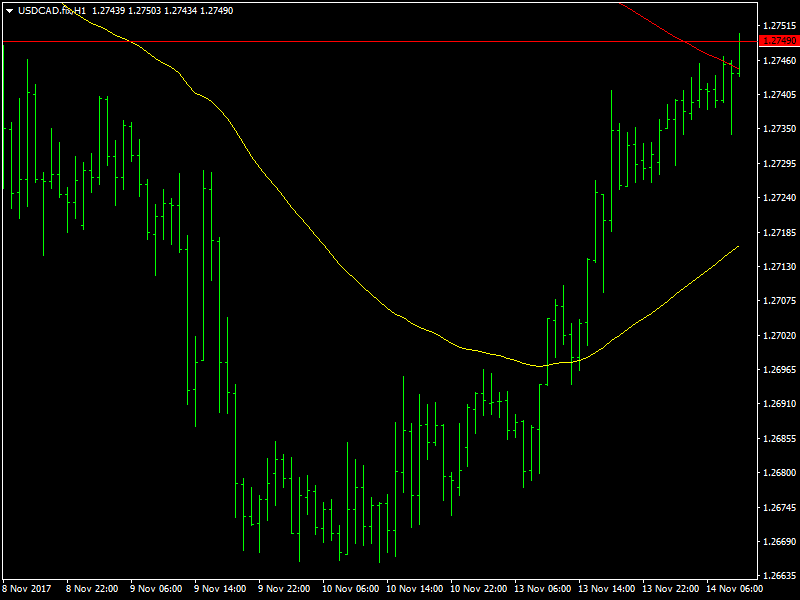

USD/CAD Daily Fundamental Forecast – November 14, 2017

After a brief period of consolidation, the prices of USDCAD have begun to move higher due to the strength of the dollar. There has not been much change in the oil prices and there havent been any major fundamental changes as far as the Canadian economy is concerned and the move higher now has been driven purely by the strength of the dollar. It was a bank holiday in Canada yesterday and the opportunity was well used by the bulls in pushing the prices higher.

USDCAD Buoyed by Dollar Strength

The dollar was strong all across the markets yesterday and this was best seen in the USDCAD pair which moved higher during the course of trading yesterday. The dollar has been buoyed by increasing expectations that the Fed would hike rates in December and the Fed member Harker added further fuel to the fire by saying that he saw one more rate hike this year and three more next year. This kind of hawkishness was enough for the dollar bulls to go about buying more of the dollar.

There has been no indication of a rate hike in December from Yellen as yet and even the incoming data from the US has been choppy at best. The market would look for more cues and hints that this was going to happen before it starts some large scale buying of the dollar but there are indeed signs that the market has begun to slowly but steadily buy the dollar in anticipation of the rate hike and this has helped the pair to move towards the 1.2750 region.

Looking ahead to the rest of the day, we have a speech from Yellen during the London session and we also have the PPI data from the US later in the day and the market would continue to look for hints from either the economic data or from Yellen.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance