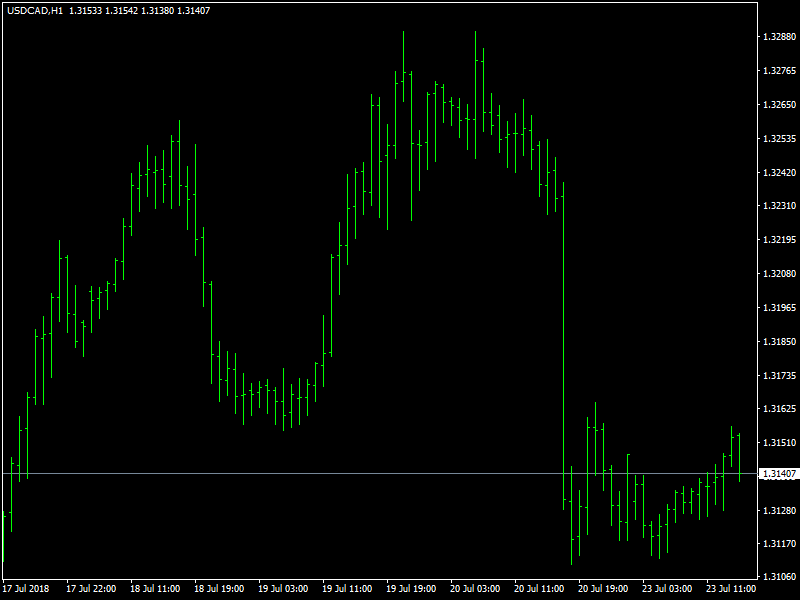

USD/CAD Daily Price Forecast – USD/CAD Moves Range Bound Near Friday Lows As US Bond Yields Cap US Dollar’s Weakness

The USD/CAD pair managed to rebound around 20-25 pips from Asian session lows and is currently placed at the top end of its consolidative trading range. Ahead of an active week in the financial markets, Monday’s session is considered relatively calm from the perspective of economic data. Nevertheless, a pair of US data releases will make headlines at the start of North American trading. North of the border, the Canadian government will report on wholesale sales at 12:30 GMT. The monthly gauge is projected to show 0.6% growth for May following a 0.1% uptick the month before. The Canadian dollar is coming off a productive Friday session following the release of solid retail sales figures. As a result, USD/CAD plunged to 1.3147 from a high of around 1.3289 earlier in the week. The pair has declined another 0.1% on Monday to trade at 1.3127. Investors can expect greater volatility for this pair amid NAFTA negotiations, central bank policy and fluctuating oil prices.

USDCAD Choppy

The pair has favorable short term scenario as long as US Dollar remains weak due to multiple CAD favorable news from last week. First, President Trump did a good job of talking down the US dollar at the end of last week. Jerome Powell provided dollar support on Tuesday and Wednesday and then Donald Trump affirmed the Fed’s independence before undermining it on Thursday and Friday. Second, last week also proved to be a good week for the Canadian dollar. There was a beat for the Canadian retail sales 2.0% vs 1.1% expected and the CPI data out on Friday 2.5%y/y vs 2.4% expected. And third, the price of oil was supported after Saudi’s OPEC governor revealed that Saudi Arabia was not about to flood the oil market with lots of supply. A higher oil price supports CAD, with multiple factors giving upward influence to Loonie a weaker greenback should help create high volatility for the pair as trading session begins for the week.

However, a modest uptick around the US Treasury bond yields extended some support to the greenback. This along with a mildly softer tone around crude oil prices, which tends to undermine demand for the commodity-linked currency – Loonie helped ease the bearish pressure on US Greenback post its 175 pip decline, at least for the time being. Currently trading around the 1.3145-55 region, traders now look forward to the release of existing home sales data for some short-term trading impetus. Any subsequent up-move is likely to confront immediate resistance near the 1.3175 level, above which the pair could make an attempt towards reclaiming the 1.3200 handle. On the flip side, the 1.3115-10 region now seems to have emerged as an immediate support, which if broken might accelerate the fall further towards 50-day SMA support near the 1.3075-70 region.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance