USD/CAD Daily Fundamental Forecast – February 19, 2018

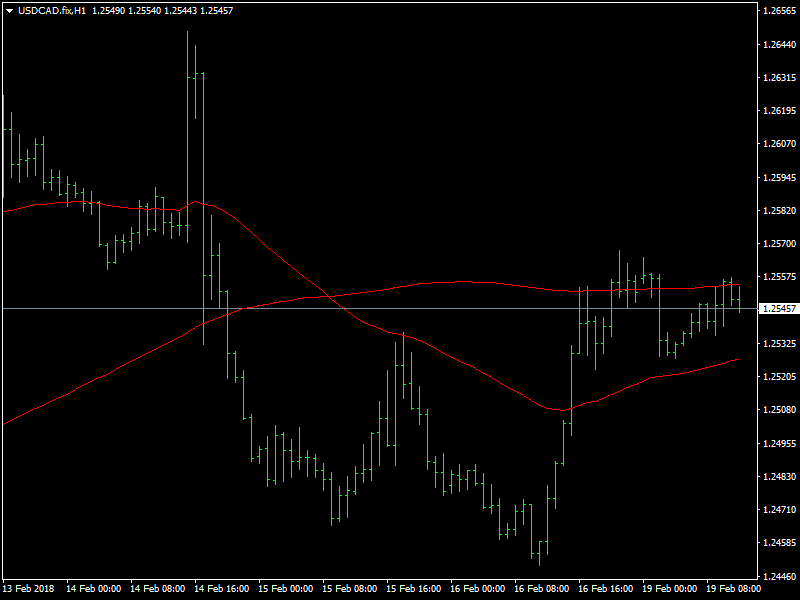

The USDCAD pair continues to trade in a strong and steady manner above the 1.25 region as the dollar manager to recover late in the day on Friday and that recovery has continued through till today as well. The dollar has managed to continue to bounce whenever there has been a sell off in this pair and this shows that the support is pretty strong.

USDCAD Buoyant

This makes the job of the bears quite difficult in the weeks ahead as it is unlikely that they would be able to break through the support easily and this would mean that the only direction would be up from now onwards. But we will have to wait and see how the data from the US and Canada pans out in the near future as this is likely to determine how the respective central banks would be working off in the next few months.

As we had mentioned before in many of our forecasts, the Fed has been looking to hike rates and the market expects the Fed to hike rates in the month of March and also expects a total of atleast 3 rate hikes during the course of this year. But that is highly contingent upon the incoming data from the US continuing to be good. But even this would not guarantee success for the bulls in the pair as they are up against the BOC which is known to be very hawkish in general and they are likely to continue to be so in the coming months as well. So, we could see some volatility and ranging in this pair as the US and Canada could alternate with their respective rate hikes.

Looking ahead to the rest of the day, we do not have any major news from Canada while it is a bank holiday in the US. So we can safely expect the consolidation and ranging to continue for the rest of the day which should keep the pair steady and buoyant for today.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance