USD/CAD Daily Fundamental Forecast – February 27, 2018

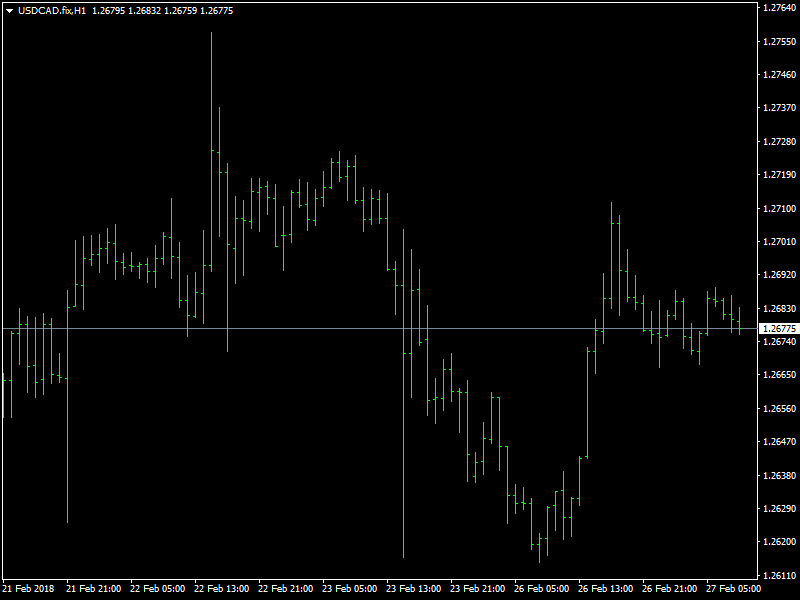

The USDCAD pair continues to consolidate and range between the 1.26 and the 1.27 regions over the last 24 hours. The pair has been trading in a strong and steady manner over the last few days and this trend is expected to continue in the short term as the market comes to terms with the strength of the dollar and the dollar bulls begin their move.

USDCAD In Tight Range

Later in the day today, we are going to see the new Fed Chief Powell testify for the first time and the market would get the opportunity to know his line of thinking as far as the monetary policy and rate hikes are concerned. Many of the Fed member have expressed the view that the hikes have to come in quickly to keep pace with the rest of the economy and it remains to be seen whether Powell shares a similar move. The market expects the Fed to hike rates in March and his concurrence would be considered very important.

This would be useful to know not only about the rate hike in March but also to form a timeline on when the next rate hikes can be expected as a part of the market expects that the Fed would be hawkish enough to hike the rates more than 3 times this year considering that the incoming data continues to be bullish. On the other hand, Canada has had to deal with some choppy data over the last few weeks and this has been affecting the prices and the strength of the CAD and is also one of the reasons for the bullishness in the pair. The oil prices have helped a bit to strengthen the CAD but that is not enough unless the data picks up.

Looking ahead to the rest of the day, we do not have any major economic news or data from Canada but we have the Fed Chief testify along with the durable goods data and trade balance data as well from the US.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance