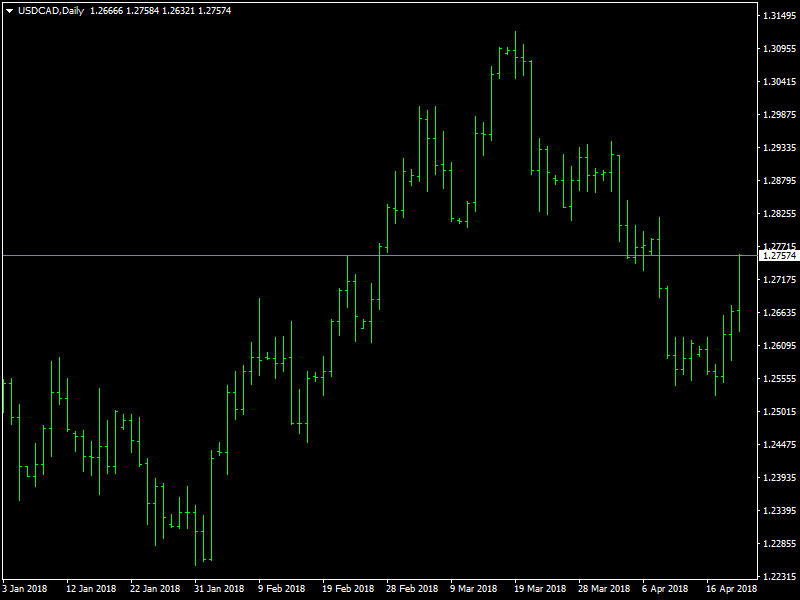

USD/CAD Fundamental Analysis – week of April 23, 2018

The USDCAD pair finished the week in a strong manner after having spent the first half of the week and the week before, under a lot of pressure. The pair had come under pressure due to the strength of the CAD which had grown due to the increase in the prices of oil and also due to the fact that a part of the market was anticipating a rate hike from the BOC.

USDCAD Pushes Through 1.27

The BOC rate announcement and statement came in during the middle of the week and it kept the rates on hold. We dont think the BOC, despite being a hawkish central bank, had much of a choice considering the fact that the incoming data over the last few weeks from Canada had been pretty weak which had been capped off by some weak employment numbers. This lack of a rate hike disappointed a part of the market.

They showed their disappointment by selling off the CAD and this helped the pair to recover and end the week strongly. Also, the oil prices also corrected towards the end of the week and we also saw the dollar beginning to gain in strength as the week progressed and a combination of these factors led the pair to push back through the 1.27 region and close the week just below the 1.28 region which should act as a strong resistance for the time being.

Looking ahead to the upcoming week, we have the GDP data from the US but we do not have any specific major economic data from Canada for the week. We expect the pair to continue in the range between the 1.25 and 1.28 regions for the week. We believe that this is going to be the range that the pair would be trading in, in the short term and hence it would be difficult for the traders and the investors to push the prices in any specific direction beyond this range at this point of time.

This article was originally posted on FX Empire

More From FXEMPIRE:

Blockchain Project Smart Trip Will Make Planning Your Trip Easy as Pie

Price of Gold Fundamental Weekly Forecast – Rising Rates Should Make It Hard to Sustain Any Rally

How Blockchain Can Solve Problems for the Online Gaming Industry

Natural Gas Price Fundamental Weekly Forecast – Bullish Over $2.806, Bearish Under $2.762

Yahoo Finance

Yahoo Finance