USD/CAD Daily Fundamental Forecast – March 1, 2018

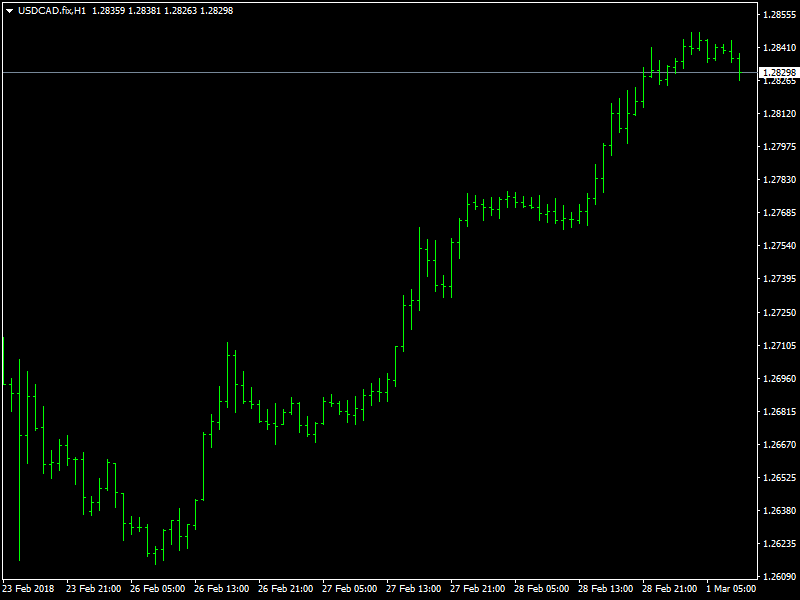

USDCAD finally managed to break through some strong resistance in the 1.2760 region after having spent a lot of time over there. The move higher has been spurred by a combination of the dollar strength and the oil price weakness and this is likely to continue in the medium term. But for now, the signs are there for the bulls to take some rest.

USDCAD On the Move

The dollar has got a boost since the beginning of the week as the new Fed Chief Powell testified at Capitol Hill for the first time after taking over from Yellen. He reiterated the strength of the US economy and he felt that the economy would continue to throw up some strong data. This was inline with the thinking of most of the other Fed members and hence this has increased the prospects of accelerated rate hikes from the US over the next few months. This has given a lot of strength to the dollar.

The strength in the dollar has also impacted the oil prices and caused them to move lower over the last couple of days and this has in turn brought in weakness to the CAD as a large part of the Canadian economy still depends on the oil prices. We saw the advance GDP data from the US yesterday and that came along expected lines and a combination of all these push the prices through the 1.28 region. But it is not yet time for elation as we believe that the prices would face a lot of resistance in the range highs near the 1.2950 region which should act as a stumbling block.

This should hold the prices for the short term and this could lead to a correction in the dollar strength during this period. We have another testimony from Powell today and also the manufacturing PMI data as well from the US and it would be interesting to see what kind of an impact these have on the prices.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance