USD/CAD Daily Forecast – Bears Buckle-up Ahead of US Q2 GDP

After skyrocketing from 1.3225 level on August 27, the USD/CAD pair had already crossed above the 1.3300 psychological mark yesterday. Notably, after marking the daily opening near 1.3306 handle, the pair was consolidating near 1.3364 level in the early hours. Somehow, the pair lost ground in the Asian session, dropping from 1.3315 level to 1.3286 level.

Key Economic Events

On Thursday, the US economic docket remains quite occupied with significant economic events. The market might pay special attention to US Q2 Annualized GDP, Jobless data reports, and Q2 QoQ Personal Consumption Expenditures (PCE) Prices. The street analysts expect the highly crucial US Q2 GDP data to record 0.1% below the 2.0% consensus estimate. Meantime, the market holds a bearish stance over the Jobless data reports. The consensus estimate the Continuing Jobless Claims computed since August 16 to record 1.680 million over the previous 1.674 million.

Later the day, July MoM Pending Home Sales data will come out. However, the market seems to stay highly bearish over these figures, forecasting 0.0% over the last 2.8%.

Interim, along with the USD-specific events, the Canadian Q2 Current Account would also come out at 12:30 GMT.

Needless to say, the calendar lacks significant EIA/API Crude data reports today, allowing the Oil traders to take a back seat.

Technical Analysis

1-Month Chart

On the monthly chart, the USD/CAD continued to stay within the upper region of the Bollinger Bands, keeping a strong uptrend intact.

Also, the ability to march upwards would immediately open up challenges on the overhead resistances stalled near 1.3697 and 1.4103 levels. Anyhow, if the pair dives below the center line of the Bollinger Bands, then that would trigger for a downtrend, encouraging the bears. Noticeably, on the southside, firm support handle remained stemmed near 1.2247 level. Nonetheless, another obvious worth noting was the southward heading Stochastic technical lines, revealing damping buyer interest.

1-Week Chart

Interestingly, the Loonie pair was struggling to close the week on a positive note, attempting to cross above the center line of the Bollinger Bands, provoking the bulls.

Anyhow, the pair was forming a rising wedge bearish trading pattern, signaling for a near-by trend reversal. The Relative Strength Index (RSI) was pointing near 50 mark, showing neutral market interest.

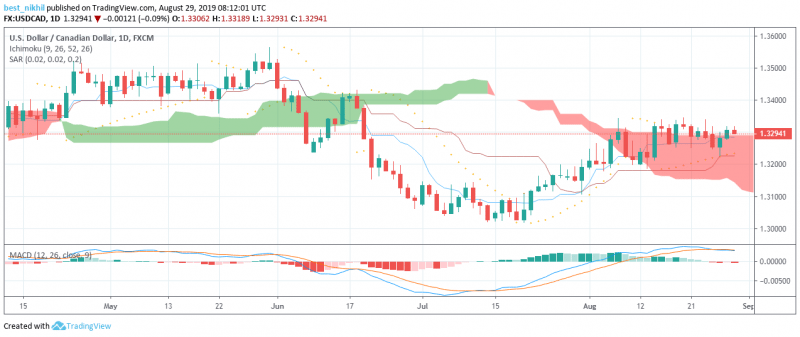

1-Day Chart

The USD/CAD pair appeared to have almost surpassed the red Ichimoku Clouds, providing extra ammunition to the bulls.

Even the base line and conversion line kept hovering below the pair, strengthening the near-term bullish stance. Nevertheless, the MACD line and the Signal line appeared to remain twisted, staying above the zero line of the MACD technical indicator. In the meanwhile, underlying Parabolic SAR ensured to provide additional bullish daily forecasts.

The article was written by Bharat Gohri, Chief Market Analyst at easyMarkets

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance