U.S. farmer: 'We need things to get back to normal'

American farmers, having felt the brunt of the Trump administration’s aggressive trade policies, are eager for a positive result of U.S. trade negotiations with China and the implementation of the United States-Mexico-Canada Agreement (USMCA).

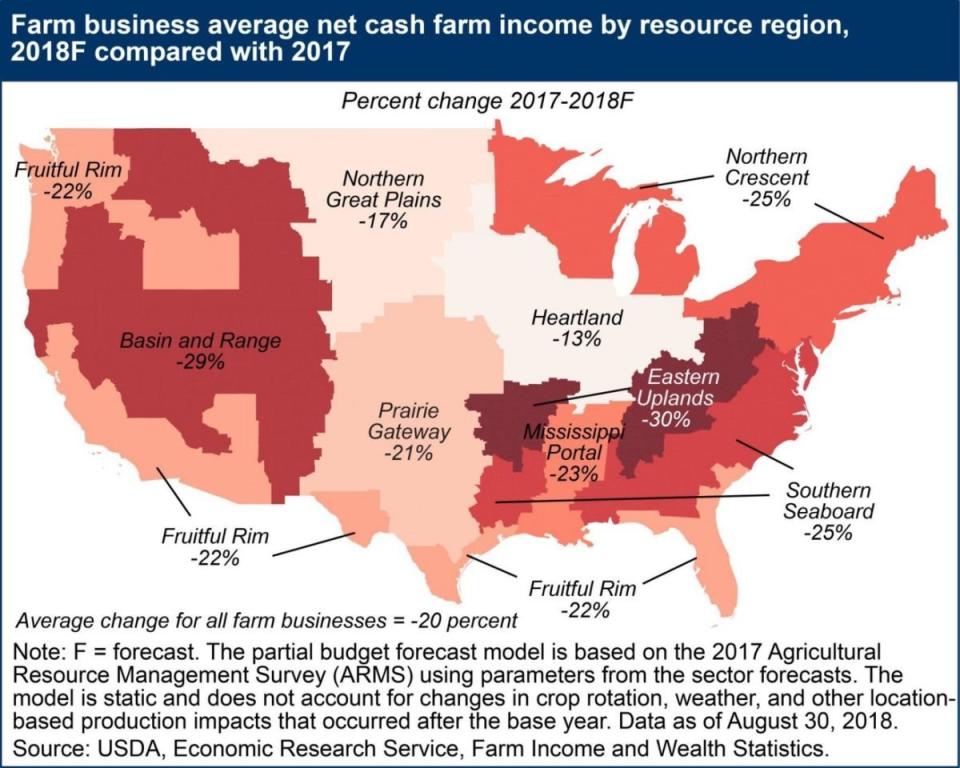

The trade war has had significant effects on American agriculture and farmers throughout the last year, ranging from soybeans, beef, dairy, wheat, and more.

“I hope they’ll make strides on that,” Oklahoma-based wheat farmer Hope Pjesky said recently during On the Move. “But we really don’t have any way of knowing what’s happening with those negotiations now. And we need things to get back to normal.”

In a recent interview with the New York Times, Trump stated: “We’re getting closer. ... Negotiations [with China] are going very well.”

On Feb. 2, following two days of trade talks, China reportedly bought two million tons of U.S. soybeans as a sign of good faith. According to Bloomberg, state-run buyers Cofco Corp. and Sinograin were the companies involved. The soybeans are expected to be shipped between April and July 2019.

‘It all started’ after Trump withdrew from the TPP

Only days after being sworn into office, Trump withdrew the U.S. from the multinational Trans-Pacific Partnership (TPP), stating that the move was a “great thing for the American worker.” However, farmers like Pjesky argue that the withdrawal gave other countries better access to international markets.

“There’s a lot of things that are impacting agricultural farmers and ranchers around the country,” Pjesky said. “And it all started with the day after President Trump was inaugurated when he pulled out of the Trans-Pacific Partnership agreement.”

She continued: “My friends who farm in other countries like Australia and New Zealand are benefiting from that, and have incredible heightened access to the Japanese market, and many other markets in Asia. They have much lower tariff rates in Japan, which is a major market for us, than we do.”

According to the International Trade Administration, Japan’s average applied tariff rate is among the lowest in the world, at 4%.

Dairy farmers “are very, very worried about that,” Pjesky said. “And I am too, as a beef and wheat producer, because our competitors have a great advantage now.”

‘The retaliatory tariffs on us are still on here’

On Feb. 1, Japan and the EU expanded their trade by officially implementing the European Union-Japan Economic Partnership Agreement.

“The U.S. Meat Export Federation estimated that Japan’s new trade agreements will cause annual losses in beef and pork exports of more than $1 billion within five years,” the Wall Street Journal reported.

“I certainly hope that we end up with better deals on things going to China in the future,” Pjesky said. “One of the big problems really has been on the beef side. When we did finally get beef into China, there were a lot of restrictions put on what they would take, as far as our beef.”

Meanwhile, in North America, after the U.S. imposed tariffs on foreign-made steel and aluminum, Canada and Mexico retaliated by placing “retaliatory duties on U.S. products, ranging from pork to yogurt, slashing profits of some U.S. food companies and leaving farmers facing huge losses,” according to Zacks.

Pjesky noted the USMCA, which is primarily intended to open up the Canadian dairy market to U.S. farmers, is key because Mexico and Canada were two of the countries that “retaliated against agricultural commodities in retaliation for this deal on aluminum tariffs. So it's very, very important now that we have successfully negotiated the USMCA..

“It's very important for those tariffs on the steel allowing them to go away, because the retaliatory tariffs on us are still on here.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

The growing U.S. soybean stockpile could come back to haunt Trump

U.S. soybean farmer: 'We obviously are struggling' amid U.S.-China trade war

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance