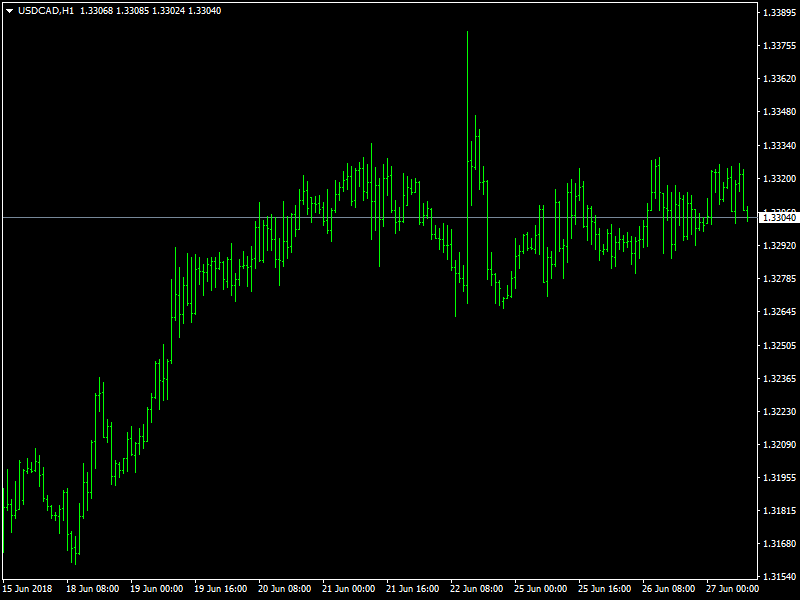

USD/CAD Price Forecast – USD/CAD Turns Range Bound Ahead of BOC Poloz’s Speech

The USD/CAD pair traded with a mild positive bias for the third consecutive session on Wednesday, albeit remained well below one-year tops set last Friday. The pair quickly reversed an early dip to an intraday low level of 1.3293 and regained positive traction on the back of some renewed buying interest surrounding the US Dollar, which might now be looking to build on overnight rebound from two-week lows. The uptick, however, seemed lacking strong conviction, with a combination of negative factors keeping a lid on any meaningful up-move. The ongoing downfall in the US Treasury bond yields, coupled with fears of a full-blown US-China trade war seemed to hinder any strong USD up-move.

USDCAD Coils Into Range

Adding to this, the prevailing strong bullish sentiment around crude oil prices, which tends to underpin demand for the commodity-linked currency – Loonie, might further contribute towards capping the bullish momentum. It would now be interesting to see if the pair is able to attract any follow-through buying interest or continues with its consolidative price action, within a broader trading range held over the past one-week or so. Analysts & CAD investors now focus on the odds of a July rate hike by the Bank of Canada. Lower rate expectations are due in part to an escalation in trade uncertainty and some disappointment on the data front. Despite this, our view for a July hike remains unchanged, consistent with incoming data and past BOC communications.

However there are multiple factors that could derail possibility of a rate hike, they are Governor Poloz’s speech scheduled later today, April GDP data and proceedings on trade wars between US and Canada by Canadian Government. Traders take cautious stance as immediate factors that could affect momentum such as Poloz’s communications as well as on trade policy and incoming data scheduled for the rest of week could go either way. Meanwhile in US markets, the release of US durable goods orders data will be looked upon to grab some short-term trading opportunities. A sustained move beyond the 1.3335 immediate hurdles is likely to accelerate the up-move back towards 1.3380-85 zone en-route the 1.3400 handle. On the flip side, any meaningful retracement below the 1.3300 handle might continue to find support near the 1.3265 area, below which the pair could be headed back towards testing the 1.3200 round figure mark.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance