USD/CAD Daily Fundamental Forecast – November 17, 2017

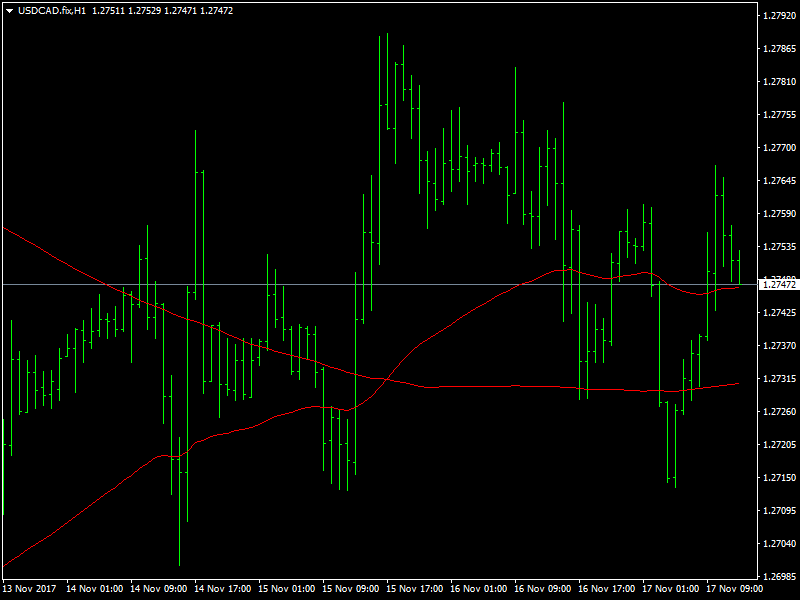

The USDCAD pair has turned choppy in its price movements as the dollar has been unable to find any direction since the beginning of the week and this is reflected in the price action not only in this pair but in other dollar related pairs as well. It has to be said that the volatility has picked up immensely this week but the direction is still not very clear for the dollar and this has been making the investors uncertain.

USDCAD Continues to be Choppy

The key for the direction in this pair remains the rate hike in December in the US. The incoming data over the course of this week continues to be choppy or steady at best and it has been difficult to guess which direction the Fed would take. The Fed members have also been sticking to their usual self as far as comments go and no one has caused any surprises so far, as far as the market is concerned. This makes it unclear on how the Fed would react to all this data come December and this confusion is clear for everyone to see in the market.

On the other hand, the CAD continues to trade in a strong manner despite the small drop in the oil prices that we have seen during the course of the week. The drop in prices of oil seem to be more of a correction rather than a change of trend and this underlying strength in oil has been able to give some support for the CAD. The CAD has not had much of adverse data of late and this also helped it to be steady.

Looking ahead to the rest of the day, we have the CPI data from Canada which would give insights into how the economy is performing. Though there is no immediate threat of a rate hike in the short term, the BOC is known to spring surprises on the market and any kind of strong data over the coming weeks could encourage them to seriously start thinking about the rate hike during the early part of 2018.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance