USD/CAD Fundamental Analysis – week of October 23, 2017

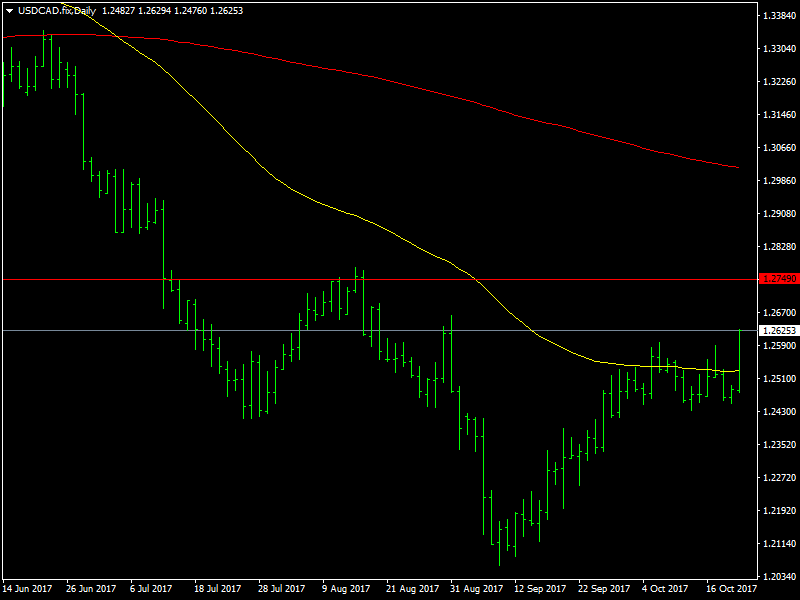

The USDCAD pair had a strong week as it closed near its highs on Friday and the way it is going, it looks good for more in the short and medium term. The move up in this pair is a measure of the strength in the dollar and also the fact that the market is losing the hawkishness and the linking that it had for the CAD. Though the CAD continues to be supported by strong oil prices, it does not seem to be enough to sustain any kind of a move against the dollar.

USDCAD Moves Higher on Weak Canadian Data

The dollar was steady for most of the week but towards the end of the week, it was helped higher by the news that the tax reform bill was passed in the US and this is seen as a major victory for Trump and his team as it sets them up for the passage of other important bills as well. This is crucial for them to hold together the US economy and now all that the dollar needs is some strong data and confirmation of a rate hike in December for it to rocket higher in the short and medium term as well.

On the other hand, the CAD lost a bit of love a couple of weeks back when the BOC Governor Poloz said that he does not have any timeline for the next rate hike. The market was expecting a hike by the end of the year and with such a statement, the CAD seems to have lost a bit of sheen and this helped the USDCAD move higher. Also, the inflation data and the retail sales data from Canada came in much weaker than expectations over the last week and this has since pushed the USDCAD pair towards its range highs in the 1.26 region.

In the upcoming week, all eyes of the traders would be on the rate statement, monetary policy report and also on the rate announcement from the BOC. Traders would be watching out for any hints on the timeline for the next rate hike and if the BOC is not hawkish on that, then we could see the USDCAD rising even higher in the coming week. The US also has its advance GDP data to deal with but as long as the dollar manages to hold steady, we could see the pair moving higher for the short term.

This article was originally posted on FX Empire

More From FXEMPIRE:

EUR/USD forecast for the week of October 23, 2017, Technical Analysis

DAX Index Price Forecast October 23, 2017, Technical Analysis

DAX Index forecast for the week of October 23, 2017, Technical Analysis

GBP/USD forecast for the week of October 23, 2017, Technical Analysis

NZD/USD forecast for the week of October 23, 2017, Technical Analysis

Silver Price forecast for the week of October 23, 2017, Technical Analysis

Yahoo Finance

Yahoo Finance