USD/CAD Daily Fundamental Forecast – February 2, 2018

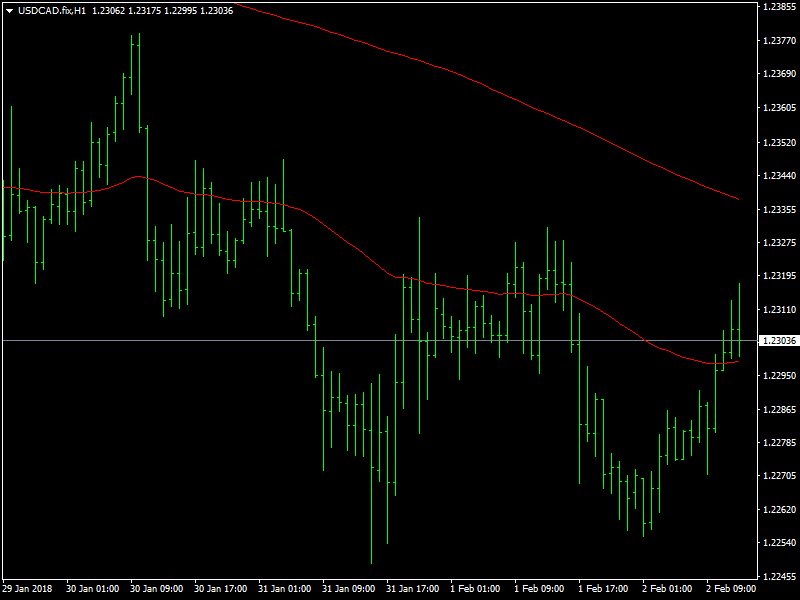

The USDCAD pair moved lower during the course of trading yesterday as the dollar got hit by weakness during this period. There has been no fundamental or economic developments during this period to warrant such a kind of move but it seems to be more of positioning and trading ahead of some big news that are going to be released later in the day and in the coming days as well.

USDCAD Likely to Get Support

We saw the oil prices moving higher yesterday and we believe that this would have lent some support to the CAD. But this seemed to have little impact on the overall prices in the USDCAD pair and we saw the pair moving lower during the day as the dollar weakened and the CAD also gained a bit during this period. We believe that the oil prices would continue to move higher in the coming days, which should lend some serious support to the CAD.

But on the other hand, for the short term, the focus is likely to be on the dollar as there is a lot of important data likely to come in over the next few days. This would determine how much of support that the Fed would get, for hiking the rates, from the incoming data. It needs all the support that it can get from the data as the market expects 3 rate hikes atleast during the course of the year and would wish that the Fed exceeds that as well.

Looking ahead to the rest of the day, we do not have any major news from Canada but we have the employment report in the form of NFP from the US. The traders expect some strong data in the form of NFP after the ADP report earlier in the week posted some strong numbers. If this data comes in strong, we should see some strong recovery from the dollar as it turns around from a prolonged slump.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance