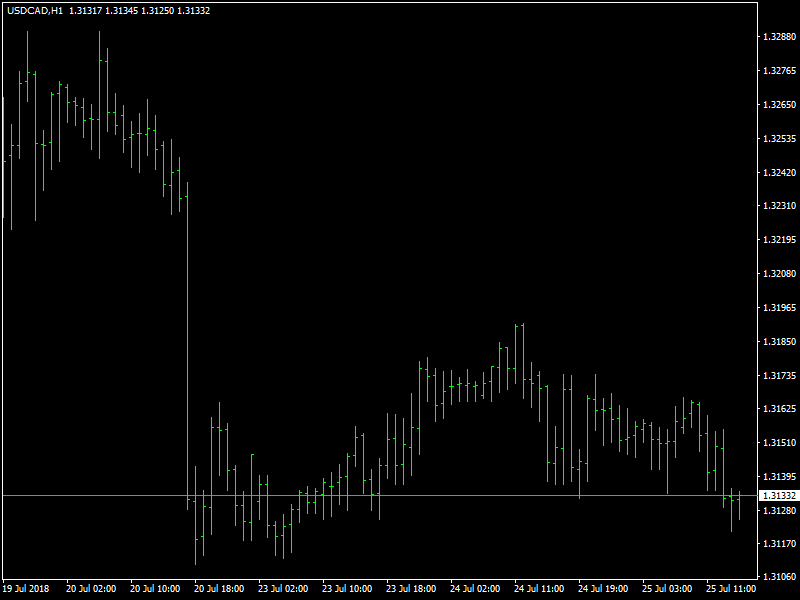

USD/CAD Daily Price Forecast – USD/CAD Stuck at 1.31 Handle amid Subdued US Greenback

The USD/CAD pair lacked any firm directional bias and seesawed between tepid gains/minor losses through the early European session on Wednesday. The pair stalled overnight rejection slide from the 1.3200 neighborhood and found some support near the 1.3140-30 region amid subdued US Dollar price action. Ahead of a key meeting between the US President Donald Trump and European Commission President Jean-Claude Juncker, the greenback remained stuck in a narrow band and did little to provide any meaningful lift. Meanwhile, crude oil prices remained supported by overnight API report that showed a fall of 3.16 million barrels in the US inventories for the week ending July 21, which underpinned demand for the commodity-linked currency – Loonie and further collaborated towards keeping a lid on any meaningful up-move for the major.

USDCAD Stable

The pair gained upper hand during Tuesday’s trading session over spike in US Treasury bond yields and this upward momentum remained solid across Tuesday and early Asian market hours on Wednesday post which the pair began its steady decline. As investors took to cautious stance ahead of the trade talk meet in US, the greenback lost its momentum which along with Loonie supported by Crude oil price action caused the pair to take a dovish stance. The pair is currently trading at 1.3134 with 0.15% decrease in value and is expected to continue a downtrend movement trapped above 1.3100 price handle during European market hours.

In absence of any major market-moving economic data, traders are likely to take cues from the official EIA report on the US crude oil inventories. The key focus, however, would be on this week’s other US macro releases, particularly the advance Q2 GDP growth figures, which should assist investors to determine the pair’s next leg of directional move. Any meaningful downfall is likely to find support near the 1.3115 level, below which the pair is likely to aim towards testing 50-day SMA support near the 1.3090 region. On the upside, momentum beyond the 1.3165-70 immediate resistance might continue to confront fresh supply near the 1.3200 handle, which if cleared might trigger a near-term short-covering bounce.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance