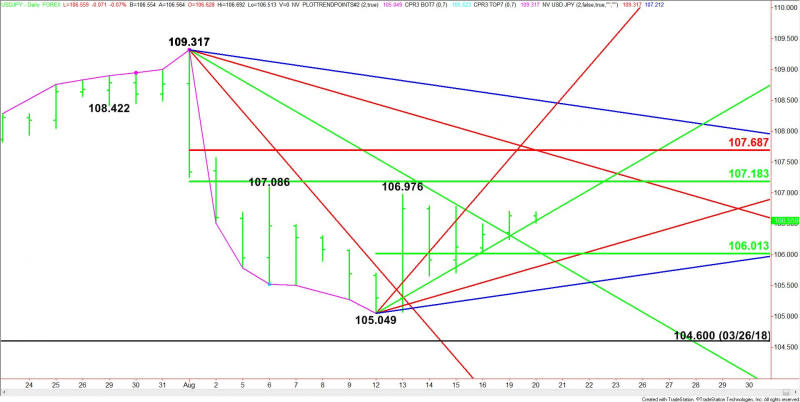

USD/JPY Forex Technical Analysis – August 20, 2019 Forecast

The Dollar/Yen is edging lower on Tuesday, mostly in reaction to flat Treasury yields and a slight drop in demand for higher risk assets. The lack of fresh economic data or a major financial news event may have something to do with the limited trading range. However, we’re little looking at a little position paring ahead of Wednesday’s release of the minutes from the July 30-31 U.S. Federal Reserve Monetary Policy meeting and Friday’s speech by Fed Chair Jerome Powell at the central bankers’ symposium in Jackson Hole, Wyoming.

At 06:35 GMT, the USD/JPY is trading 106.495, down 0.135 or -0.13%.

Daily Technical Analysis

The main trend is down according to the daily swing chart. However, momentum is getting close to turning higher. The main trend will change to up on a move through 109.317. A trade through 105.049 will signal a resumption of the downtrend.

The minor trend is also down. A trade through 107.086 will change the minor trend to up. This will shift momentum to the upside.

The minor range is 105.049 to 106.976. Its 50% level or pivot at 106.013 is controlling the short-term direction of the Forex pair.

The main range is 109.317 to 105.049. Its retracement zone at 107.183 to 107.687 is the primary upside target. Even though the minor trend will be up when this zone is reached, sellers could still show up on this move.

Daily Technical Forecast

Based on the early price action and the current price at 106.563, the direction of the USD/JPY on Tuesday is likely to be determined by trader reaction to the uptrending Gann angle at 106.549.

Bullish Scenario

A sustained move over 106.549 will indicate the presence of buyers. If this move is able to generate enough upside momentum then look for buyers to take a run at the high at 106.976, the minor top at 107.086 and the main 50% level at 107.183.

Bearish Scenario

A sustained move under 106.549 will signal the presence of sellers. If this generates enough downside momentum then look for a potential plunged into the minor pivot at 106.013. If this fails then look for the selling to possibly extend into the short-term uptrending Gann angle at 105.799.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance