USD/CAD Fundamental Analysis – week of November 6, 2017

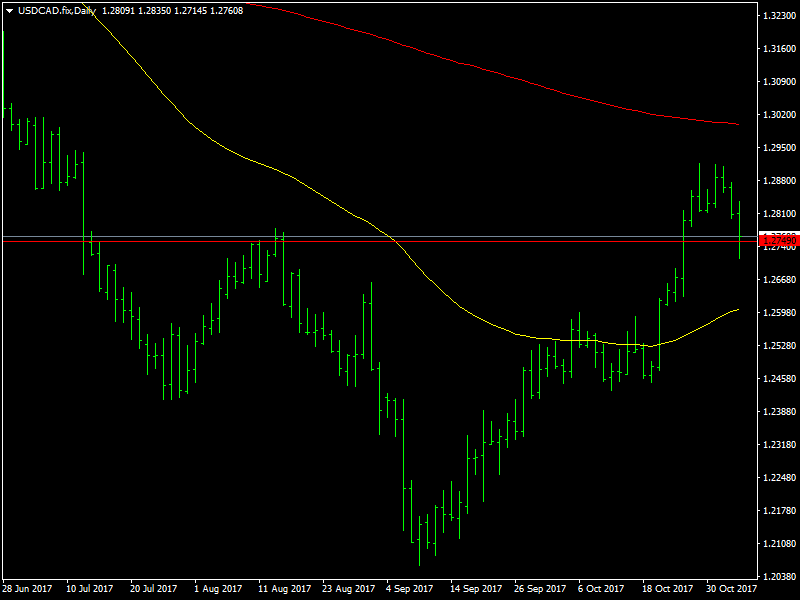

The USDCAD pair had a correction during the course of the week as all the data from the US did not do much to add strength to the dollar and hence left it open for correction from the strength of the CAD during the week. This led the pair lower and it finished in the middle of the weekly range looking ahead to the new week for some direction.

CAD Gains Some Strength

The dollar had a slew of data that got released during the course of the week but all the data was so choppy that it was largely ignored by the market and the dollar continued to being steady at the end of the week. The NFP data came and went and even that did not have much of an impact on the dollar as the current data came in weaker than expect but the data from last month was revised higher and this choppy data did not add much value to the dollar. This also did not solve the question on whether the Fed would hike the rates in December or not and this kind of deadlock has led to uncertainty for the dollar.

There was also the announcement of Powell as the next Fed Chief to succeed Yellen but this was also widely anticipated and hence did not have much reaction from the markets. On the other hand, the CAD was boosted by some strong employment data though the trade balance and the unemployment rate data came in weaker than expected. This strength in the CAD led the pair below 1.28 during Friday and the pair is now likely to consolidate in this region.

Looking ahead to the coming week, we have speeches from Poloz and Yellen and both of them are likely to have a bit of an impact on the market. The focus of the market would continue to be on the dollar and any hint of confirmation of the rate hike in December is likely to lead to a bull rally in the dollar. Till that happens, we can safely expect some consolidation and ranging to happen in the USDCAD pair below the 1.28 region during the coming week.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance