USD/CAD Fundamental Analysis – week of May 14 2018

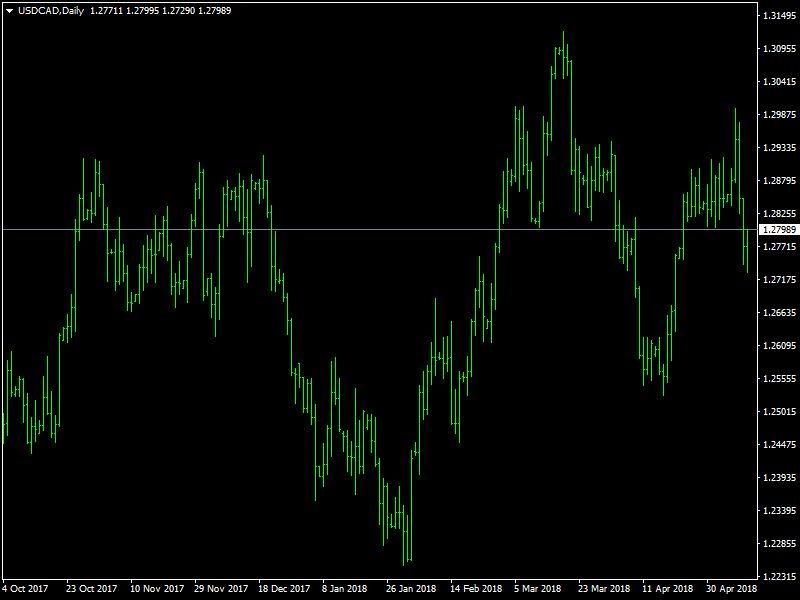

The USDCAD pair fell hard during the course of the week after having pushed higher earlier in the week. This led to some choppy trading during the week but ultimately, the bears seemed to have taken control of the pair and the pair finished lower during the week and we believe that this is set to continue in the coming week.

USDCAD Highly Choppy

The USDCAD pair rose higher during the first half of the week on the back of dollar strength that was seen all across the markets but the dollar strength gave away during the second half as the incoming data from the US was weaker than expected. This continued the trend from the last few weeks where we have been seeing the US data being weaker with the NFP data and now the inflation data coming in lesser than expectations. This was the break that the CAD bulls needed and they made full use of it.

This led the pair lower and the speed of the fall was accelerated by the rising oil prices as well. The oil prices rose due to the tension in the Middle East between the US, Iran and Israel and this sought to support the CAD in the short term as much of the Canadian economy depends on the oil prices. This pushed the pair towards the 1.28 region where it has found some support for the time being.

Looking ahead to the coming week, we continue to have a lot of data coming in with the retail sales data from the US scheduled to be released towards the middle of the week while we have the manufacturing sales data and the inflation data from Canada as well. All of these data, along with the oil inventory data are expected to have a lot of impact on the pair and this is going to lead to some volatile trading in the coming days as far as this pair is concerned. Though the CAD bulls seem to have the upper hand now, we believe that the dollar could stage a come back in the coming week and hence the traders need to be on their toes.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance