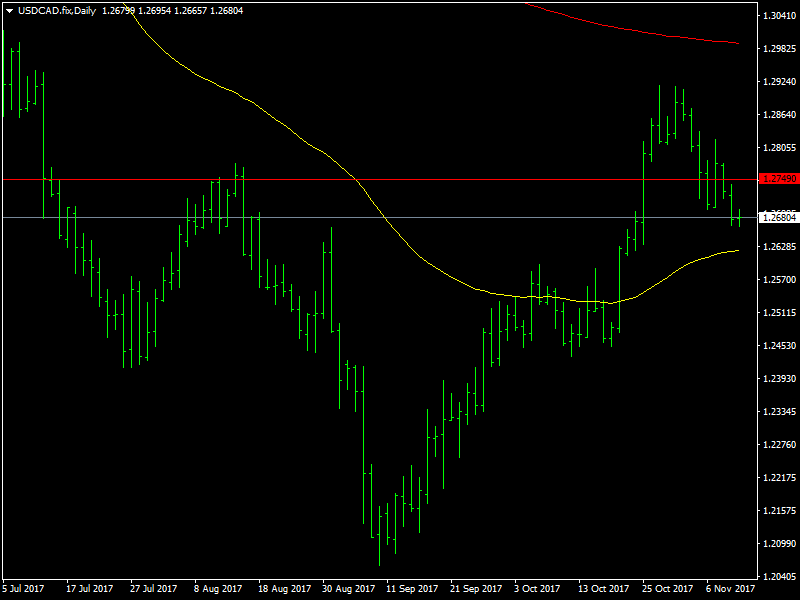

USD/CAD Fundamental Analysis – week of November 13, 2017

The USDCAD pair moved lower during the course of the week as the dollar weakened across the board as we approached into the second half of the week. There was not much in terms of fundamental changes or events or news to drive the markets last week but whatever was there, led to very little volatility in the markets last week. The same was the case with the USDCAD pair as well with much of the moves over last week coming on the last day of the week.

USDCAD Moves Lower on Dollar Weakness

There was not much news from the CAD during this period and it clearly showed in the lack of direction in this pair for much of the week. The oil prices continued to trade in a strong manner due to the crisis in Saudi Arabia and this helped the CAD to stay strong during the course of the week. This was the only fundamental driver for the CAD during the week whereas the rest of the moves were purely driven by the weakness and the strength of the dollar.

For the dollar, the major news of note over this period was the implementation of the tax reform bill which was passed a few weeks earlier and which had led to a strengthening of the dollar as it proposed major tax cuts for the corporates. But the dollar bulls were in for disappointment last week as the tax cuts for the corporates was delayed by a year and this led to a sell off in the dollar towards the end of the week which pushed the prices trough the 1.27 region and the pair closed the week near the lows of its range.

Looking ahead to the coming week, we have the PPI and retail sales data from the US as well as a speech from the Fed Chief Yellen. The market is hoping for a rate hike from the Fed in December and hence would be looking forward to the speech and the data for clues and hints to confirm the same. For Canada, the CPI data would be released towards the end of the week and it remains to be seen whether the data continues to be choppy as it has been over the last few weeks. If there is a confirmation of a rate hike in the form of good incoming data, then we should see the dollar moving up and the USDCAD heading towards 1.28 and further.

This article was originally posted on FX Empire

More From FXEMPIRE:

EUR/USD Price forecast for the week of November 13, 2017, Technical Analysis

FTSE 100 Index Price forecast for the week of November 13, 2017, Technical Analysis

Dow Jones 30 and NASDAQ 100 Price forecast for the week of November 11, 2017, Technical Analysis

USD/JPY Fundamental Daily Forecast – U.S. Bank Holiday May Have Prevented Further Weakness

Yahoo Finance

Yahoo Finance