There's a much bigger issue playing out in the background of the U.S.-China trade war

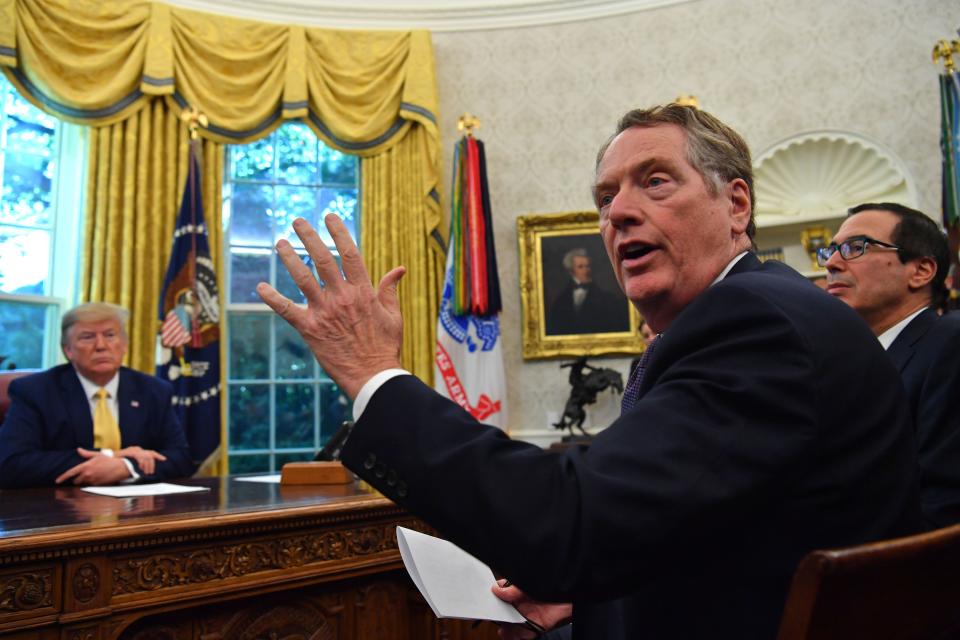

The U.S.-China trade war appeared to reach a breakthrough last Friday after President Trump announced that he had reached phase 1 of a trade deal with China.

And although the tit-for-tat tariffs have been the focus of this trade spat, Neil Shearing of Capital Economics argued in a research note on Monday that the fact this is only the first stage of a deal shows how nuanced the issues around IP theft, technology transfer, and industrial strategy are.

“In the background a much bigger issue is playing out – namely that China’s rapid rise is starting to destabilize the global order,” Shearing wrote.

“Policymakers (and most economists) are probably overplaying the economic effects of the trade war so far,” Shearing added. “Jerome Powell made an oblique reference to the trade war in a speech last Tuesday and it’s become increasingly common for central banks to cite it as a key drag on growth over the past six months. But while the trade war has clearly been a headwind to growth, it has been one of several factors weighing on the global economy.”

He referred to the U.S. Commerce Department’s decision to blacklist several Chinese firms due to human rights violations, the NBA-China controversy, the State Department’s visa restrictions on Chinese officials, and the threat to limit Chinese firms seeking to IPO in the U.S.

“There are, in and of themselves, relatively minor issues,” Shearing said. “But taken together, they represent a slow and steady shift towards a more antagonistic relationship between the U.S. and China.”

Presidential candidate Mayor Pete Buttigieg (D-IN) echoed a similar sentiment over the weekend while speaking on the issue of China at the New Yorker Festival.

“I actually think China presents more of a challenge than any of my fellow Democrats do,” Buttigieg said. “It’s because I look at what’s happening there and what I see is the use of technology for the perfection of dictatorship.

“But, that doesn’t mean that the president’s approach makes any sense,” he said. “Because it’s not a strategy. He’s just poking the guy to see what will happen. Moreover, he’s essentially reduced the U.S-China relationship to the question of who’s selling more dishwashers.”

Shearing estimates that the trade war accounts for approximately 25% of the slowdown in global GDP over the last several years. Other factors include European auto sector problems, “the unwinding of a particularly large inventory cycle in the electronic sectors,” and policy tightening between the U.S. and China, among other issues at hand.

“It’s unclear how this broader shift will develop, but one plausible outcome is that aspects of the global economy start to splinter into U.S. and Chinese-led spheres,” Shearing said. “Suffice it to say that, while this will play out over several years and decades rather than months and quarters, it has the potential to cause much greater damage to the global economy than the current trade dispute.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

Buttigieg on Trump’s trade war: This is bigger than ‘who’s selling more dishwashers’

American farmers 'are in it for the long haul,' Iowa governor says about trade war

Trump administration has ‘a lot of interest’ in input from companies affected by trade war

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance