USD/CAD Daily Fundamental Forecast – November 15, 2017

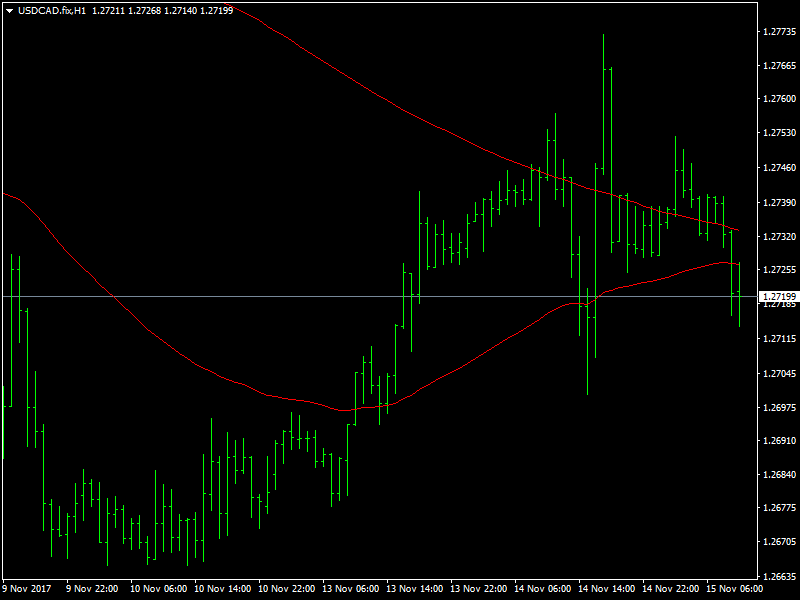

The USDCAD pair has been under pressure over the last 24 hours as the dollar has been choppy and has been trading under some bearish pressure despite some strong incoming data from the US. It is likely to continue under pressure till the release of the data from the US later in the day today which might then give some respite for the dollar.

USDCAD Moves Lower on Dollar Weakness

The dollar was clearly on the backfoot over the last 24 hours though the reasons continue to be inexplicable. Maybe the market knows something that we dont. The only data of interest from the US yesterday was the PPI data but this came in much stronger than expected. But this despite this strong data, the dollar weakened across the board over the last 24 hours and this led to the USDCAD pair also moving lower during this period.

There were also speeches from Yellen and some other members of the Fed but these were on the usual lines and as expected and they did not give much hint on whether the Fed would be hiking rates in December or not. This is the key point that the market would be looking for, as far as the dollar is concerned and a part of this has already been priced into the markets. So, it is a kind of a surprise to see the unwinding of the dollar longs especially when so close to a bunch of data that is going to come in over the coming days of the week.

Looking ahead to the rest of the day, we do not have any major news from Canada but we have the inflation data in the form of CPI and the retail sales data from the US later in the day today. Apart from the NFP, these are the key data that are likely to determine whether the Fed would hike rates in December and hence the market would be watching it very closely. Any kind of weakness in the data could probably put paid to the hopes of a hike in the short term and could lead the USDCAD pair towards the lows of its range in the 1.26 region.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance