US home values are surging at their fastest pace since before the financial crisis

Jeffrey Collé

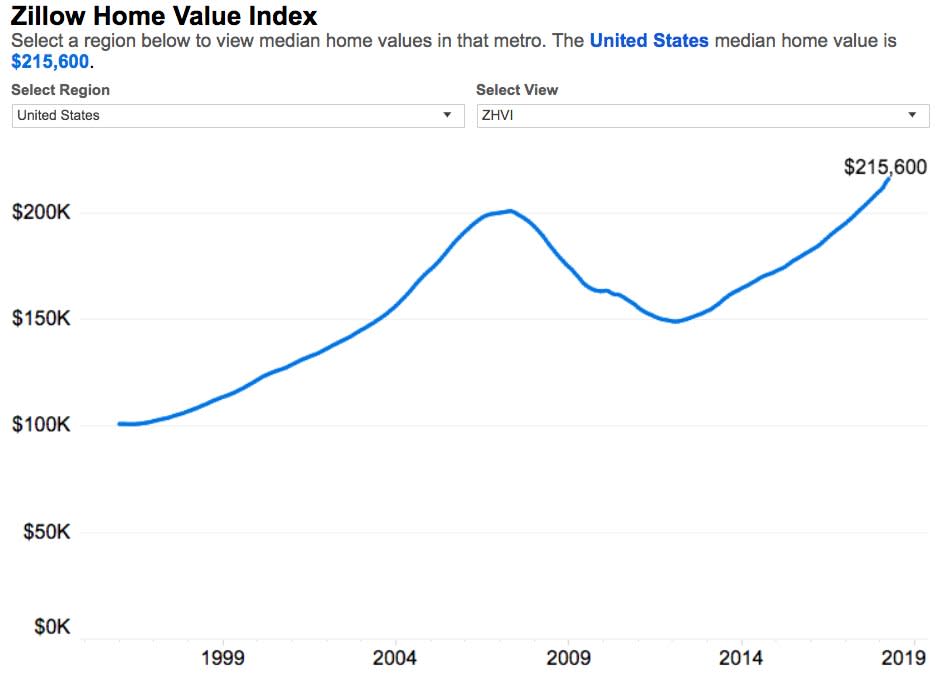

The median US home value rose 8.7% year-over-year in April to $215,600, the fastest increase since 2006, according to Zillow data.

Las Vegas, Seattle, and San Jose, California, saw the biggest increases over the period.

Homes in the US haven't been this valuable since before the financial crisis.

That's according to new data from Zillow, which finds the median US home value climbed 8.7% to $215,600 in April, the quickest year-over-year increase since June 2006.

While this is a bad sign for prospective buyers, it's positive for existing homeowners, because it opens up the possibility of a so-called cash-out refinance.

Such a transaction allows a person to replace his or her mortgage with a new home loan worth more than is owed on the house. The person then gets the difference in cash, which can be used for home improvements and other value-increasing activities.

Zillow notes that the historically high growth rate in home values is a culmination of an uptick that began more than three years ago.

"The current gain is part of a general upward trend that started in early 2015, when values were climbing at less than 5% year-over-year," Svenja Gudell, the chief economist of Zillow Group, wrote in a research note. "They picked up steam that summer and, aside from occasional pauses and slight declines, have not looked back."

Here's a breakdown of Zillow's data by market:

Fastest year-over-year home growth

San Jose, California — Up 26.2% to $1.26 million

Las Vegas — Up 16.5% to $260,800

Seattle — Up 13.6% to $490,000

Slowest year-over-year home growth

Baltimore — Up 4.4% to $262,700

Washington, DC — Up 4.5% to $398,900

Houston — Up 4.7% to $195,500

Zillow

NOW WATCH: A Nobel Prize-winning economist explains what Milton Friedman got wrong

See Also:

Yahoo Finance

Yahoo Finance