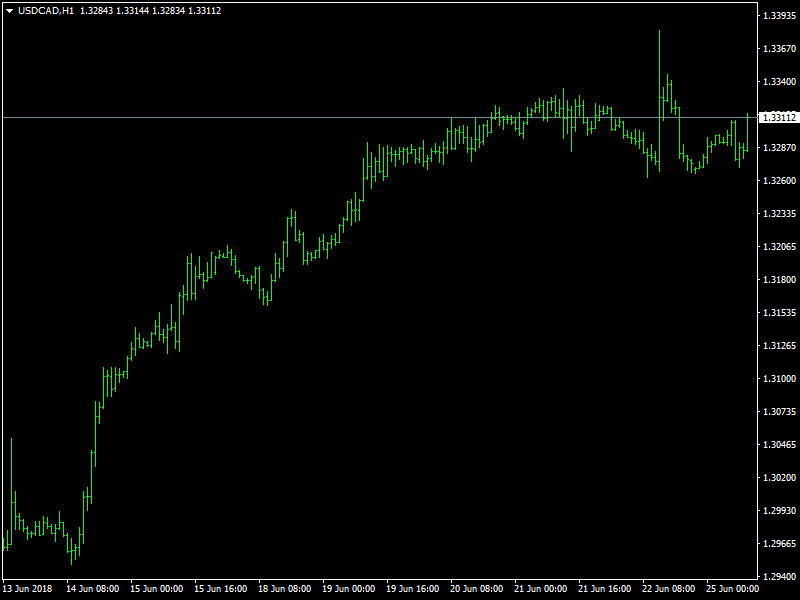

USD/CAD Price Forecast – Weaker Oil Price Weighs Down Loonie Amid Global Trade War Concerns

The USD/CAD pair regained positive traction at the start of a new trading week and recovered a major part of Friday’s corrective fall from one-year tops. A goodish pickup in the US Dollar demand, despite escalating US-China trade tensions and the ongoing retracement in the US Treasury bond yields, was seen as one of the key factors that helped the pair to reclaim the 1.3300 handle. Renewed USD buying helps regain positive traction on Monday, while weaker oil prices weigh on Loonie and provide an additional boost. This coupled with a mildly softer tone around oil prices, with WTI crude oil retreating from Friday’s near one-month tops, weighed on the commodity-linked currency – Loonie and further collaborated to the pair’s strong bid tone.

USDCAD Still Buoyant

Meanwhile, Friday’s sluggish readings for both inflation and retail sales cast doubts about how quickly the Bank of Canada could proceed with future rate hikes and might now help limit any immediate sharp downside, at least for the time being. The dollar is staying well bid in European trading today as it extends gains against other major currencies – barring the yen. For USD/CAD, buyers are looking to sustain a hold above the 100-hour MA above $1.3300 handle. As of writing the pair is trading around 1.32867 with slight range bound momentum.

On release front, macro calendar remains silent in Canada for majority of the week except for Bank of Canada Governor Poloz’s speech on Thursday and GDP data on Friday. Investors will focus on developments in US Greenback to make short term bets as they await updates from Canadian market later this week. In US markets, Investors will focus on new home sales data scheduled to release later today and Consumer confidence data scheduled to release on Tuesday along with a speech by Atlanta Fed President Raphael Bostic at an event in Atlanta. Immediate resistance is pegged near the 1.3320 area, above which the pair could make a fresh attempt towards reclaiming the 1.3400 handle with some intermediate resistance near the 1.3370-80 region. On the flip side, the 1.3270-65 zone now seems to have emerged as an immediate support, which if broken might prompt some fresh long-unwinding trade and drag the pair back towards the 1.3200 handle.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance