USD/CAD Daily Fundamental Forecast – October 31, 2017

It was a very tight day of trading yesterday which is understandable considering the lack of fundamentals and economic news in the headlines yesterday. It was the first day of the week and it could turn out to be an important week for the dollar and CAD as well. It is also a week where a month ends and a new one begins and hence it is likely to witness of lot of monthly flows which could affect the liquidity in the market.

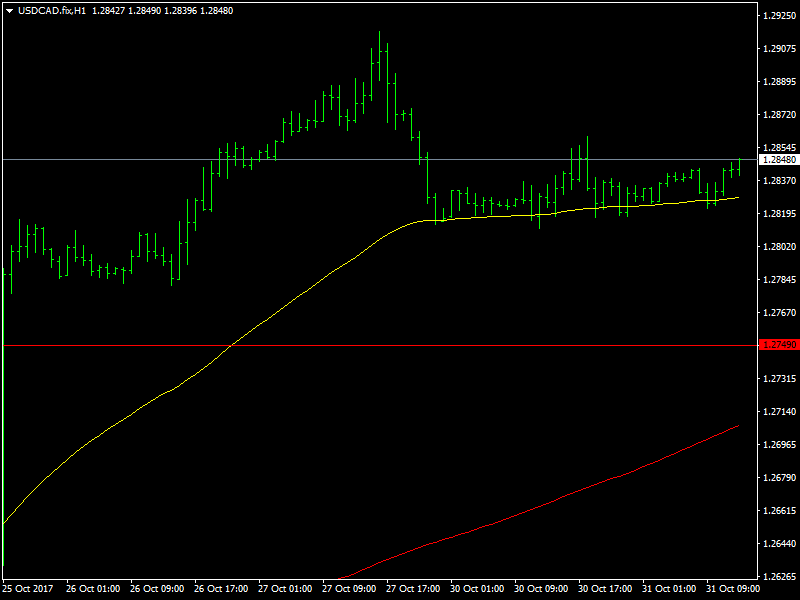

USDCAD Likely to Consolidate

The dollar is also likely to witness a lot of volatility this week as a range of news i set to be released later in the week. This includes the wages and employment report from the US and we believe that this report is likely to determine whether the Fed hikes the rates in December or not. If this data comes out to be strong, it would more or less ensure the rate hike and this should then see the dollar strengthen across the board and this is likely to push the pair towards the 1.30 region.

On the other hand, a strong employment report will improve hopes of a turnaround in the Canadian economy after the disastrous retail sales report from Canada a couple of weeks back. This will also improve the chances of a rate hike from the BOC in the early part of 2018. These are the events that are lined up later in the week and should see some volatility around them.

Looking ahead to the rest of the day, we do not have any major news from Canada but we have the consumer confidence data from the US. This is unlikely to bring in too much of volatility and so we can safely expect some more consolidation in the USDCAD pair below 1.29 for today as well.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance