USD/CAD Daily Fundamental Forecast – February 20, 2018

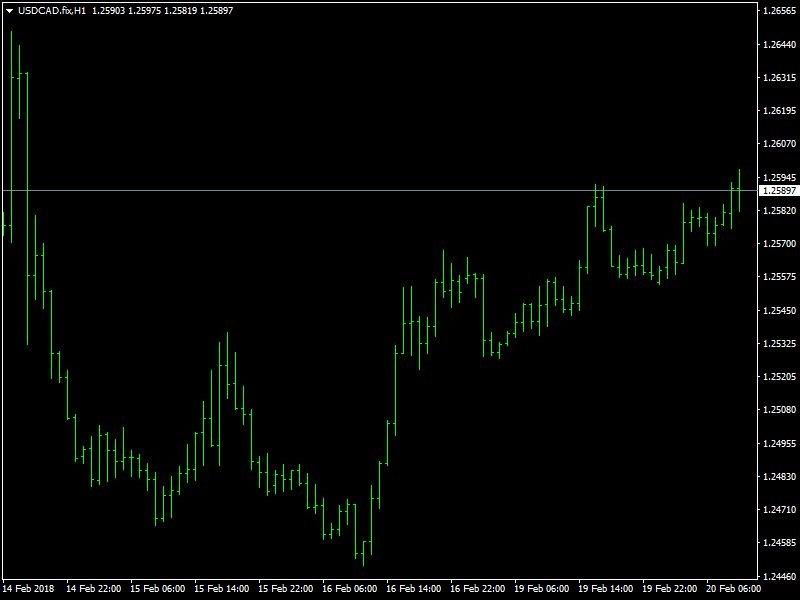

The USDCAD pair had some choppy trading during the course of the day yesterday but this was only on expected lines due to the bank holiday in the US. The pair closed the day almost at the same level where it began for the day and the more interesting and volatile day should be the one ahead of us now. The dollar gained across the board yesterday but that did not seem to have too much of an impact on this pair.

USDCAD Choppy

The bulls continue to be in control of this pair and the dollar seems to be getting all the attention that it can get. The reason for that is the FOMC meeting minutes that is scheduled to be released a bit later in the week and the market is looking forward to the same due to the fact that the traders expect the Fed to spell out the expectation that there would be a rate hike in March and the traders also expected the Fed to lay down a possible timeline for the future rate hikes. This looks too much of an ask, considering the history of what the Fed says and does.

The Fed rarely lays down a timeline for the future rate hikes though it always tends to keep the door open for the same and it also seeks to keep the market interested. It usually keeps the expectations open ended by saying that they would look at the incoming data to decide on the future but with the incoming data being generally strong, this should help to keep the dollar buoyed if that is the language that the Fed is going to use.

Looking ahead to the rest of the day, we do not have any major economic data or news from the US or Canada for the day and that should mean a good period of consolidation. The traders from the US return back to their desks after the long weekend and this should keep the traders on their toes with the volatility.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance