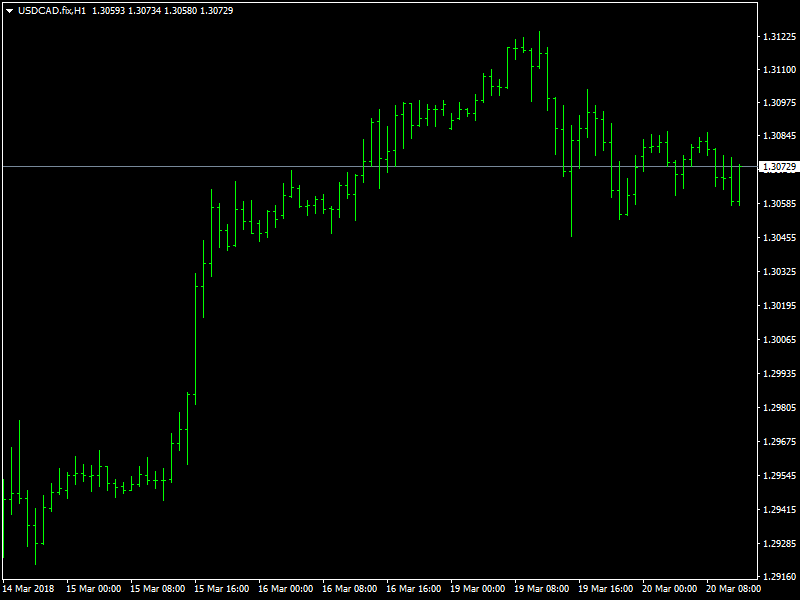

USD/CAD Daily Fundamental Forecast – March 20, 2018

The USDCAD pair has managed to stay near the highs of its range despite the weakness in the dollar that has been seen all across the markets yesterday. It has to be said that the dollar bulls seem to be most active in this pair as they have not let the prices drop by much over the past few weeks and this is an increasing sign that the bulls are in control.

USDCAD Still High

In fact yesterday, not only did we see an increase in the weakness of the dollar, we also saw that the oil prices also rose higher and continue to trade near the top of its range and this would have helped the CAD under normal circumstances. But the influence of the bulls has been so much in this pair that we are seeing very little impact of all these developments on the pair and it continues to trade above the 1.3050 region as of this writing and it is likely that it would remain strong during the medium term.

The pair pushed through the 1.30 region a couple of days back on the back of some strong anticipation that the dollar would strengthen in the short and medium term due to help from the Fed. There is increasing hope that the Fed would hike rates for the first time this year, later this week and there is also a belief that they would lay down the timelines for some of the future rate hikes as well. This has helped the dollar to stay relatively buoyant over the last few weeks.

Looking ahead to the rest of the day, we do not have any further economic news or data from the US or Canada and hence we believe that we are likely to see more and more of consolidation and ranging in the short term as the market looks forward to the Fed later in the week.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance