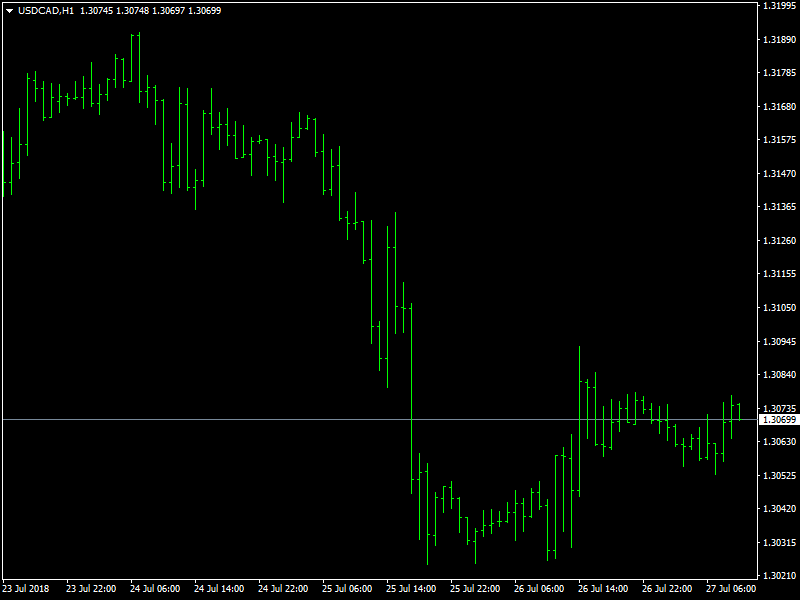

USD/CAD Daily Price Forecast – USD/CAD Moved To Mid 1.30 Handle Amid Soft USD Greenback

The USD/CAD pair met with some fresh supply on Friday and eroded a major part of overnight modest recovery gains. Currently hovering around mid-1.3000s, the pair stalled its positive momentum just ahead of the 1.3100 handle and struggled to make it through/sustain above 50-day SMA. Some renewed US Dollar weakness, despite a mildly positive US Treasury bond yields, was seen as one of the key factors prompting some fresh selling on the last trading day of the week. Even the prevalent negative trading sentiment around crude oil prices, which tend to undermine demand for the commodity-linked currency – Loonie, did little to lend support, albeit seemed to help limit any deeper losses, at least for the time being. Moving ahead, investors’ focus will remain glued to the advance US Q2 GDP growth figures, where any positive surprise, over and above already elevated expectations, should boost the greenback and assist the pair to regain some positive traction. Nevertheless, the pair still remains on track to the end with the second consecutive week of losses and possibly the lowest weekly close since early June.

USDCAD Under Pressure

The US dollar recovered after bouncing at 1.30335 supports and its 500 EMA during the overnight session and now trades at 1.30703 heading towards 1.30905. The Pair looks a bit exhausted after the short sprint and will need to break and maintain above 1.30905 to move further to the next target at 1.31274. From the technical point of view, the momentum indicators seem to be negative and the market could ease a little bit more in the short-term. The RSI indicator is in negative territory after declining sharply in recent days. Also, the MACD oscillator dropped below the zero line and stands far below the trigger line. Should prices decline further, immediate support could be found at the 1.3020 bottom, taken from the lows in the last few days. Then a leg below that level, the price could meet the 38.2% Fibonacci mark of 1.2880, increasing chances for further bearish movements.

When taking a look at 4 hour and daily charts though, the greenback seems to be in a strong bullish rally against the loonie as it has been holding within an ascending movement since September 2017. On the macro calendar front, CAD has no major news release but market will see Budget Balance for April and this release is not expected to affect the price action. Aside from GDP data US markets will also see Michigan consumer sentiment and expectations data for July and U.S. Baker Hughes Oil Rig Count data which could considerably affect price action of US Greenback in case of better than expected readings.

This article was originally posted on FX Empire

More From FXEMPIRE:

EUR/USD Daily Price Forecast – EUR/USD Drops Post Comment from Draghi on Interest Rate

NZD/USD Forex Technical Analysis – Strengthens Over .6773, Weakens Under .6765

Crude Oil Price Update – Strengthens Over $70.42, Weakens Under $69.64

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – July 27, 2018 Forecast

Yahoo Finance

Yahoo Finance