USD/JPY Forex Technical Analysis – August 23, 2019 Forecast

The Dollar/Yen is trading higher early Friday, which could be a sign that traders are expecting Fed Chair Powell to deliver a message that drives up demand for higher risk assets. However, since the Forex pair is still trading inside its wide range from August 13, I have to conclude that investors still aren’t sure about what to expect from Powell and that a few of the weaker shorts are just squaring up positions.

At 06:49 GMT, the USD/JPY is trading 106.637, up 0.198 or +0.19%.

Traders should look for extreme volatility when Powell delivers his speech at Jackson Hole at 14:00 GMT. Look for disappointment if Powell reiterates that “mid-cycle adjustment” narrative since the markets are pricing in a number of rate cuts starting in September. This could drive stocks sharply lower, while driving up demand for the safe-haven Japanese Yen.

The Dollar/Yen is likely to rally sharply higher if Powell delivers a dovish message with clarity and conviction.

Daily Technical Analysis

The main trend is down according to the daily swing chart. However, some of the downside momentum has been sucked out of the market since August 12 -13.

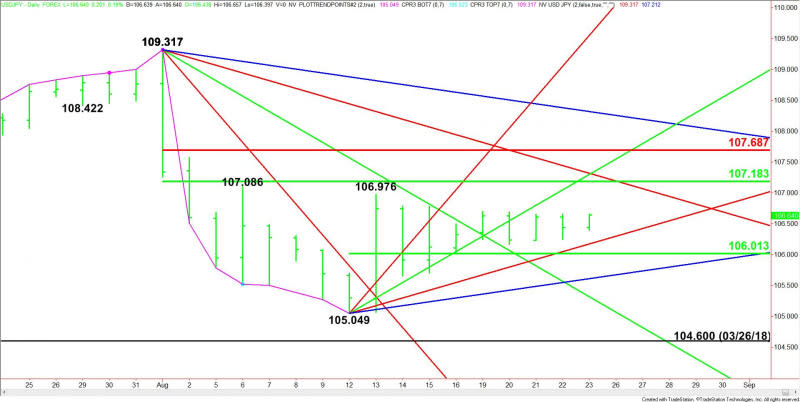

A trade through 105.049 will signal a resumption of the downtrend. The main trend will change to up on a move through 109.317.

The minor trend is also down. A trade through 107.086 will change the minor trend to up. This will also shift momentum to the upside.

The minor range is 105.049 to 106.976. Its 50% level or pivot at 106.013 has been providing support for about two weeks.

The short-term range is 109.317 to 105.049. Its retracement zone at 107.183 to 107.687 is the primary upside target. This zone is also controlling the near-term direction of the Forex pair.

Daily Technical Forecast

The direction of the USD/JPY on Friday will be determined by the momentum created by Powell at 14:00 GMT. Holding above the pivot at 106.013 is giving the market an early upside bias. Traders should watch this level all session.

Bullish Scenario

A sustained move over 106.013 will give the USD/JPY an early upside bias. Holding above the uptrending Gann angle at 106.174 will indicate the buying is getting a little stronger.

If there is enough upside momentum then look for a surge into a cluster of potential resistance points. The first target is the high at 106.976. This is followed by the minor top at 107.086, the short-term 50% level at 107.183, and a pair of Gann angles at 107.299 and 107.317. Taking out 107.687 should drive the USD/JPY into the short-term Fibonacci level at 107.687. This is a potential trigger point for an acceleration into the downtrending Gann angle at 108.317.

Bearish Scenario

A sustained move under 106.013 will signal the presence of sellers. The first target angle comes in at 105.612. This is the last potential support angle before the 105.049 main bottom. If this bottom fails then look for the selling to extend into the March 26, 2018 main bottom at 104.600. This is a potential trigger point for an acceleration to the downside.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance