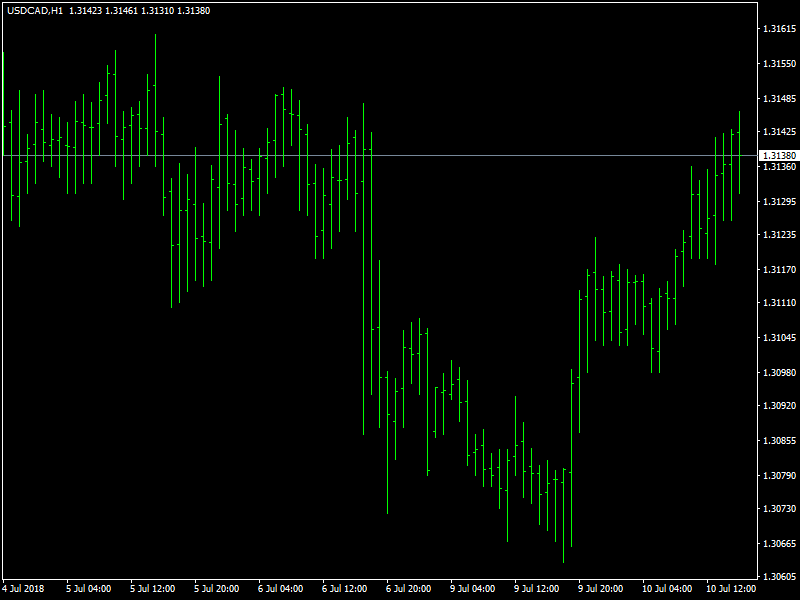

USD/CAD Price Forecast – US Greenback Recovers Ground against Loonie over Increase in Dollar Bids

The USD/CAD pair traded with a positive bias for the second consecutive session and is currently placed at fresh session tops, comfortably above the 1.3100 handle. Investors looked past Friday’s softer US wage growth data, with a goodish pickup in the US Dollar demand assisting the pair to built on overnight rebound from near four-week low level of 1.3066. The uptick seemed largely unaffected by the prevalent strong bullish sentiment around crude oil prices, which tends to underpin demand for the commodity-linked currency – Loonie, with the USD price dynamics acting as an exclusive driver of the pair’s steady climb. Despite the USD weakness witnessed yesterday, the Loonie struggled to gather strength. This along with a sharp increase in the US T-bond yields and a modest sell-off on crude oil during late North American market hours helped the pair gain momentum to breach 1.31 price handle.

Bounces From Range Lows

With today’s up-move, the pair has now recovered around 65-pips since the early North-American session on Monday and might now be aiming to test its immediate strong resistance near the 1.3150-60 regions amid relatively thin macro calendar. OPEC members have vocalized their contempt for US President Donald Trump as predicted when U.A.E. Energy Minister Suhail Al Mazrouei mentioned today that OPEC has enough capacity to offset output shortfalls and told “OPEC alone cannot be blamed for all the problems that are happening in the oil industry, but at the same time we were responsive in terms of the measures we took in our latest meeting in June” in response to President Trump’s accusations on OPEC driving oil prices higher.

Iranian Crude trading activity is increasing and this is causing global unrest as possibility of Iranian Navy blocking major oil passage way increases higher by the day. On release front Canada will see housing Starts and building permits data while US markets will see release of JOLTS Jobs Opening data. The Bank of Canada is expected to raise interest rates at its meeting tomorrow and investors await updates from BOC policy meeting before placing any long term bets. On a sustained move beyond the mentioned barrier of 1.3150/60 price handle, the momentum could get extended towards the 1.3200 handle en-route the 1.3225 supply zone. On the flip side, the 1.3100 handle now seems to protect the immediate downside, which if broken might increase the pair’s vulnerability to aim towards testing 50-day SMA support near the key 1.30 psychological mark.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini Dow Jones Industrial Average (YM) Futures Analysis – July 10, 2018 Forecast

The Pound Continues to Weaken as UK Political Uncertainty Prevails, Global Stocks Rise

Investors Should Be Watching Guidance During This Earnings Season

Price of Gold Fundamental Daily Forecast – Rally Stops Cold as Treasury Yields Surge

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – July 10, 2018 Forecast

Yahoo Finance

Yahoo Finance