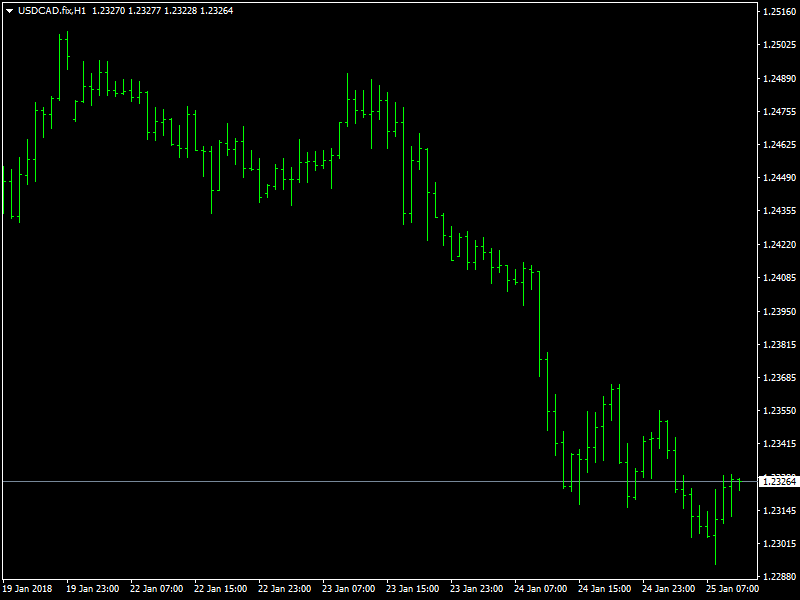

USD/CAD Daily Fundamental Forecast – January 25, 2018

The USDCAD continued to crash lower yesterday in what is turning out to be a total rout as far as the dollar is concerned. The dollar has been sold across the board over the last 24 hours and the pair has been no exception to this selling. It is likely that there might be a bounce in the horizon but getting the timing right would be the key and hence it is advisable for traders to trade with tight stop losses at this point.

USDCAD Moves Lower

The pair moved lower mainly on the weakness of the dollar and in the case of this pair, the situation was made worse by the fact that the CAD gained in strength during the same period due to the increase in the oil prices. The dollar as beaten back on renewed fears of a global trade war happening with each country trying to follow protectionist policies by following what the US has done so far as well. This does not bode well for the global economy and with the US being considered as the main culprit this time, it was sold off.

Also, the US treasury secretary said that he would prefer a weaker dollar as it would help in US trade and economy and this was the green signal that the market needed to sell off the dollar, which it did successfully. The pair has currently found some support in the 1.23 region for now but it remains to be seen how long this is likely to last before the next round of dollar selling comes in.

On the other hand, the CAD has been pretty steady as it has been well supported by the rising oil prices which have shot through the $66 region and seem destined to move towards the $70 region in due course of time. Looking ahead to the rest of the day, we do not have any major economic news from the US or Canada but the dollar selling seems a bit overstretched at the moment and hence the dollar bulls could hit back at any time.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance