The Loonie also benefited from the oil-price rally, after the US oil tracked the gains in its European counterpart, Brent, in the wake of the looming concerns over the Venezuelan exports.

The downside in the spot can be also attributed to broad-based US dollar weakness, mainly driven by a fresh rally in EUR/USD following upbeat comments by the ECB speakers and European political climate. Attention now turns towards the trade figures from both the US and Canada for fresh trading impetus while the EIA crude stockpiles and Crude Oil Inventory data will also have some impact on the resource-linked Loonie. This week sees Canadian Unemployment figures on Friday, and the economic calendar is largely free of high-impact events until then for the Loonie. Market focus will remained locked onto the ongoing NAFTA talks, and the worsening trade dispute between the US and Canada.

The pair remains in a Tug-off war in short term as new driven market amid geo-political concerns seem to favor both sides of pair on alternate sessions. This week will see pair move well inside a wide range of 1.3065 to 1.2850 based on news driven momentum. Expected support and resistance for the pair are at 1.2865 / 1.2790 and 1.3067 / 1.3126 respectively.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance