USD/CAD Daily Fundamental Forecast – November 7, 2017

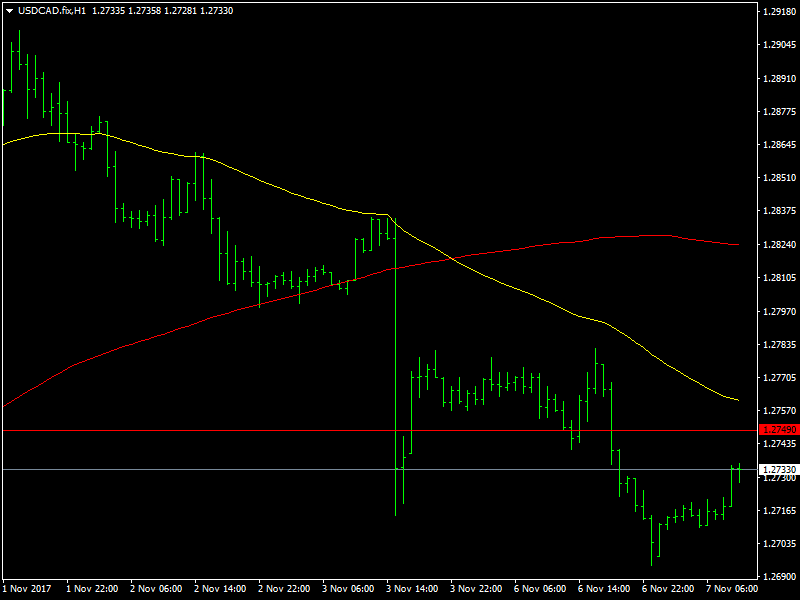

The USDCAD continued to move lower over the last 24 hours as the CAD strength clearly shone through and we also saw the dollar weaken all across the board. The CAD strength had begun to take shape ever since the employment report was released from Canada last Friday and the pair has weakened towards the 1.27 region since then.

USDCAD Moves Lower on CAD Pressure

After the pair had dropped by several hundred pips over the last few months, we had seen a bounce from the 1.25 region by over 300 pips as the dollar began to gain in strength and the BOC made it clear that the next rate hike was not on the horizon as yet. In fact, during their last meeting, the BOC released a statement where they practically ruled out any kind of hike for the time being which was a blow to the bulls. The incoming data from Canada also began to grow weaker and this helped to push the pair even higher as the pair made its way towards the 1.28 region.

But the turnaround of sorts came about last Friday as the Canadian employment data came in much stronger than expected. This was in contrast to the US employment data which was choppy, as it has been over the past couple of months. This combination of data was enough for the CAD bulls to take control and the pair weakened towards the 1.27 region and continues to trade in that region, as of this writing.

Looking ahead to the rest of the day, we have the BOC Governor Poloz making a speech later in the day and that could lead to some volatility in the pair. But the fact remains that the BOC would not be hiking rates atleast till the middle of 2018 while the Fed still has the doors open for a rate hike in December. This should weigh in favor of the dollar and we should see the pair begin to move up in the coming days.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance