USD/CAD Daily Fundamental Forecast – February 13, 2018

The USDCAD pair finished lower for the day yesterday but the bulls seem to be building up the momentum in a slow and steady manner in this pair. The correction in this pair does not seem to be close to an end in this pair as yet but we continue to believe that the overall trend in still up only.

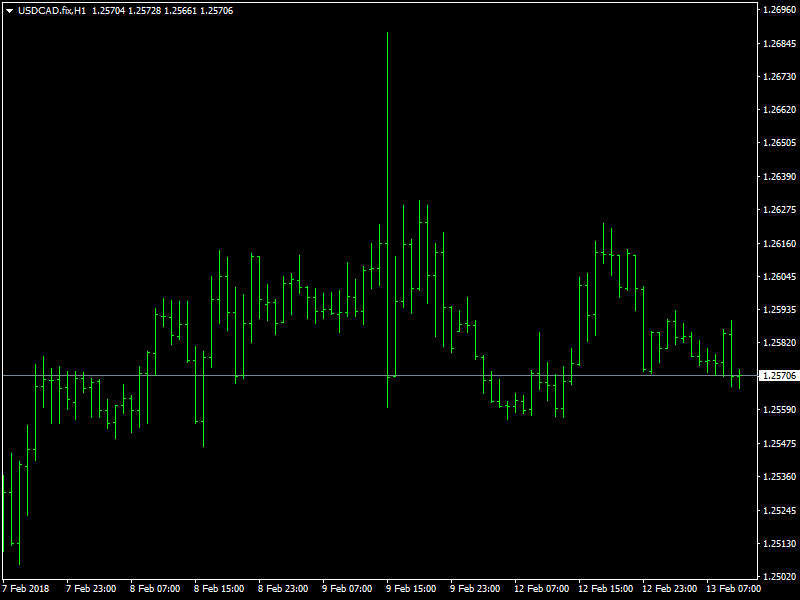

USDCAD In Support Region

The pair has been pretty volatile over the last week or so as action from the US, Canadian and the oil markets seem to be pushing the pair this way and that with no specific direction. While we saw a period of weakness in the dollar and rising oil prices and this helped to push the pair towards the 1.23, this has since been followed by a period of strength in the dollar and the oil prices have also fallen which has lent even more support to the bulls in the pair and helped the pair to move higher in a slow and steady manner.

Last week, we saw that the employment reports from Canada came in in a very weak manner with the data missing the expectations by a long way. This led to weakness in the CAD but that has since been reversed and now we see the pair trying to form a base in the 1.2550 region as of this writing. It is clear that the dollar is set to gain in the medium term due to the anticipation over the rate hikes from the Fed for the rest of the year while the BOE would be unable to consider rate hikes if the economic data from Canada continues to be weak like last week.

It is in this scenario that we believe that the trend has reversed and the trend is still up and the move down that we are seeing right now is more of a correction than a change in the trend. Looking ahead to the rest of the day, we do not have any major economic news from Canada or the US and so we should see some consolidation and ranging in the support region.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini S&P 500 Index (ES) Futures Technical Analysis – February 13, 2018 Forecast

Natural Gas Price Fundamental Daily Forecast – Prices Hovering Around December 21 Bottom at $2.532

Time to come back to the main trends. Gold, SP500 and Bitcoin

European Equities Slide on Weaker U.S Dollar, US Futures Point to Lower Open

EUR/USD Mid-Session Technical Analysis for February 13, 2018

Yahoo Finance

Yahoo Finance